Alternative payment methods

Regional distribution

Unlocking the United States digital wallets market

August 2, 2024•10 min

Are you a game developer looking to expand your reach? Discover how targeting the largest video game markets in the world, such as the U.S., can elevate your sales. This blog post delves into the digital payments landscape of the largest global video game market, offering key insights and strategies to maximize your success.

Sources: Newzoo, US Gaming Market Report, Allcorrect, Statista

Sources: Newzoo, US Gaming Market Report, Allcorrect, Statista

Source: PPRO country report

While credit cards continue to dominate the United States payments landscape, digital wallets are emerging as a significant challenger. This shift is particularly evident in the U.S. e-commerce sector, where mobile wallets are increasingly becoming the preferred payment method. According to the STELLAR analysis, the digital wallets segment is projected to grow at a CAGR of 16.9% from 2024 to 2030. It emerges as the leading segment in the United States digital payment market due to:

Source: PPRO country report

While credit cards continue to dominate the United States payments landscape, digital wallets are emerging as a significant challenger. This shift is particularly evident in the U.S. e-commerce sector, where mobile wallets are increasingly becoming the preferred payment method. According to the STELLAR analysis, the digital wallets segment is projected to grow at a CAGR of 16.9% from 2024 to 2030. It emerges as the leading segment in the United States digital payment market due to:

Sources: World population review, Zelle, Oberlo, CapitalOne Shopping Research, Oberlo, techreport

PayPal

Sources: World population review, Zelle, Oberlo, CapitalOne Shopping Research, Oberlo, techreport

PayPal

PayPal, operating for over 25 years, serves consumers and businesses in more than 200 countries, with the U.S. being its largest market, embraced by over 278 million residents.

Users can send and receive money globally by linking their bank accounts or up to 24 bank cards with their verified PayPal account. In addition to speed and security, PayPal provides payment flexibility with options like Pay Later and rewards programs.

PayPal, operating for over 25 years, serves consumers and businesses in more than 200 countries, with the U.S. being its largest market, embraced by over 278 million residents.

Users can send and receive money globally by linking their bank accounts or up to 24 bank cards with their verified PayPal account. In addition to speed and security, PayPal provides payment flexibility with options like Pay Later and rewards programs.

Venmo

Venmo

Established in 2009 and now owned by PayPal (since 2013), Venmo has established itself as a quick, secure, and social payment app.

Initially created for friends and roommates to split rent, expenses, and transfer funds to each other (peer-to-peer), the app quickly expanded its user base.

A year prior to being acquired by PayPal, Venmo introduced a new feature enabling users to view their friends' transactions and interact by leaving emojis and comments. This social element of the app played a key role in boosting user engagement and enhancing its overall appeal.

Nowadays, with over 70 million users in the United States, Venmo offers features like instant and easy payments, purchase protection, spending management tools for splitting payments, and rewards for eligible transactions. The app also supports financial education and inclusivity by providing a debit card for teens aged 13-17, along with Venmo access.

Established in 2009 and now owned by PayPal (since 2013), Venmo has established itself as a quick, secure, and social payment app.

Initially created for friends and roommates to split rent, expenses, and transfer funds to each other (peer-to-peer), the app quickly expanded its user base.

A year prior to being acquired by PayPal, Venmo introduced a new feature enabling users to view their friends' transactions and interact by leaving emojis and comments. This social element of the app played a key role in boosting user engagement and enhancing its overall appeal.

Nowadays, with over 70 million users in the United States, Venmo offers features like instant and easy payments, purchase protection, spending management tools for splitting payments, and rewards for eligible transactions. The app also supports financial education and inclusivity by providing a debit card for teens aged 13-17, along with Venmo access.

Zelle

Zelle

Zelle is a digital wallet operating in the U.S. that offers a quick and easy way to send and receive money. The app has garnered over 100 million users and has established partnerships with over 2,000 banking apps throughout the country.

Zelle simplifies person-to-person payments, small business transactions, and disbursements under a single consumer brand. To begin using Zelle, users can register with their email or U.S. mobile number via their mobile banking app or the Zelle app. They can then enter the recipient's email or U.S. mobile number to send money to trusted individuals with U.S. bank accounts. If the recipient is already enrolled with Zelle, the funds are deposited directly into their bank account.

Cash App Pay

Zelle is a digital wallet operating in the U.S. that offers a quick and easy way to send and receive money. The app has garnered over 100 million users and has established partnerships with over 2,000 banking apps throughout the country.

Zelle simplifies person-to-person payments, small business transactions, and disbursements under a single consumer brand. To begin using Zelle, users can register with their email or U.S. mobile number via their mobile banking app or the Zelle app. They can then enter the recipient's email or U.S. mobile number to send money to trusted individuals with U.S. bank accounts. If the recipient is already enrolled with Zelle, the funds are deposited directly into their bank account.

Cash App Pay

Cash App is a financial services platform that is utilized by 1 in 6 consumers in the U.S.. Offering advanced security features, Cash App ensures the protection of each account. Users can leverage the app for instant payments, money transfers, access to exclusive discounts, and more. Promoting financial inclusivity, individuals aged 13 and above can begin using Cash App with sponsorship from a parent or guardian.

Cash App is a financial services platform that is utilized by 1 in 6 consumers in the U.S.. Offering advanced security features, Cash App ensures the protection of each account. Users can leverage the app for instant payments, money transfers, access to exclusive discounts, and more. Promoting financial inclusivity, individuals aged 13 and above can begin using Cash App with sponsorship from a parent or guardian.

Apple Pay

Apple Pay

Apple Pay boasts a user base exceeding 500 million across more than 80 countries and territories, with approximately 12% of users in the United States. Renowned for its seamless checkout experience, robust security features, and widespread acceptance on millions of websites and applications, Apple Pay has become a popular choice for consumers in the United States and beyond.

Apple Pay boasts a user base exceeding 500 million across more than 80 countries and territories, with approximately 12% of users in the United States. Renowned for its seamless checkout experience, robust security features, and widespread acceptance on millions of websites and applications, Apple Pay has become a popular choice for consumers in the United States and beyond.

Google Pay

Google Pay

With a user base exceeding 150 million worldwide, the Google Pay app has been embraced by over 25 million consumers in the United States. As of June 4, 2024, the U.S. version of the Google Pay app has been discontinued, and users will be transitioned to Google Wallet. This transition allows users to seamlessly access and transfer their Google Pay balance through the Google Wallet website. Google Wallet offers a faster, safer, and more convenient payment method, safeguarding personal information, enabling the aggregation and management of rewards and loyalty programs, and providing various other features.

With a user base exceeding 150 million worldwide, the Google Pay app has been embraced by over 25 million consumers in the United States. As of June 4, 2024, the U.S. version of the Google Pay app has been discontinued, and users will be transitioned to Google Wallet. This transition allows users to seamlessly access and transfer their Google Pay balance through the Google Wallet website. Google Wallet offers a faster, safer, and more convenient payment method, safeguarding personal information, enabling the aggregation and management of rewards and loyalty programs, and providing various other features.

In contrast to other digital wallets where users typically link their bank accounts or cards, Apple Pay and Google Pay offer the option to link additional digital wallets such as PayPal and Cash App to top up their Apple and Google Pay balances. Furthermore, to enhance users' shopping convenience, integration of Apple Pay and Google Pay accelerated checkout can be implemented. This feature enables consumers to swiftly navigate through the digital wallet buttons and have seamless one-touch access to complete their payments with Apple Pay or Google Pay.

Great news: Xsolla has integrated all the major digital wallets in the United States to enhance your in-game payment experience: PayPal, Venmo, Cash App, Apple Pay and Google Pay. These integrations have been enriched with essential features aimed at improving conversion rates and increasing sales:

In contrast to other digital wallets where users typically link their bank accounts or cards, Apple Pay and Google Pay offer the option to link additional digital wallets such as PayPal and Cash App to top up their Apple and Google Pay balances. Furthermore, to enhance users' shopping convenience, integration of Apple Pay and Google Pay accelerated checkout can be implemented. This feature enables consumers to swiftly navigate through the digital wallet buttons and have seamless one-touch access to complete their payments with Apple Pay or Google Pay.

Great news: Xsolla has integrated all the major digital wallets in the United States to enhance your in-game payment experience: PayPal, Venmo, Cash App, Apple Pay and Google Pay. These integrations have been enriched with essential features aimed at improving conversion rates and increasing sales:

Armed with a thorough understanding of the United States gaming and digital payments market, it's time to seize the opportunity to broaden your reach and maximize your potential.

Not partnered with Xsolla yet? Curious about how Xsolla can streamline the game publishing process across various platforms and regions? Contact our team of experts today to learn more or set up your Publisher Account to get started today.

Written & Published By

Armed with a thorough understanding of the United States gaming and digital payments market, it's time to seize the opportunity to broaden your reach and maximize your potential.

Not partnered with Xsolla yet? Curious about how Xsolla can streamline the game publishing process across various platforms and regions? Contact our team of experts today to learn more or set up your Publisher Account to get started today.

Written & Published By

Yulia Mikhailova, Product Marketing Manager at Xsolla

The United States video games market overview

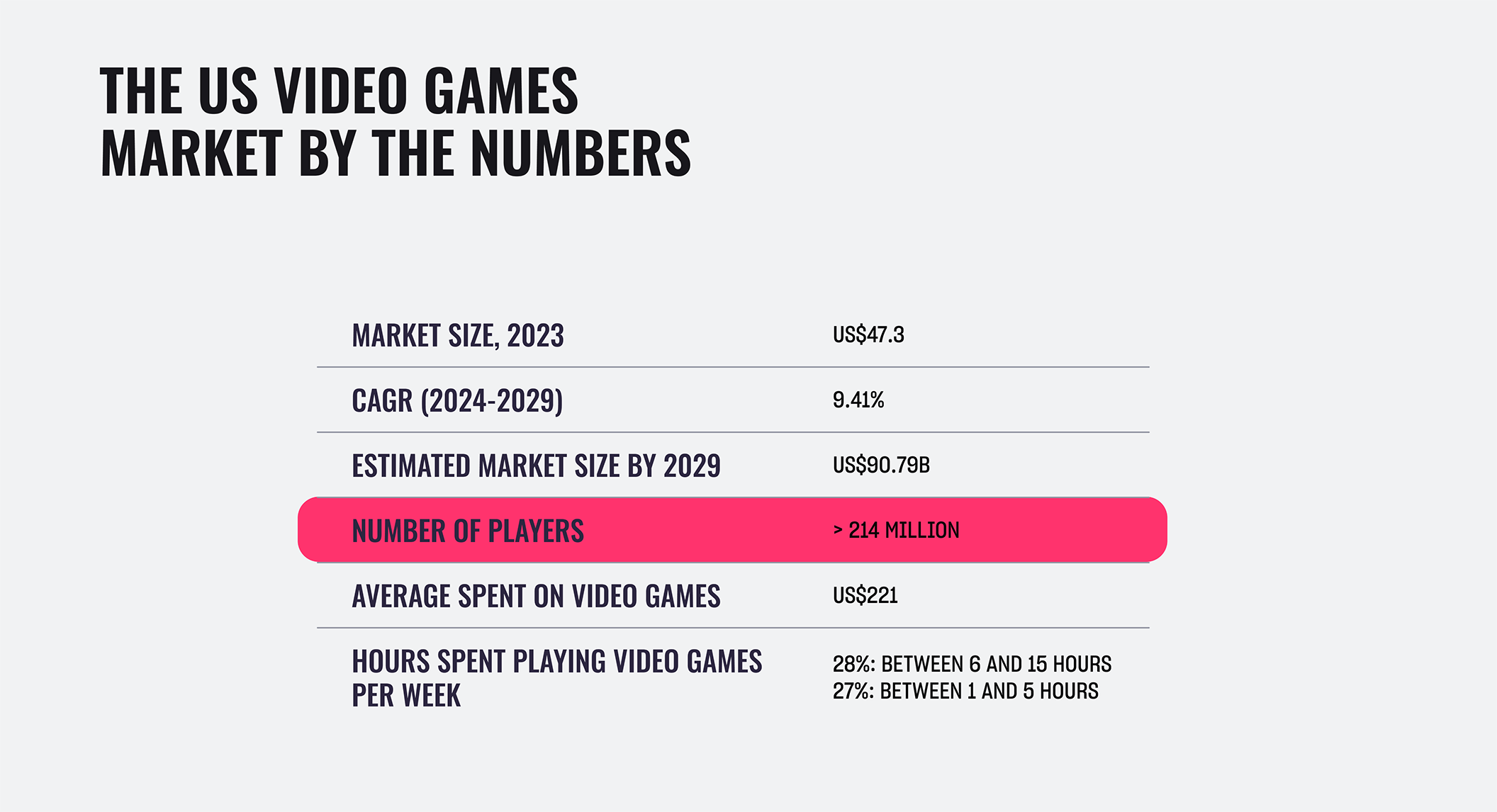

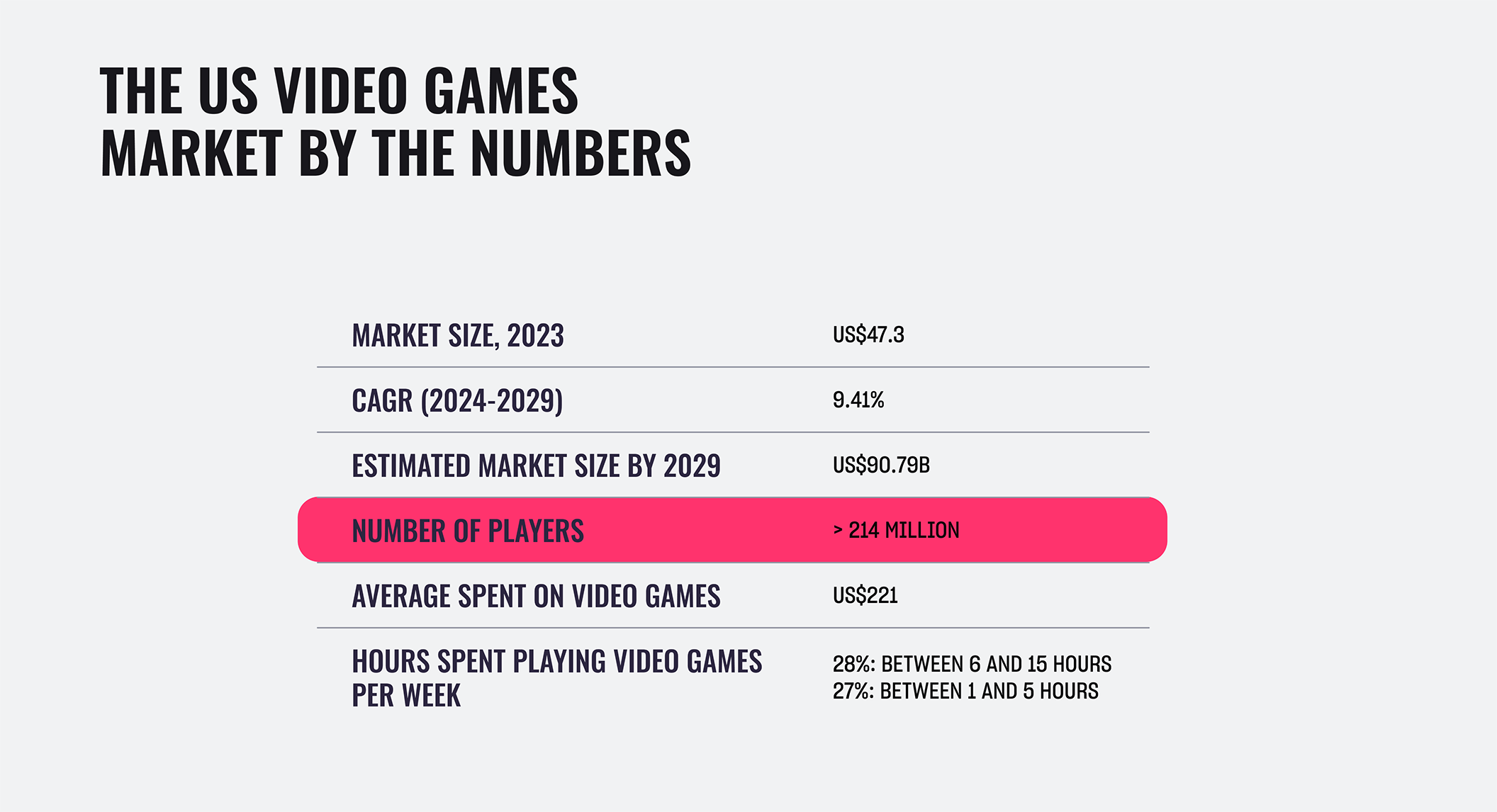

Newzoo reports that North America ranks as the second-largest region in the global gaming market. In 2023, the United States consumers alone spent a record US$47.3 billion on games out of the total global revenue of US$184 billion, solidifying the market's significant contribution of nearly 26% to the global video game industry. With over 214 million players, the United States is a leading country in terms of money spent on video games, with the average gamer spending approximately US$221 on video games. Researches reveal that over 65% of the United States population participates in online video gaming. Of these gamers, 27% play for 1 to 5 hours per week, with 28% dedicating between 6 and 15 hours to gaming on a weekly basis. In terms of the most popular gaming platforms, 57% of the United States gamers prefer mobile, 46% choose consoles, and 42% opt for PC gaming. The United States video games market by the numbers Sources: Newzoo, US Gaming Market Report, Allcorrect, Statista

Sources: Newzoo, US Gaming Market Report, Allcorrect, Statista

The United States digital payments market overview

Industry studies indicate that 50% of the United States consumers would utilize multiple payment methods if offered at checkout, showing a notable increase from 43% in 2022. This highlights the increasing demand for flexibility in modern payment systems. Moreover, the data reveals a shift in consumer behavior, with 79.2% of respondents utilizing 2-5 payment methods monthly, a substantial increase from 57% in 2022. Consumers make payment choices based on various factors, including ticket size, store or merchant, types of goods purchased, and more. Therefore, when developing your payment strategy, it is crucial to provide a range of options and flexibility to meet the preferences of your consumers. Based on the PPRO country report, card payments make up 50% of the U.S. payments landscape, followed by digital wallets at 32%, bank transfers at approximately 9%, and other payment methods comprising the remaining 10%. Source: PPRO country report

While credit cards continue to dominate the United States payments landscape, digital wallets are emerging as a significant challenger. This shift is particularly evident in the U.S. e-commerce sector, where mobile wallets are increasingly becoming the preferred payment method. According to the STELLAR analysis, the digital wallets segment is projected to grow at a CAGR of 16.9% from 2024 to 2030. It emerges as the leading segment in the United States digital payment market due to:

Source: PPRO country report

While credit cards continue to dominate the United States payments landscape, digital wallets are emerging as a significant challenger. This shift is particularly evident in the U.S. e-commerce sector, where mobile wallets are increasingly becoming the preferred payment method. According to the STELLAR analysis, the digital wallets segment is projected to grow at a CAGR of 16.9% from 2024 to 2030. It emerges as the leading segment in the United States digital payment market due to:

- Convenience, fast and simple checkout process

- Availability of rewards and consumer tailored programs

- Advanced security protocols

- Data connectivity

- Finance and expenses management tools

Sources: World population review, Zelle, Oberlo, CapitalOne Shopping Research, Oberlo, techreport

PayPal

Sources: World population review, Zelle, Oberlo, CapitalOne Shopping Research, Oberlo, techreport

PayPal

PayPal, operating for over 25 years, serves consumers and businesses in more than 200 countries, with the U.S. being its largest market, embraced by over 278 million residents.

Users can send and receive money globally by linking their bank accounts or up to 24 bank cards with their verified PayPal account. In addition to speed and security, PayPal provides payment flexibility with options like Pay Later and rewards programs.

PayPal, operating for over 25 years, serves consumers and businesses in more than 200 countries, with the U.S. being its largest market, embraced by over 278 million residents.

Users can send and receive money globally by linking their bank accounts or up to 24 bank cards with their verified PayPal account. In addition to speed and security, PayPal provides payment flexibility with options like Pay Later and rewards programs.

Venmo

Venmo

Established in 2009 and now owned by PayPal (since 2013), Venmo has established itself as a quick, secure, and social payment app.

Initially created for friends and roommates to split rent, expenses, and transfer funds to each other (peer-to-peer), the app quickly expanded its user base.

A year prior to being acquired by PayPal, Venmo introduced a new feature enabling users to view their friends' transactions and interact by leaving emojis and comments. This social element of the app played a key role in boosting user engagement and enhancing its overall appeal.

Nowadays, with over 70 million users in the United States, Venmo offers features like instant and easy payments, purchase protection, spending management tools for splitting payments, and rewards for eligible transactions. The app also supports financial education and inclusivity by providing a debit card for teens aged 13-17, along with Venmo access.

Established in 2009 and now owned by PayPal (since 2013), Venmo has established itself as a quick, secure, and social payment app.

Initially created for friends and roommates to split rent, expenses, and transfer funds to each other (peer-to-peer), the app quickly expanded its user base.

A year prior to being acquired by PayPal, Venmo introduced a new feature enabling users to view their friends' transactions and interact by leaving emojis and comments. This social element of the app played a key role in boosting user engagement and enhancing its overall appeal.

Nowadays, with over 70 million users in the United States, Venmo offers features like instant and easy payments, purchase protection, spending management tools for splitting payments, and rewards for eligible transactions. The app also supports financial education and inclusivity by providing a debit card for teens aged 13-17, along with Venmo access.

Zelle

Zelle

Zelle is a digital wallet operating in the U.S. that offers a quick and easy way to send and receive money. The app has garnered over 100 million users and has established partnerships with over 2,000 banking apps throughout the country.

Zelle simplifies person-to-person payments, small business transactions, and disbursements under a single consumer brand. To begin using Zelle, users can register with their email or U.S. mobile number via their mobile banking app or the Zelle app. They can then enter the recipient's email or U.S. mobile number to send money to trusted individuals with U.S. bank accounts. If the recipient is already enrolled with Zelle, the funds are deposited directly into their bank account.

Cash App Pay

Zelle is a digital wallet operating in the U.S. that offers a quick and easy way to send and receive money. The app has garnered over 100 million users and has established partnerships with over 2,000 banking apps throughout the country.

Zelle simplifies person-to-person payments, small business transactions, and disbursements under a single consumer brand. To begin using Zelle, users can register with their email or U.S. mobile number via their mobile banking app or the Zelle app. They can then enter the recipient's email or U.S. mobile number to send money to trusted individuals with U.S. bank accounts. If the recipient is already enrolled with Zelle, the funds are deposited directly into their bank account.

Cash App Pay

Cash App is a financial services platform that is utilized by 1 in 6 consumers in the U.S.. Offering advanced security features, Cash App ensures the protection of each account. Users can leverage the app for instant payments, money transfers, access to exclusive discounts, and more. Promoting financial inclusivity, individuals aged 13 and above can begin using Cash App with sponsorship from a parent or guardian.

Cash App is a financial services platform that is utilized by 1 in 6 consumers in the U.S.. Offering advanced security features, Cash App ensures the protection of each account. Users can leverage the app for instant payments, money transfers, access to exclusive discounts, and more. Promoting financial inclusivity, individuals aged 13 and above can begin using Cash App with sponsorship from a parent or guardian.

Apple Pay

Apple Pay

Apple Pay boasts a user base exceeding 500 million across more than 80 countries and territories, with approximately 12% of users in the United States. Renowned for its seamless checkout experience, robust security features, and widespread acceptance on millions of websites and applications, Apple Pay has become a popular choice for consumers in the United States and beyond.

Apple Pay boasts a user base exceeding 500 million across more than 80 countries and territories, with approximately 12% of users in the United States. Renowned for its seamless checkout experience, robust security features, and widespread acceptance on millions of websites and applications, Apple Pay has become a popular choice for consumers in the United States and beyond.

Google Pay

Google Pay

With a user base exceeding 150 million worldwide, the Google Pay app has been embraced by over 25 million consumers in the United States. As of June 4, 2024, the U.S. version of the Google Pay app has been discontinued, and users will be transitioned to Google Wallet. This transition allows users to seamlessly access and transfer their Google Pay balance through the Google Wallet website. Google Wallet offers a faster, safer, and more convenient payment method, safeguarding personal information, enabling the aggregation and management of rewards and loyalty programs, and providing various other features.

With a user base exceeding 150 million worldwide, the Google Pay app has been embraced by over 25 million consumers in the United States. As of June 4, 2024, the U.S. version of the Google Pay app has been discontinued, and users will be transitioned to Google Wallet. This transition allows users to seamlessly access and transfer their Google Pay balance through the Google Wallet website. Google Wallet offers a faster, safer, and more convenient payment method, safeguarding personal information, enabling the aggregation and management of rewards and loyalty programs, and providing various other features.

In contrast to other digital wallets where users typically link their bank accounts or cards, Apple Pay and Google Pay offer the option to link additional digital wallets such as PayPal and Cash App to top up their Apple and Google Pay balances. Furthermore, to enhance users' shopping convenience, integration of Apple Pay and Google Pay accelerated checkout can be implemented. This feature enables consumers to swiftly navigate through the digital wallet buttons and have seamless one-touch access to complete their payments with Apple Pay or Google Pay.

Great news: Xsolla has integrated all the major digital wallets in the United States to enhance your in-game payment experience: PayPal, Venmo, Cash App, Apple Pay and Google Pay. These integrations have been enriched with essential features aimed at improving conversion rates and increasing sales:

In contrast to other digital wallets where users typically link their bank accounts or cards, Apple Pay and Google Pay offer the option to link additional digital wallets such as PayPal and Cash App to top up their Apple and Google Pay balances. Furthermore, to enhance users' shopping convenience, integration of Apple Pay and Google Pay accelerated checkout can be implemented. This feature enables consumers to swiftly navigate through the digital wallet buttons and have seamless one-touch access to complete their payments with Apple Pay or Google Pay.

Great news: Xsolla has integrated all the major digital wallets in the United States to enhance your in-game payment experience: PayPal, Venmo, Cash App, Apple Pay and Google Pay. These integrations have been enriched with essential features aimed at improving conversion rates and increasing sales:

- PayPal with various features support such as refund support (including partial refunds), one-time and recurring billing, PayPal Pay Later, and other functionalities.

- Apple Pay enhances the in-game payment process with an accelerated checkout using Apple Pay. To ensure universal accessibility, Apple Pay transactions can be conducted in over 70 local currencies (including the recent addition of 60+ new currencies), along with optimized processing in Europe.

- Google Pay simplifies users' shopping experience by supporting 50+ currencies across 200+ countries and streamlining payments with a quick Google Pay payment button.

Challenges and solutions to overcome them

Expanding your payment reach into the largest video games market may present challenges, but overcoming them will enable you to access over 214 million United States players and increase revenue. We have identified key challenges that developers and studios may face when entering the United States gaming market and outlined how Xsolla can assist in addressing these challenges. Enabling support of all key digital wallets Now that you understand the importance of adding various payment methods to your checkout, including local options preferred by the United States consumers, you have a choice to make. You can either directly connect with payment service providers, which will require time and resources for processes like KYC procedures, agreement signings, integrations, and ongoing support for settlements, accounting, tax collection, and more. Alternatively, you can partner with an experienced partner like Xsolla, who has established connections with key local payment methods, streamlining all the process for you under a single licensing agreement and integration. Seamless payment experience It's crucial to ensure that your checkout process is smooth and seamless for players. A lengthy checkout with too many fields can kill conversion rates. Therefore, only ask for essential information, such as zip codes for accurate sales tax calculation. Customizing your checkout to match the look and feel of your game enhances customer loyalty and creates a familiar and unique checkout experience for players. Xsolla Pay Station provides various integration options, ranging from a ready-to-use UI with customization features to a Headless checkout option that allows you to create and manage your checkout experience. For more insights, check out our blog post on building the ideal checkout experience. Tax management In the USA, sales tax rules vary by state and can include local taxes, making the final tax amount dependent on the end user's address. Businesses selling in the United States need a reliable data-gathering mechanism for this. Each state may have unique tax rules for digital products, and companies must stay updated on legislative changes. Check out our blog post for detailed information on sales tax in the United States. Tax compliance can be achieved by partnering with experts such as third-party companies or agencies, or by working with Merchants of Record. Xsolla, as Merchant of Record, handles tax calculations and filings at no extra cost, ensuring compliance with the USA and international tax regulations. Fraud protection and dispute management Prioritizing fraud prevention in your game and payment transactions is crucial, regardless of the market or payment method. Consider implementing gaming-specific techniques and mechanics, such as custom in-game parameters, cross-game analytics, trust and blocklists, machine learning, and filters, to combat fraudulent activity effectively. Additionally, ensure you have the right tools to manage chargebacks. While bank cards are commonly associated with chargebacks, expertise in handling disputes for payment methods like PayPal is essential. When selecting a partner for chargeback management services, ensure they can provide comprehensive coverage in handling disputes for various payment methods. At Xsolla, our Anti-Fraud system features a robust set of filters, cross-game intelligence, custom parameters, machine learning, and other tools to effectively prevent and halt fraudulent activity, safeguarding legitimate transactions. Our in-house dispute management team handles chargebacks for over 10 payment methods, alleviating partners from the complexities associated with disputes. Learn more about how we maintain the lowest chargeback rate and assist partners in recovering their funds in our detailed blog post. Armed with a thorough understanding of the United States gaming and digital payments market, it's time to seize the opportunity to broaden your reach and maximize your potential.

Not partnered with Xsolla yet? Curious about how Xsolla can streamline the game publishing process across various platforms and regions? Contact our team of experts today to learn more or set up your Publisher Account to get started today.

Written & Published By

Armed with a thorough understanding of the United States gaming and digital payments market, it's time to seize the opportunity to broaden your reach and maximize your potential.

Not partnered with Xsolla yet? Curious about how Xsolla can streamline the game publishing process across various platforms and regions? Contact our team of experts today to learn more or set up your Publisher Account to get started today.

Written & Published ByYulia Mikhailova, Product Marketing Manager at Xsolla

Featured articles

Contact us

Talk to an expert

Ready to maximize revenue opportunities? Reach out to our experts and learn how to start earning more and spending less.