Understanding taxes for game developers

February 29, 2024•8 min

As a game developer, you focus on crafting epic experiences rather than deciphering global taxes and delving into VAT rates. Understanding tax regulations for digital goods and services can feel like navigating a maze. That's why we created a four-part tax series to explain the fundamentals of taxes, highlight concepts, and guide you through regional intricacies worldwide.

This first blog will introduce the basics of taxes and give you a solid foundation to build your tax knowledge. The following three blogs will delve into more details, like how taxes are calculated and paid and the dangers of non-compliance.

United States

Unlike most countries where indirect tax rates are uniform nationwide, US sales tax rules vary by state. Each state sets its own state-level sales tax rate, and every city, county, and municipality within the state may impose its own local sales tax, which is added to the state-level sales tax. Since all these individual rates vary, the final sales tax amount depends on the end user's address, requiring companies to have a reliable mechanism for gathering such data.

When a company sells digital products in several states in the US, it is crucial to monitor whether the company has reached an economic nexus in a particular state. Having a nexus in a state (defined by a certain threshold of transactions or sales activity with consumers in the state) requires the company to register with the state's local tax authorities and pay sales tax from the sales in that state. That adds a level of compliance complexity, as the company has to file tax returns and remit sales tax separately in each state with a nexus.

Each state in the US may have its own rules and approaches to determine which products and services are taxable, especially when it comes to digital products (some states may not impose any sales tax on digital products at all). Given the variety of rules and the changing dynamics of laws and rates, companies must monitor legislative updates in the US closely.

United States

Unlike most countries where indirect tax rates are uniform nationwide, US sales tax rules vary by state. Each state sets its own state-level sales tax rate, and every city, county, and municipality within the state may impose its own local sales tax, which is added to the state-level sales tax. Since all these individual rates vary, the final sales tax amount depends on the end user's address, requiring companies to have a reliable mechanism for gathering such data.

When a company sells digital products in several states in the US, it is crucial to monitor whether the company has reached an economic nexus in a particular state. Having a nexus in a state (defined by a certain threshold of transactions or sales activity with consumers in the state) requires the company to register with the state's local tax authorities and pay sales tax from the sales in that state. That adds a level of compliance complexity, as the company has to file tax returns and remit sales tax separately in each state with a nexus.

Each state in the US may have its own rules and approaches to determine which products and services are taxable, especially when it comes to digital products (some states may not impose any sales tax on digital products at all). Given the variety of rules and the changing dynamics of laws and rates, companies must monitor legislative updates in the US closely.

Canada

In Canada, indirect taxes are levied under different names and rates, depending on the province or territory.

Canada

In Canada, indirect taxes are levied under different names and rates, depending on the province or territory.

Other regions

In LATAM countries, indirect taxation has certain complexities and, sometimes, additional taxes.

Other regions

In LATAM countries, indirect taxation has certain complexities and, sometimes, additional taxes.

What are taxes, exactly?

Think of taxes as necessary contributions, like dues paid to a club. Both individuals and companies must pay taxes to the government, which then uses this money to fund important things like schools (education), hospitals (healthcare), and roads (infrastructure). These are essential for any society to function well. Companies pay taxes on their business activities. Traditionally, they needed an office in a country to be taxed there. But today, thanks to globalization and technological advancement, companies can easily operate online without a physical presence in local markets, creating a "tax gap" where income isn't taxed. There are two main types of taxes, including those imposed on digital goods and services, which are becoming increasingly important as our world gets more digital:- Direct taxes. These are paid directly to the government, like income tax on your salary.

- Indirect taxes. These are added to the price of goods and services, like sales tax added to your shopping cart.

Direct taxes, or income tax

Some countries charge income taxes on sales of digital goods and services abroad. While indirect taxes are levied on the consumer, income tax is charged directly to the business. The mechanism usually operates in two ways:- Local counterparties, such as payment service providers, withhold tax from the payment to the foreign business.

- Foreign companies pay the tax directly.

Indirect tax

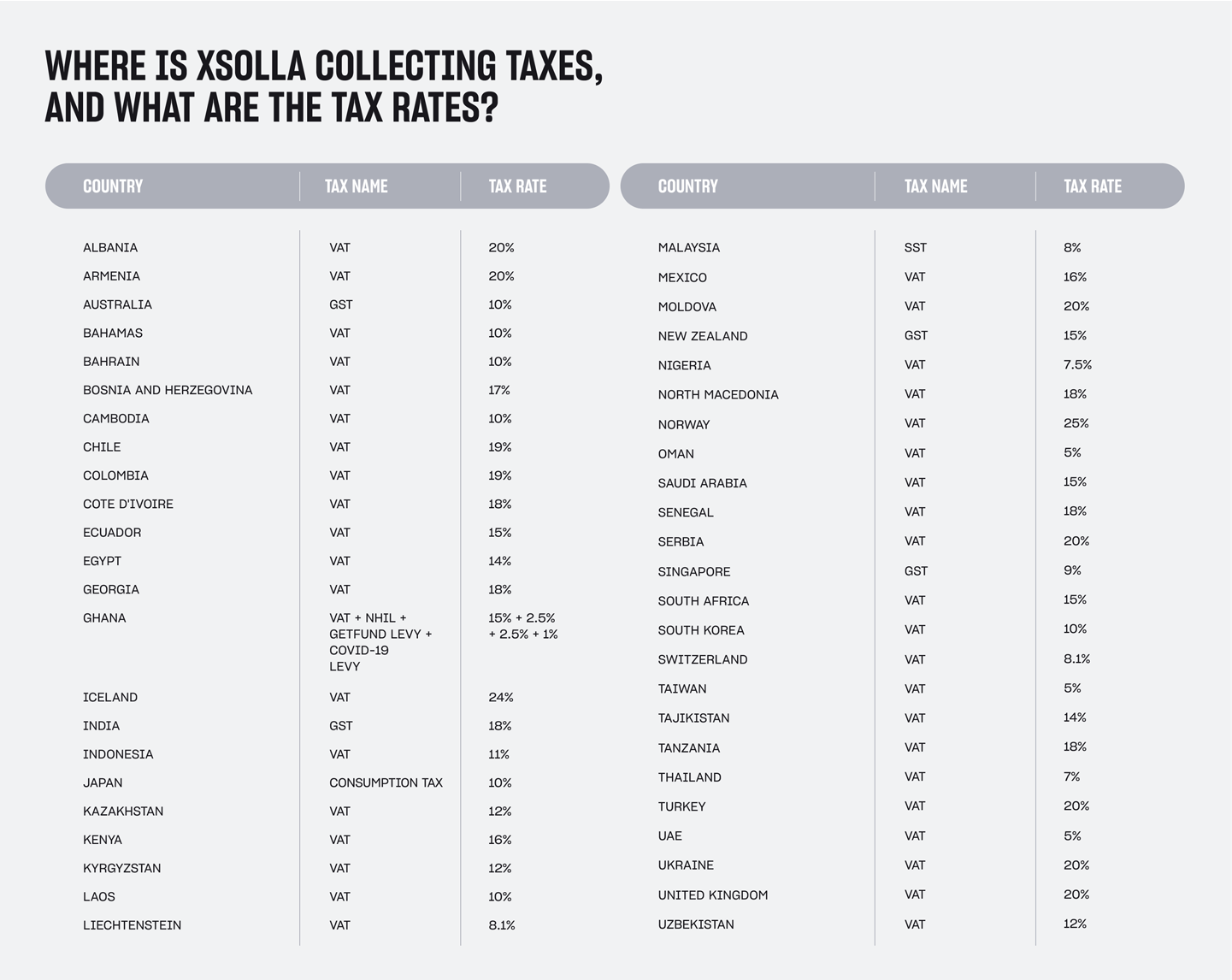

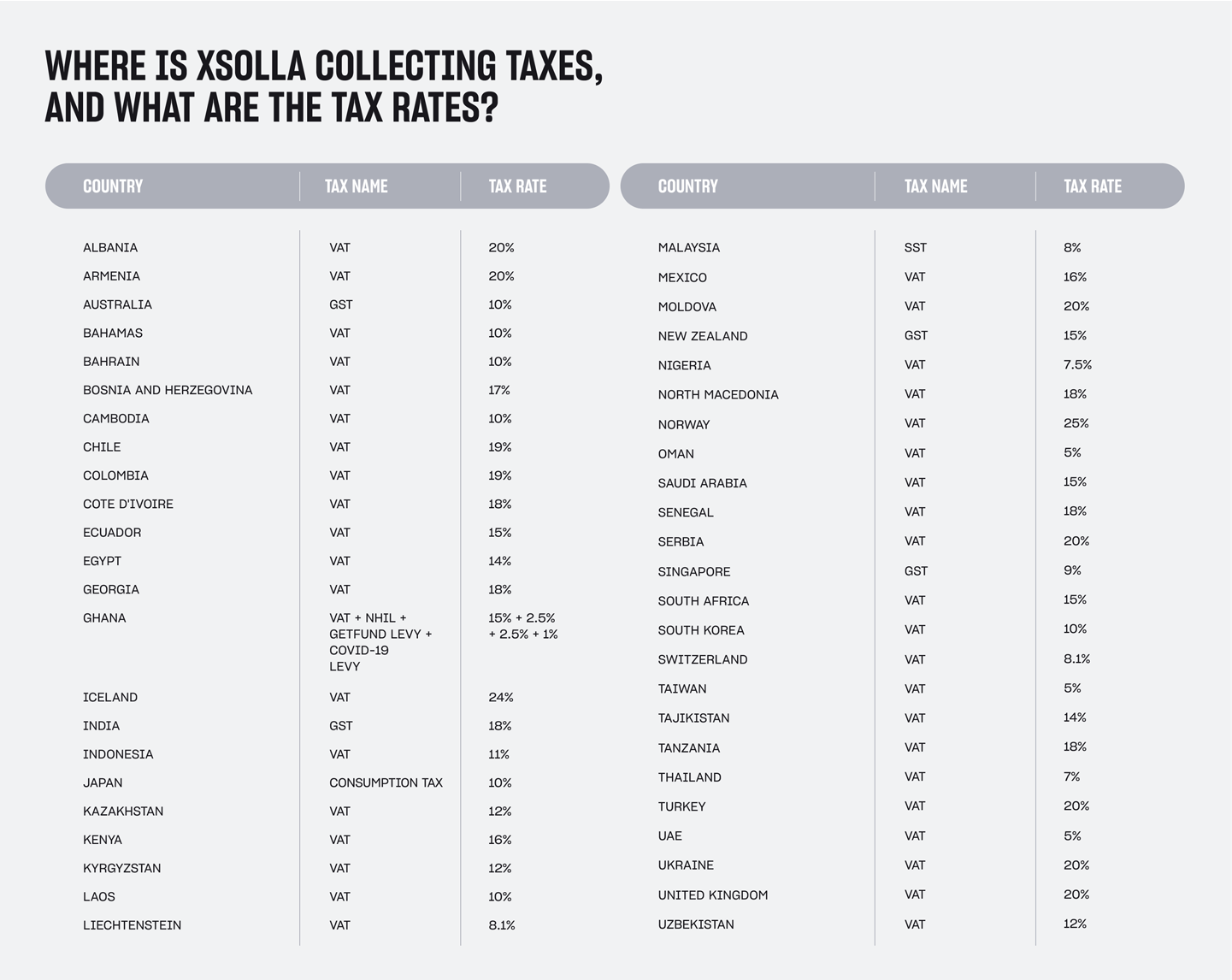

Indirect taxes are value-added taxes (VAT) in most countries, including the European Union. In India or Australia, for instance, it's referred to as a goods and service tax (GST), while Japan calls it a consumption tax (CT). In the United States, it's known as a sales tax. Indirect tax is applied to almost every consumer purchase, whether buying a t-shirt at a mall or ordering early access to the latest game release. Technically, the consumer pays this tax, but the supplier needs to collect it from the consumer and remit it to the government. Businesses must administer this tax carefully, especially if they operate in multiple countries, as the regulations vary from country to country, and consequences for non-compliance can be big. Taxation of digital goods and services The sale of all digital goods and services is subject to indirect taxes. Many countries have already implemented regulations on taxing online businesses, and this happens in more places every year. They want to make sure everyone plays fair, so foreign companies selling digital goods and services (also known as "electronically supplied services") inside those countries get taxed just like local companies do. Again, if your business sells online globally, it's crucial to stay on top of any changes to global laws to avoid any potential trouble. Compliance process If your business sells digital products or services to customers around the globe, you might need to collect and pay taxes on those sales. That means registering as a digital supplier, filing tax returns regularly, and sending the money to the right authorities on time. Sounds complicated? It can be! Without the right help, navigating these international tax rules can be a real headache.Global tax landscape: Regional overview

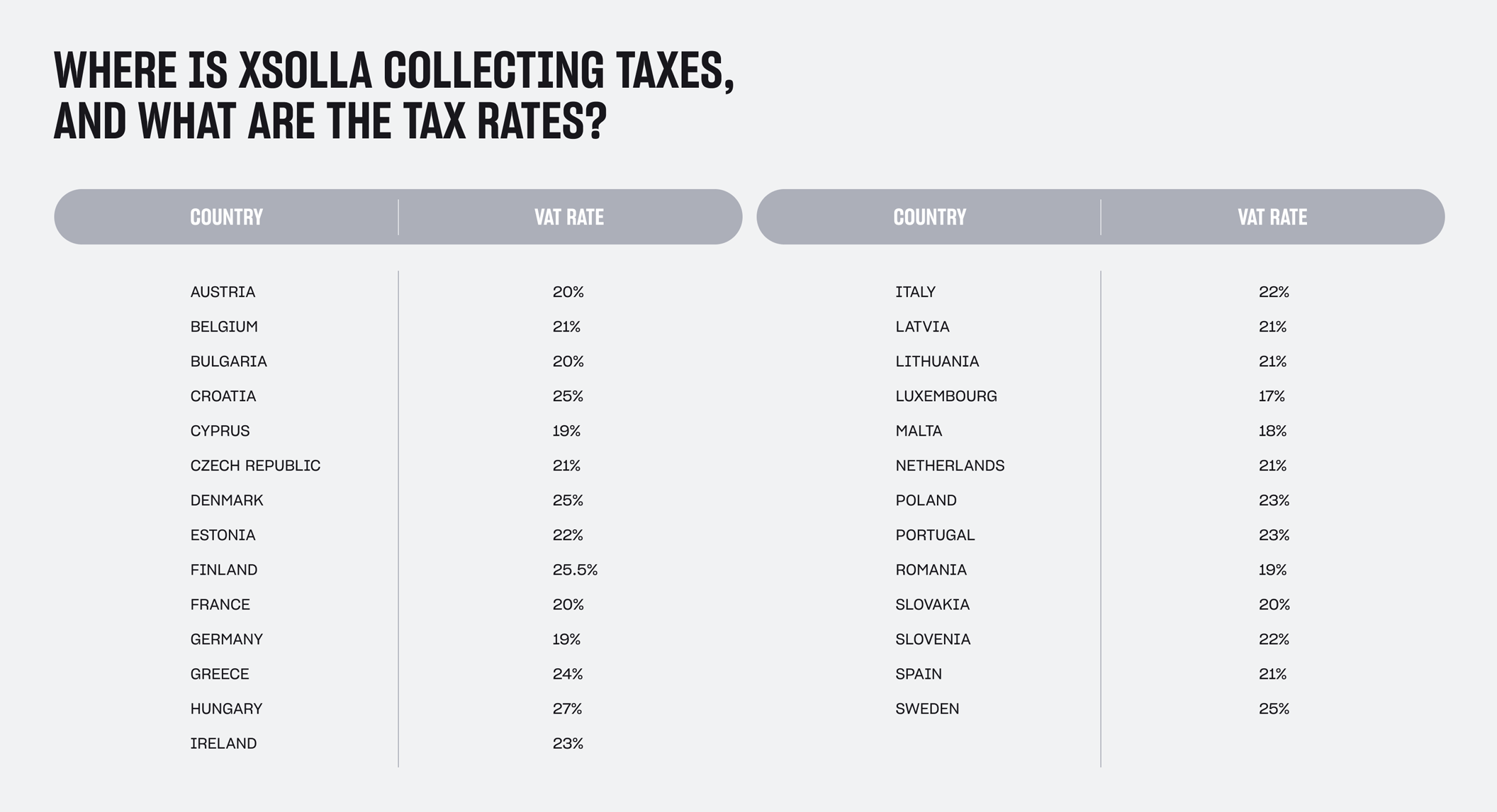

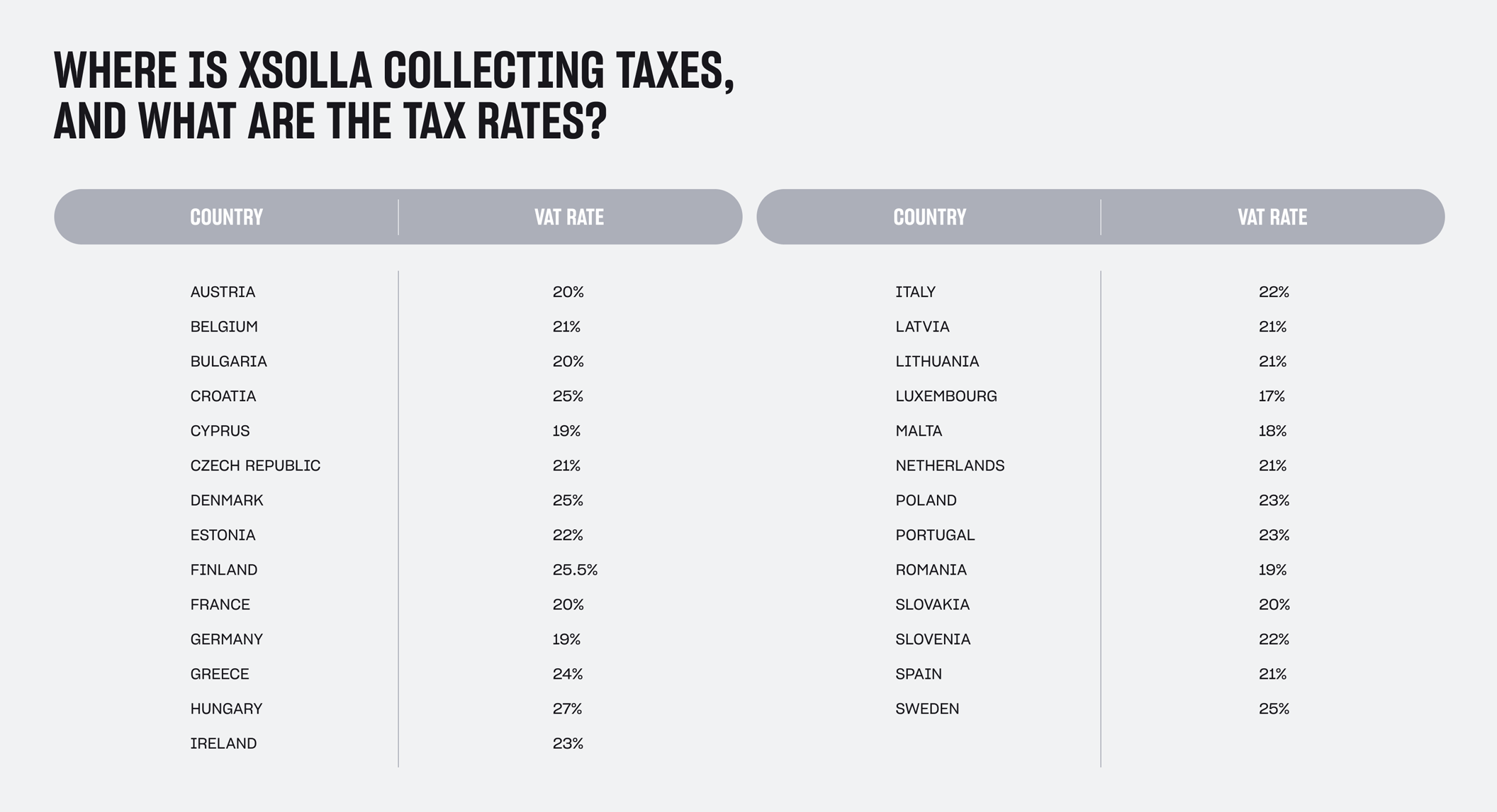

Tax regulations vary by country and region. Below, you can read more about the tax challenges that companies may face. Xsolla actively tracks global laws regarding the taxation of digital products, and we consistently update our systems to ensure sales adhere to local tax regulations. European Union VAT rates in the EU vary by country. A company selling digital products to individual consumers in multiple EU countries can either perform a separate registration in each EU country or register for the VAT One Stop Shop (OSS) scheme to simplify the VAT collection and payment process. VAT OSS eliminates the need to register in each EU country where the company sells digital products. Instead, the company may be registered in one domestic EU country (non-EU residents may choose an EU country for registration), submit a quarterly OSS return only in the country of registration, and remit all collected VAT across the EU only to the local tax authority. Subsequently, the local tax authority will distribute the VAT to other EU countries on the company's behalf. While this approach may seem convenient, it may require frequent communication with 27 tax authorities across the EU on any issues connected with the distribution of VAT among countries. Tax audits are conducted separately by the local tax authorities in each country of sale. Xsolla is a registered supplier under the VAT OSS scheme and handles VAT collection and communication with the local tax authorities all across the EU. United States

Unlike most countries where indirect tax rates are uniform nationwide, US sales tax rules vary by state. Each state sets its own state-level sales tax rate, and every city, county, and municipality within the state may impose its own local sales tax, which is added to the state-level sales tax. Since all these individual rates vary, the final sales tax amount depends on the end user's address, requiring companies to have a reliable mechanism for gathering such data.

When a company sells digital products in several states in the US, it is crucial to monitor whether the company has reached an economic nexus in a particular state. Having a nexus in a state (defined by a certain threshold of transactions or sales activity with consumers in the state) requires the company to register with the state's local tax authorities and pay sales tax from the sales in that state. That adds a level of compliance complexity, as the company has to file tax returns and remit sales tax separately in each state with a nexus.

Each state in the US may have its own rules and approaches to determine which products and services are taxable, especially when it comes to digital products (some states may not impose any sales tax on digital products at all). Given the variety of rules and the changing dynamics of laws and rates, companies must monitor legislative updates in the US closely.

United States

Unlike most countries where indirect tax rates are uniform nationwide, US sales tax rules vary by state. Each state sets its own state-level sales tax rate, and every city, county, and municipality within the state may impose its own local sales tax, which is added to the state-level sales tax. Since all these individual rates vary, the final sales tax amount depends on the end user's address, requiring companies to have a reliable mechanism for gathering such data.

When a company sells digital products in several states in the US, it is crucial to monitor whether the company has reached an economic nexus in a particular state. Having a nexus in a state (defined by a certain threshold of transactions or sales activity with consumers in the state) requires the company to register with the state's local tax authorities and pay sales tax from the sales in that state. That adds a level of compliance complexity, as the company has to file tax returns and remit sales tax separately in each state with a nexus.

Each state in the US may have its own rules and approaches to determine which products and services are taxable, especially when it comes to digital products (some states may not impose any sales tax on digital products at all). Given the variety of rules and the changing dynamics of laws and rates, companies must monitor legislative updates in the US closely.

Canada

In Canada, indirect taxes are levied under different names and rates, depending on the province or territory.

Canada

In Canada, indirect taxes are levied under different names and rates, depending on the province or territory.

- GST (Goods and Services Tax) is a federal tax applied to most goods and services sold or provided in Canada.

- PST (Provincial Sales Tax) is a tax levied by some provinces. The provincial sales tax in Quebec is called the Quebec Sales Tax (QST). It's charged in addition to the GST in provinces that have not harmonized their indirect taxes with federal taxes. Some provinces have no PST, so only the GST is applied.

- HST (Harmonized Sales Tax) is a combined federal and provincial tax used in provinces that have harmonized their PST with the GST. The HST rate varies depending on the province.

Other regions

In LATAM countries, indirect taxation has certain complexities and, sometimes, additional taxes.

Other regions

In LATAM countries, indirect taxation has certain complexities and, sometimes, additional taxes.

- In Ecuador, for instance, foreign companies may encounter an additional currency repatriation tax (ISD) imposed by the local central bank.

- In Argentina, a provincial gross revenues tax (IIBB) is charged at different rates depending on the province and arises together with VAT on taxable transactions.

- The tax registration process in Mexico can take significant time, and a local representative is required for tax purposes.

Staying compliant

You can confidently navigate the digital tax maze by understanding the different tax types, regional complexities, and available resources. Working with a reliable business partner that has extensive expertise in global tax regulations can significantly ease the burden. Xsolla actively tracks global tax laws and updates its systems to ensure compliance - and takes care of all the backend logistics for you. Create a free Xsolla Publisher Account and get started today, or explore our next blog post on the challenges of global tax management. Disclaimer: Tax rates and regulations are subject to change. Xsolla continuously monitors updates and adjusts rates accordingly. This blog is for informational purposes only and should not be construed as tax advice.Featured articles

Contact us

Talk to an expert

Ready to maximize revenue opportunities? Reach out to our experts and learn how to start earning more and spending less.