Alternative payment methods

In-game purchases

Mobile

Mobile payments are here to stay

January 31, 2025•6 min

Mobile payments: The primer

Mobile payment solutions offer speed and convenience, making them an increasingly popular choice for consumers worldwide. As smartphones and tablets become central to daily life, more people use these devices to pay for products and services. What are mobile payments? In short, a mobile payment is a contactless payment method that uses a mobile device, such as a smartphone, smartwatch, or tablet, to complete a transaction. Mobile payments enable users to transfer funds via smartphones, tablets, and more, eliminating the need for cash, checks, or physical cards. These payment methods are versatile and can be used in various scenarios, such as:- Peer-to-peer transactions: Sending money directly to a friend or an online contact.

- In-person payments: Paying for goods or services at retail locations through mobile apps.

- Mobile wallets: Applications like Apple Pay, Google Pay, and Samsung Pay store payment information for seamless transactions.

- Near-field communications (NFC): Tap-enabled payments through NFC-compatible devices and readers. NFC payments are one of the most widely adopted methods for mobile transactions. They rely on secure, short-range wireless communication between a mobile device and a payment terminal.

- QR codes: Payments are initiated by scanning a QR code with a mobile device.

- Virtual terminals: Manual entry of payment details via a virtual terminal app on a mobile device.

State of the market

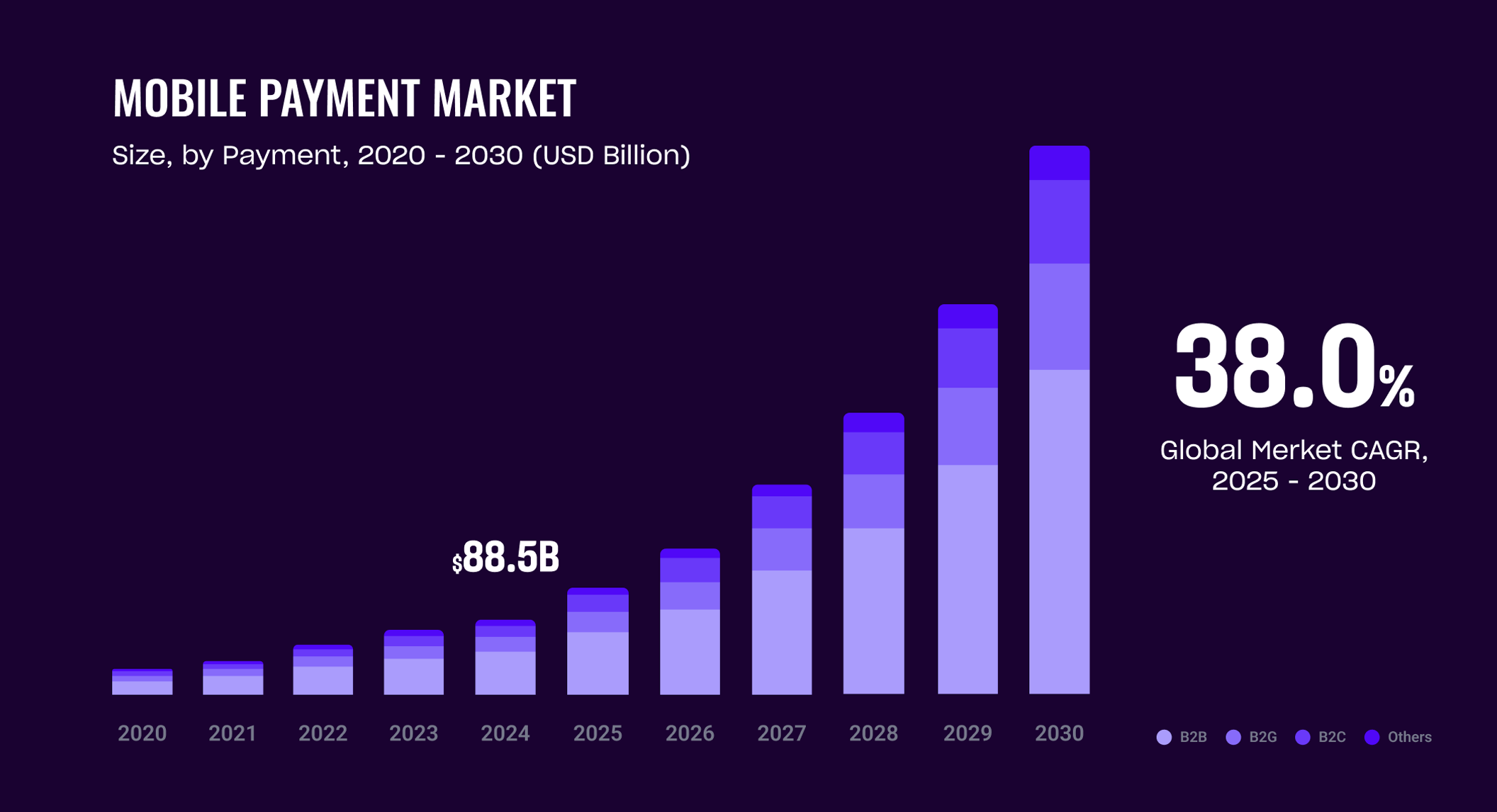

The global mobile payment market, valued at $88.50 billion in 2024, is expected to grow at a compound annual growth rate (CAGR) of 38.0% from 2025 to 2030. This growth is driven by key features of mobile payments, including improved security, user-friendly interfaces, fast transaction times, cost efficiency, and widespread internet accessibility. Factors such as the rapid increase in mobile commerce —aka “m-commerce—, the steady rise in smartphone adoption, businesses’ growing focus on integrating mobile payment options into their platforms, and broader access to high-speed internet are expected to further accelerate the adoption of mobile payment systems during this period.

As we move into 2024 and beyond, the rise of mobile payments is impossible to ignore. With more players using mobile devices for their gaming experiences, they also expect seamless and secure payment options. Offering mobile payments is no longer just a convenience—it's becoming a standard expectation in the industry.

As we move into 2024 and beyond, the rise of mobile payments is impossible to ignore. With more players using mobile devices for their gaming experiences, they also expect seamless and secure payment options. Offering mobile payments is no longer just a convenience—it's becoming a standard expectation in the industry.

- By 2027, mobile payments are expected to surpass $1 trillion in point-of-sale transactions in the United States.

- According to a March 2024 forecast, ~40% of people in the US will use proximity mobile payments this year.

- Mobile payments are projected to account for 79% of all digital transactions in 2025 —up from 71% in 2021.

The value of mobile payments

In today’s digital-first world, adopting mobile payment options is no longer optional —especially for game developers. Here’s why. Simplified transactions Mobile payments make purchases easier for players. With a tap or scan, players can complete transactions without carrying cash or multiple cards. This convenience allows for smoother in-game purchases and enhances the overall user experience. Improved security Mobile payment systems employ advanced security measures to protect users. Encryption and tokenization ensure sensitive information, like card details, are not exposed during transactions. Additionally, biometric authentication methods, such as fingerprint or facial recognition, add extra layers of protection, building trust with players. Speed and efficiency Mobile payments significantly reduce transaction times. Contactless options streamline checkout, ensuring players can make purchases quickly and return to the game without unnecessary delays. Adapting to global trends The COVID-19 pandemic accelerated the adoption of contactless payment methods, making mobile payments a preferred choice for many consumers. Features like NFC smartphone technology enable fast and hygienic transactions, aligning with the growing demand for safer and more convenient payment solutions.The benefits of mobile payments

By enabling mobile payments, game developers can offer a seamless, secure, and efficient payment experience, meeting player expectations while staying competitive in an evolving market. Boosted sales and higher conversion: By integrating mobile payment options, gaming companies can reach a wider audience, particularly players who prefer digital and convenient transaction methods. This often results in increased sales and improved conversion rates. Reduced cart abandonment: In digital storefronts, mobile payments streamline the checkout process, minimizing the likelihood of players abandoning their carts and encouraging them to complete purchases. Enhanced player experience: Providing modern and seamless payment options improves the overall experience for players. This convenience can foster stronger player loyalty and enhance the studio’s reputation within the industry. Better security and fraud prevention: Mobile payment platforms often come with advanced security features, reducing instances of fraud and chargebacks. This not only protects your business; it lifts player confidence and simplifies compliance with payment security standards. Streamlined financial operations: Digital payments reduce the complexity of managing cash or manual transactions. They make it easier for studios to track, reconcile, and report revenue, allowing teams to focus on core business activities. Access to gamer insights: Mobile payment platforms can provide valuable data on player behavior and preferences. This information can guide studios in making strategic decisions, such as optimizing pricing, promotions, and in-game purchases. By adopting mobile payments, gaming companies can not only improve their operational efficiency but also create a better experience for players, driving both revenue and customer satisfaction.Leveraging Xsolla for digital payment success

Mobile payments are no longer optional—they are crucial for extending your game's reach in a global market. With smartphones in the hands of players worldwide, offering easy and secure payment options ensures your game remains accessible to a diverse audience. Mobile payments simplify the purchasing process, making it easier for players from various regions to buy in-game content. Xsolla covers a broad range of mobile payment coverage options, including leading mobile wallets (PayPal, Apple Pay), QR payments (WeChat and Alipay), mobile carrier billings, and regional mobile payment solutions (M-Pesa, Grabpay, Gcash) plus many more. Staying ahead of payment trends is essential in a fast-evolving industry. Xsolla focuses on delivering secure, streamlined checkout experiences with an intuitive, multi-platform interface tailored for mobile transactions. These tools are designed to help your game tap into the growing mobile payments market. The result? A seamless purchasing experience for players, driving engagement and revenue growth.Take the next step

Ready to optimize your players’ payment experience? Connect with our team of experts to explore how Xsolla can enhance your payment solutions. Schedule a meeting today. See Xsolla Payments in action. Try our demos to understand how our payment system works and how it can benefit your business. Join the Xsolla community. Not a partner yet? Create an Xsolla Publisher Account today to unlock powerful tools for your game.Featured articles

Contact us

Talk to an expert

Ready to maximize revenue opportunities? Reach out to our experts and learn how to start earning more and spending less.