Alternative payment methods

Exploring mobile carrier billing: Another way to monetize digital payments

November 1, 2024•5 min

Mobile payments are revolutionizing how consumers interact with their favorite services, especially in the gaming industry. Among these, mobile carrier billing has emerged as a convenient and secure method for mobile users to pay for value-added services without relying on traditional payment methods like credit/debit cards.

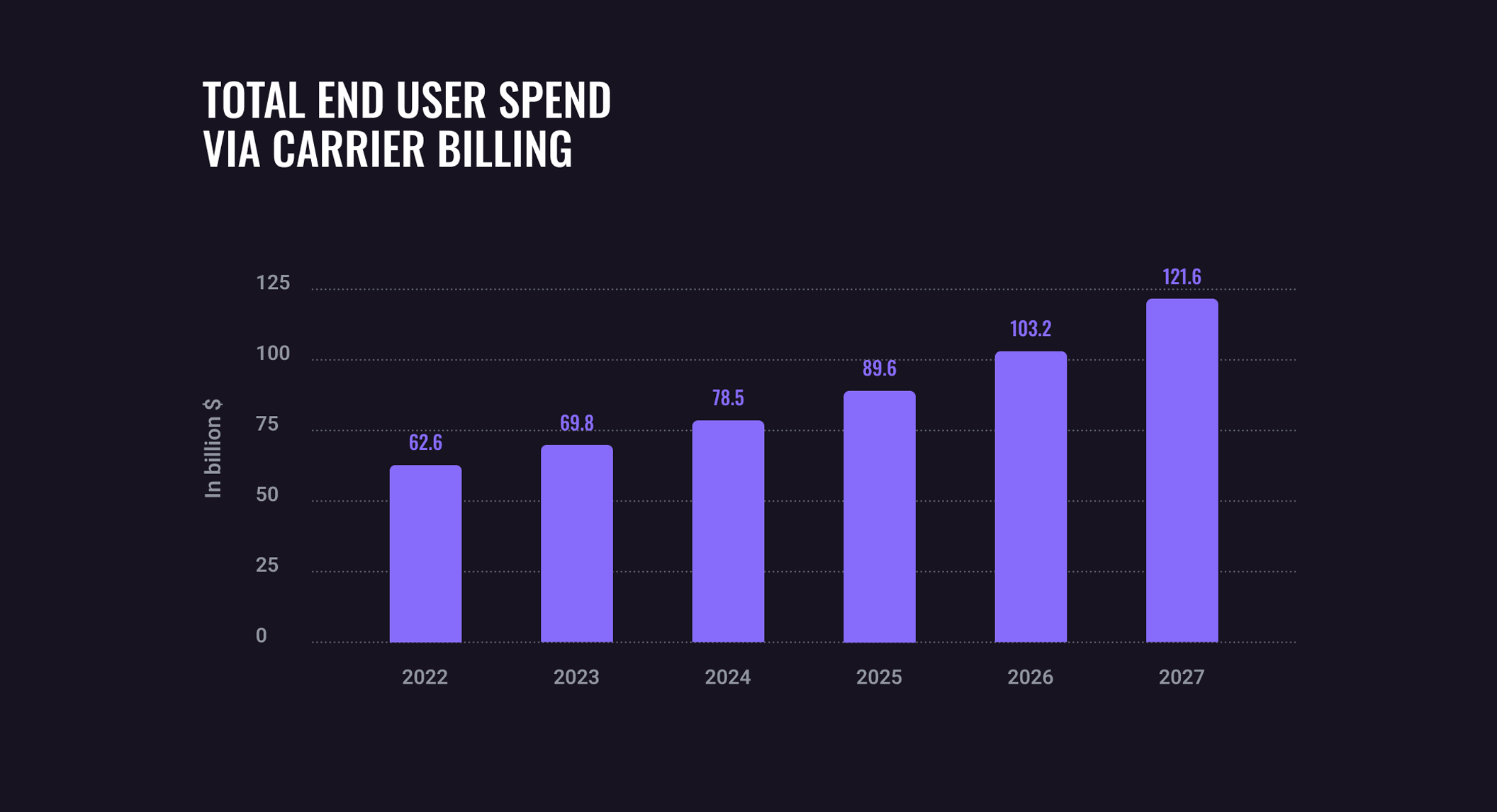

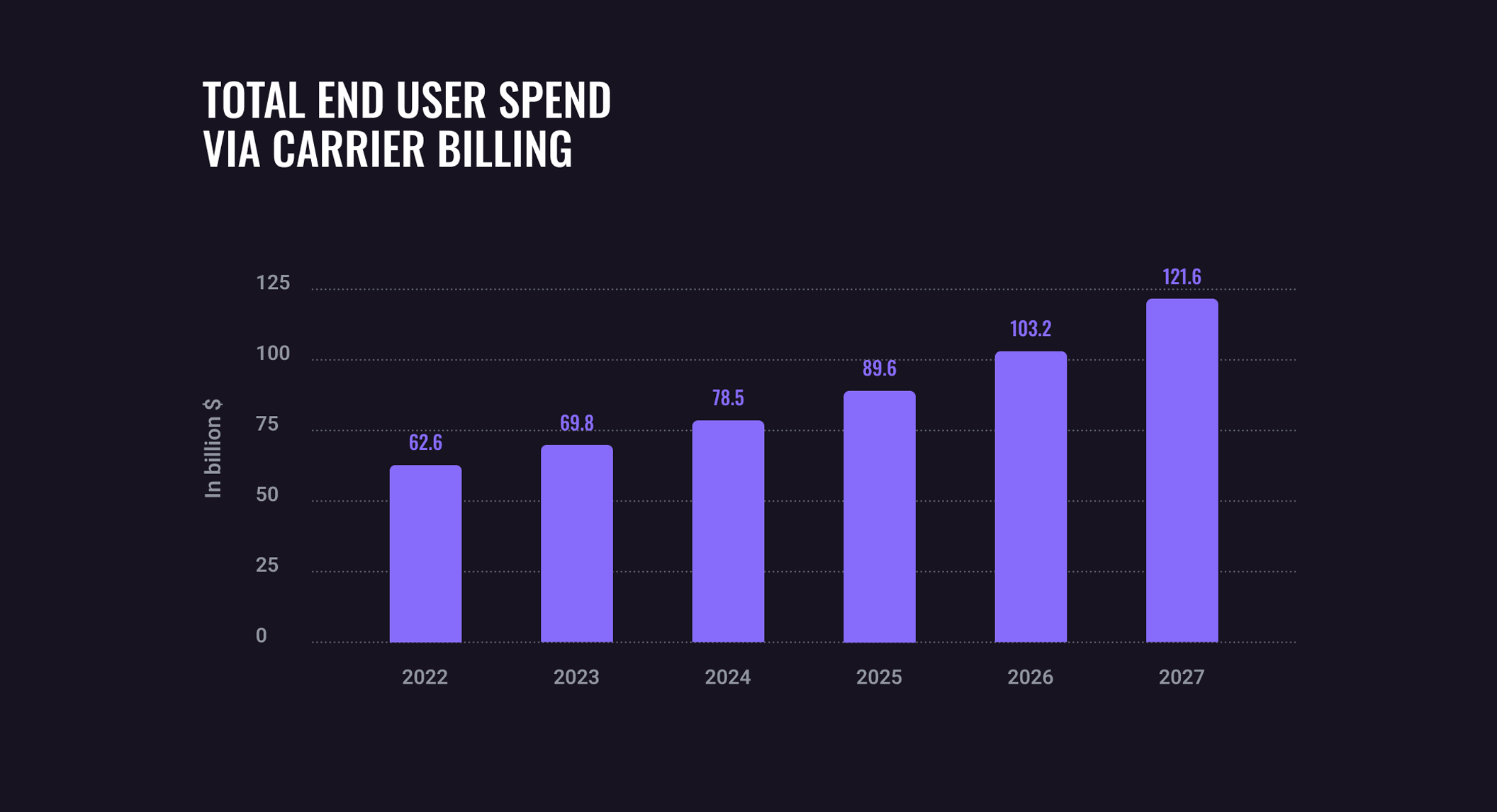

Source: Juniper Research’s Carrier Billing: Regional Analysis, Key Verticals & Market Forecasts 2023-2027 report. The rise of mobile payments is fueled by the ever-growing smartphone adoption, increasing internet penetration, and more demand for digital content. In fact, the number of carrier billing users is expected to reach 1.8 billion by 2027, up from 1.65 billion in 2024. As digital games continue to dominate this market segment, reaching an estimated $40.8 billion in spend by 2027, mobile carrier billing is poised to play a pivotal role in the future of mobile payments.

Source: Juniper Research’s Carrier Billing: Regional Analysis, Key Verticals & Market Forecasts 2023-2027 report. Understanding mobile carrier billing: DCB v PSMS Before we dive into the benefits of mobile payments, it's important to distinguish between the two primary methods: Direct Carrier Billing (DCB) and Premium SMS (PSMS).

While both DCB and PSMS offer convenient ways to pay using your mobile phone, DCB's user-friendly interface and efficient transaction process have solidified its position as the go-to method for many digital content providers and consumers alike.

While both DCB and PSMS offer convenient ways to pay using your mobile phone, DCB's user-friendly interface and efficient transaction process have solidified its position as the go-to method for many digital content providers and consumers alike.

These regions are experiencing a surge in the popularity of mobile payments, driven by factors such as increasing smartphone adoption and expanding mobile connectivity. The carrier billing market in these areas is projected to experience substantial growth, with compound annual growth rates (CAGRs) of 37.7% and 37.3%, respectively. The low penetration of traditional payment methods, such as credit cards, has created a favorable environment for the adoption of alternative options like mobile payments. This has helped the region emerge as a leader in the number of carrier billing users, with projections indicating a growth from 742 million in 2024 to 803 million by 2027. Latin America (LATAM)

With historically low rates of financial services penetration, carrier billing spending is expected to grow from $2.6 billion in 2023 to $6.5 billion by 2027, boasting a CAGR of 25.1%. The rise of digital content consumption, coupled with improved mobile connectivity, is driving this change.

Mobile carrier billing: Industry trends and shifts

With the global spend on carrier billing projected to grow from $78.5 billion in 2024 to $122 billion by 2027, it's clear that this payment solution is becoming increasingly vital—especially in regions where access to traditional banking is limited.

Source: Juniper Research’s Carrier Billing: Regional Analysis, Key Verticals & Market Forecasts 2023-2027 report. The rise of mobile payments is fueled by the ever-growing smartphone adoption, increasing internet penetration, and more demand for digital content. In fact, the number of carrier billing users is expected to reach 1.8 billion by 2027, up from 1.65 billion in 2024. As digital games continue to dominate this market segment, reaching an estimated $40.8 billion in spend by 2027, mobile carrier billing is poised to play a pivotal role in the future of mobile payments.

Source: Juniper Research’s Carrier Billing: Regional Analysis, Key Verticals & Market Forecasts 2023-2027 report. Understanding mobile carrier billing: DCB v PSMS Before we dive into the benefits of mobile payments, it's important to distinguish between the two primary methods: Direct Carrier Billing (DCB) and Premium SMS (PSMS).

- Direct Carrier Billing (DCB) offers a seamless payment experience by simply adding the cost to your phone bill or deducting it from your prepaid balance. This convenient approach has made DCB a popular choice among digital content providers, such as gaming companies, who appreciate its ease of use for their customers.

- Premium SMS (PSMS) involves sending a text message to a designated short code. This action triggers the payment process, adding the cost to your phone bill or prepaid balance. While PSMS provides a straightforward payment method, DCB's streamlined nature often makes it the preferred choice for digital goods and services.

While both DCB and PSMS offer convenient ways to pay using your mobile phone, DCB's user-friendly interface and efficient transaction process have solidified its position as the go-to method for many digital content providers and consumers alike.

While both DCB and PSMS offer convenient ways to pay using your mobile phone, DCB's user-friendly interface and efficient transaction process have solidified its position as the go-to method for many digital content providers and consumers alike.

The appeal of mobile payments

One of the key advantages of mobile payments is their speed and efficiency. With just a few taps on their smartphones, users can complete their purchases without the hassle of entering lengthy payment details. Mobile payments also offer a higher level of security compared to traditional payment methods and have useful advantages that make them an attractive payment option across various regions.- Speed and security. Fast, secure, and user-friendly, the mobile payment process is streamlined, requiring only a few clicks to complete a transaction. Additionally, many DCB providers have implemented strict user verification processes like one-time passwords (OTPs) or biometric authentication, to ensure that only authorized users can make transactions. This means mobile carrier billing minimizes fraud risks since it doesn’t require users to enter sensitive payment information.

- Higher conversion rates. Mobile payments' seamless checkout process leads to significantly higher conversion rates. In fact, DCB can result in conversion rates up to 10 times higher than credit card payments for digital goods and services.

- Financial inclusion. Mobile payments, especially carrier billing, play a crucial role in promoting financial inclusion. In regions with low bank penetration, these payment methods provide a convenient way for individuals to participate in the digital economy. As smartphone ownership continues to rise, mobile payments offer a gateway to a world of opportunities for previously underserved populations.

These regions are experiencing a surge in the popularity of mobile payments, driven by factors such as increasing smartphone adoption and expanding mobile connectivity. The carrier billing market in these areas is projected to experience substantial growth, with compound annual growth rates (CAGRs) of 37.7% and 37.3%, respectively. The low penetration of traditional payment methods, such as credit cards, has created a favorable environment for the adoption of alternative options like mobile payments. This has helped the region emerge as a leader in the number of carrier billing users, with projections indicating a growth from 742 million in 2024 to 803 million by 2027. Latin America (LATAM)

With historically low rates of financial services penetration, carrier billing spending is expected to grow from $2.6 billion in 2023 to $6.5 billion by 2027, boasting a CAGR of 25.1%. The rise of digital content consumption, coupled with improved mobile connectivity, is driving this change.

The future is mobile: Xsolla can help you get there

Mobile payments are not just a trend; they are essential for expanding your game's global reach. They empower every player with a smartphone to make seamless payments, ensuring that your game can thrive in diverse markets. By offering a seamless and convenient payment experience, you can empower players from all corners of the world to make purchases easily and securely. With the extensive network of mobile carriers on Xsolla Pay Station, you can tap into the lucrative mobile payments market and ensure that your game is accessible to a wider audience:- 56+ mobile operators. We partner with major mobile carriers, such as SKT, KT, LG U+, Maxis, T-Mobile, Vodafone, and more to provide comprehensive coverage worldwide.

- 28+ countries. With dozens of countries supported, our team of experts is here to help you harness the power of mobile carrier billing.

Featured articles

Contact us

Talk to an expert

Ready to maximize revenue opportunities? Reach out to our experts and learn how to start earning more and spending less.