How global taxes are calculated and paid

February 29, 2024•5 min

Navigating taxes as a game studio or publisher is challenging, as your digital sales taxes are heavily scrutinized. To remain compliant and successful, your company must understand local and global tax compliance rules and regulations, from filing tax returns to understanding audits.

That's where Xsolla can help as your merchant of record (MoR). Xsolla has helped sell digital goods on behalf of game developers, accepted end-user payments through various payment methods, assumed responsibility for tax collection and remittance, and ensured compliance with local government regulations. Our global experience, dedicated workforce, and expertise have provided numerous game developers with a focus on creating instead of worrying about taxes.

To understand how taxes are calculated and paid, this blog will give you a high-level overview of how the tax compliance process works and the benefits your company can obtain by partnering with Xsolla. If you need a refresher on the basics of global taxes, read our first blog in this tax series here.

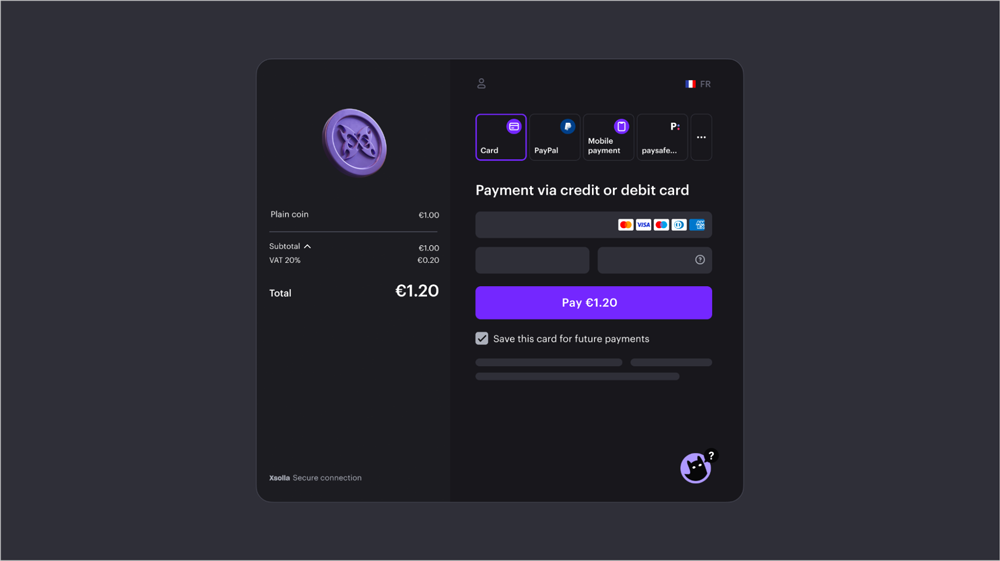

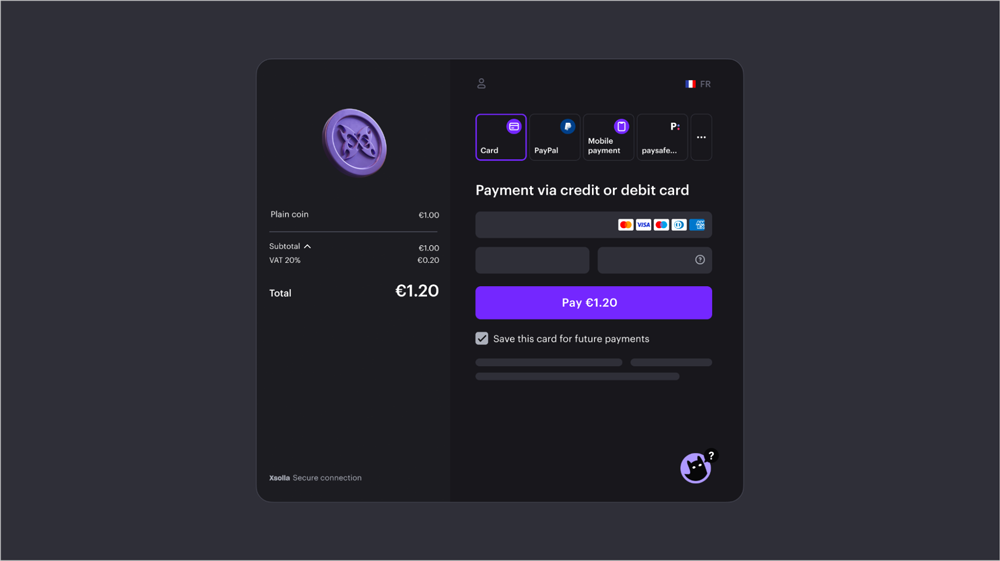

Example of Player’s Checkout Interface with transaction details

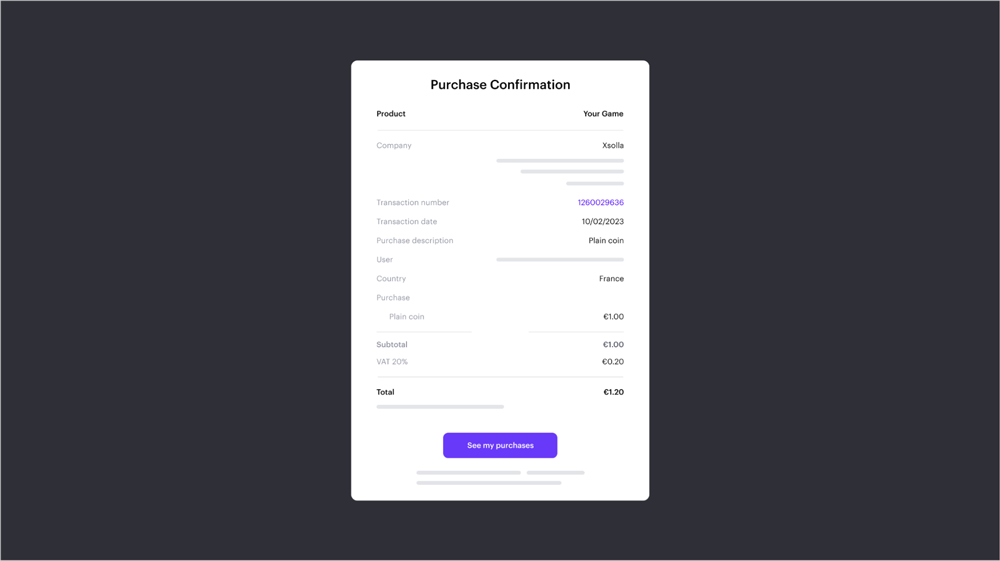

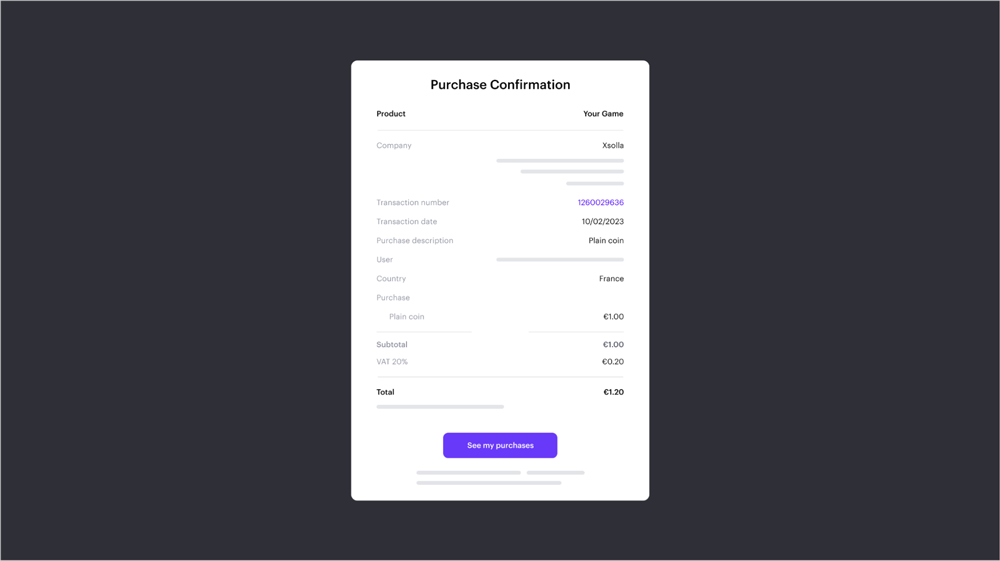

After the payment is complete, the user receives a purchase confirmation with all the transaction details, including the applied indirect tax rate and amount.

Example of Purchase Confirmation

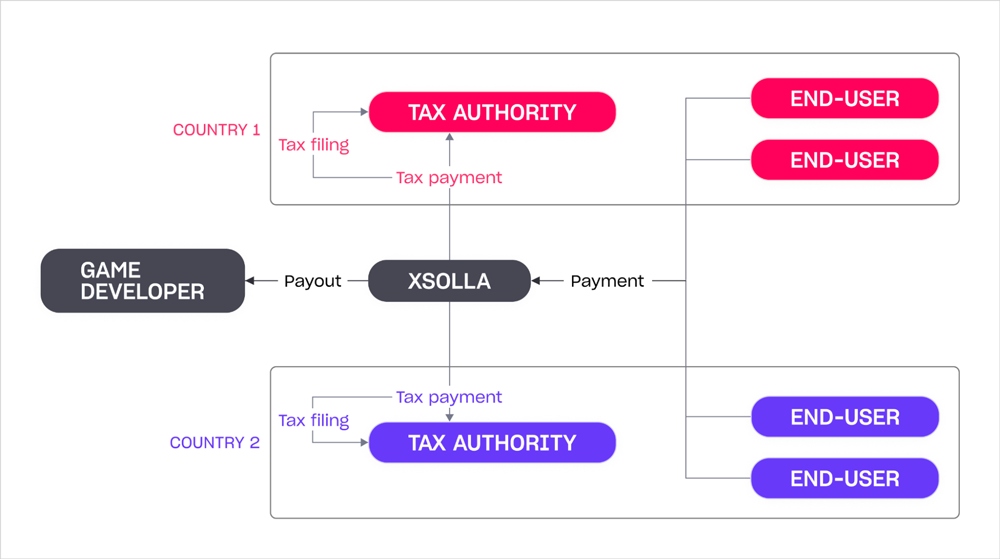

In some countries, local laws might require issuing special tax invoices in a specific format or using specific equipment or software to issue the invoices. Xsolla handles that by creating and delivering these special invoices directly to the user, ensuring compliance even with the most complex regulations. Reporting and payment Reporting and paying taxes is the second step in the tax compliance process, and it can be the most complicated for a business to manage locally and globally. Regions and countries have different rules, regulations, and requirements for when and how to file and pay taxes. For example, the countries in which your customers are located may require you to file taxes for different periods (monthly, bimonthly, quarterly, or yearly), to use specific software for tax returns, to assign a local filing agent, to pay taxes through a local bank account, and so on. Xsolla handles all these details on your behalf as your MoR. Based on each region, Xsolla collects all the information on each purchase made and files the appropriate tax returns. Xsolla also constantly monitors changes in global tax regulations to ensure full compliance across multiple regions. Tax aggregation, filing returns, and paying taxes are handled by our tax experts, leaving you free to focus on other aspects of your business.

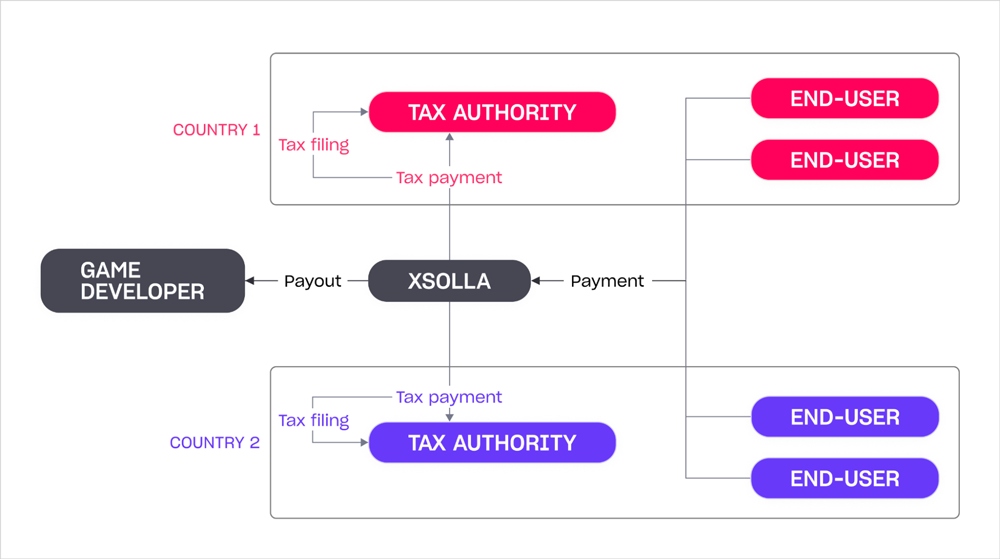

The reporting process with Xsolla as your merchant of record

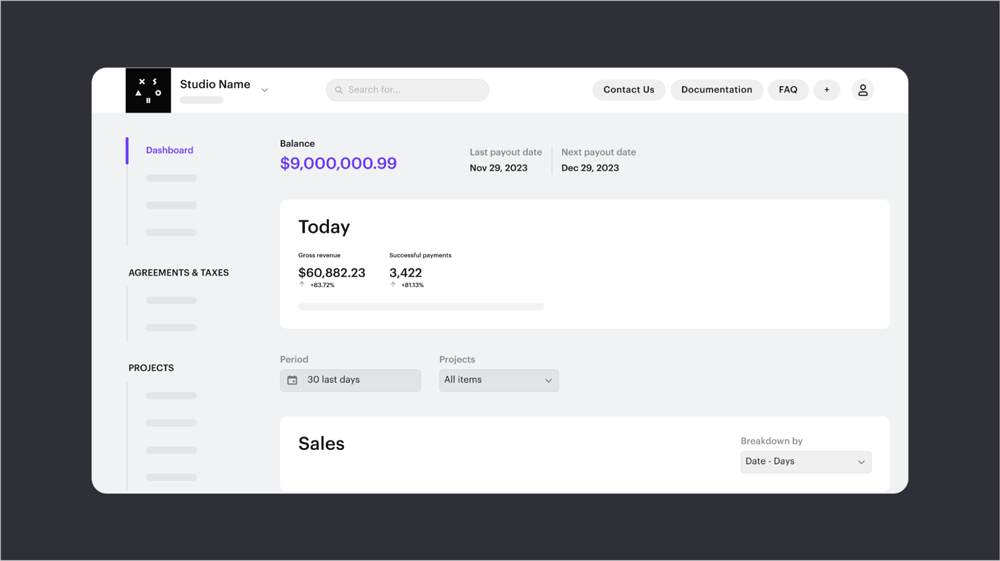

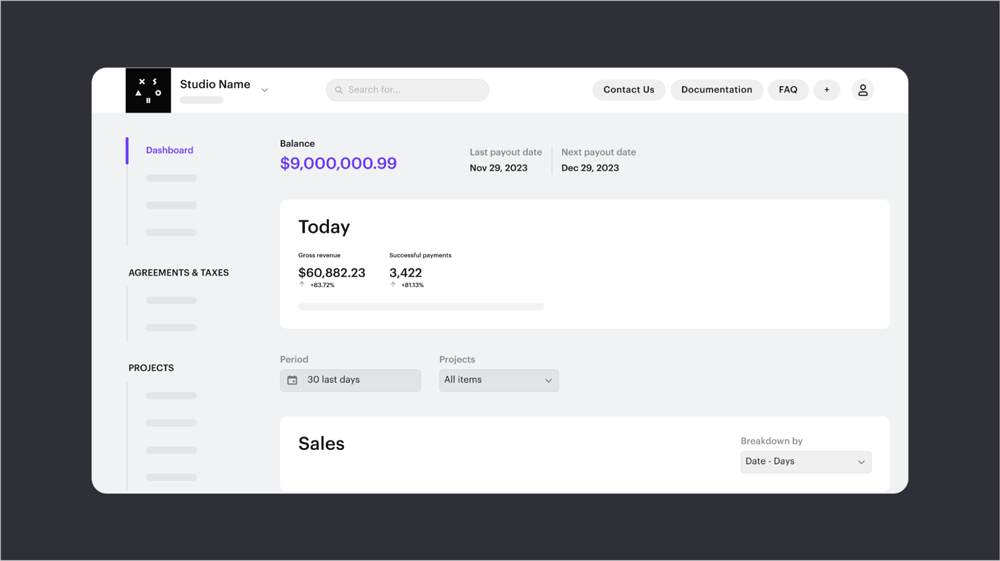

Xsolla Publisher Account general overview

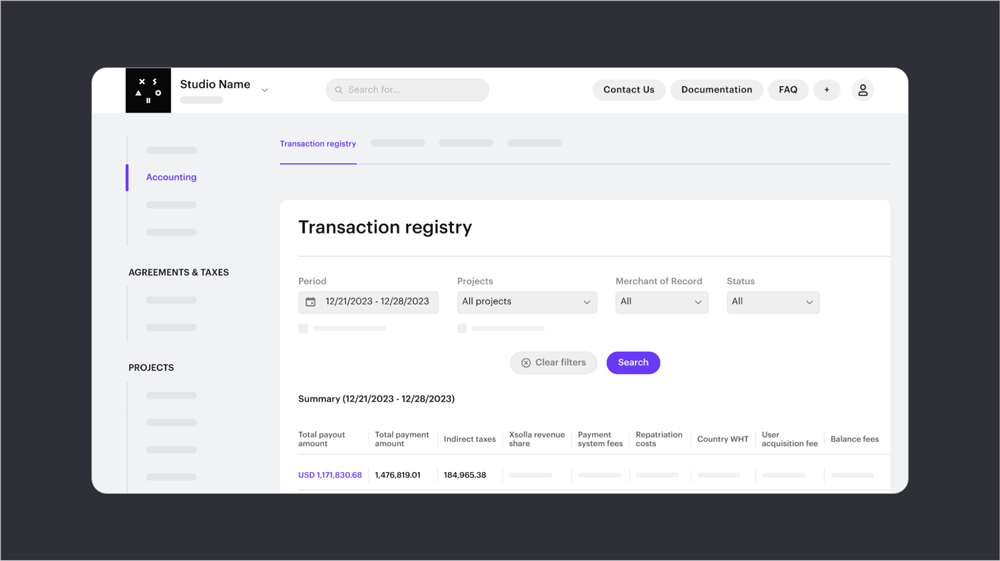

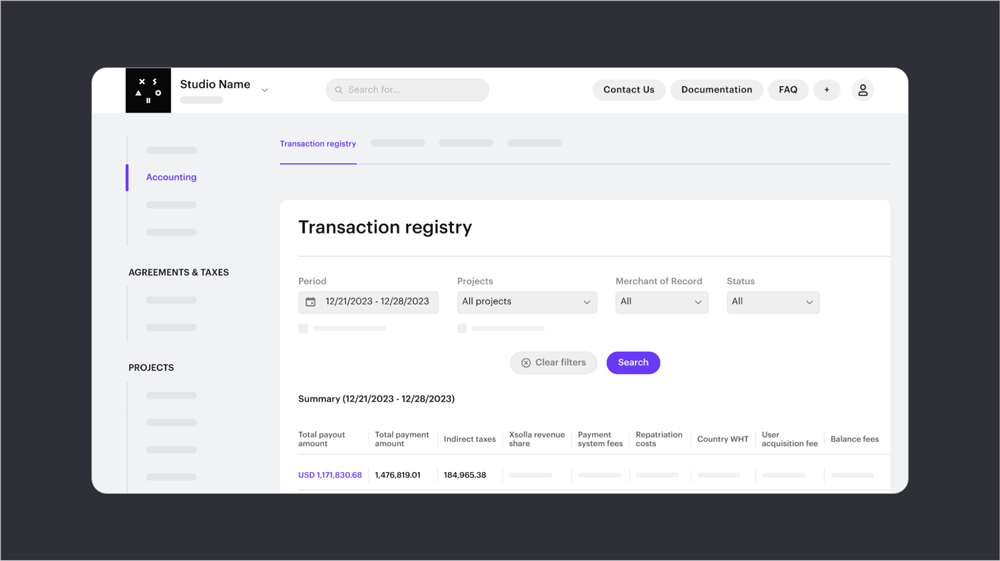

Transaction registry and indirect taxes in Xsolla Publisher Account

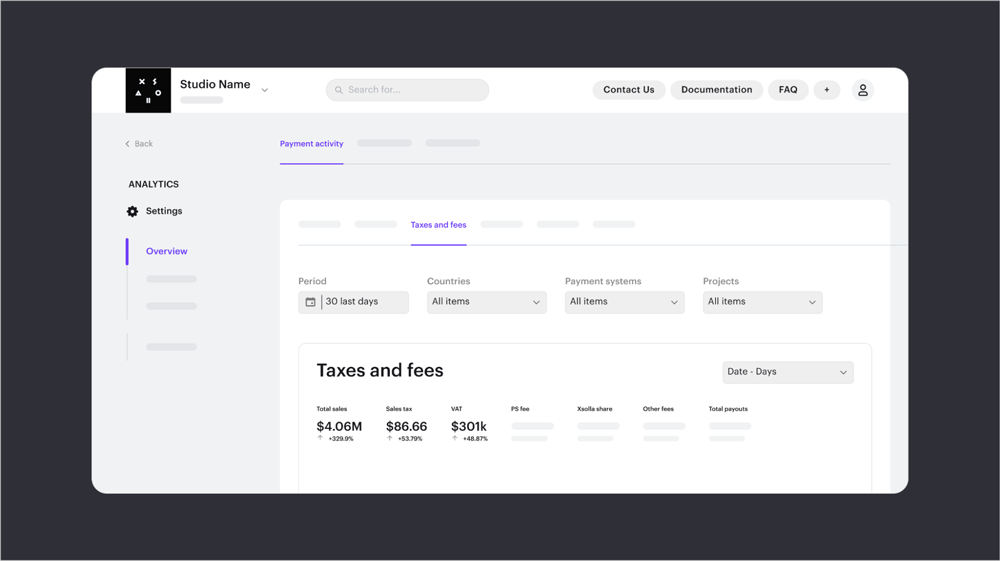

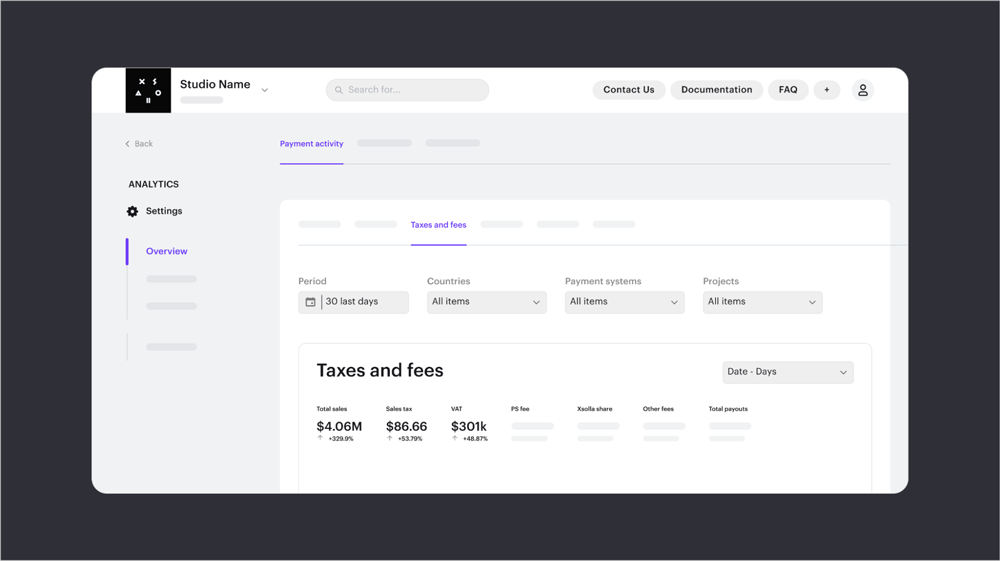

Exploring taxes and fees in Xsolla Publisher Account

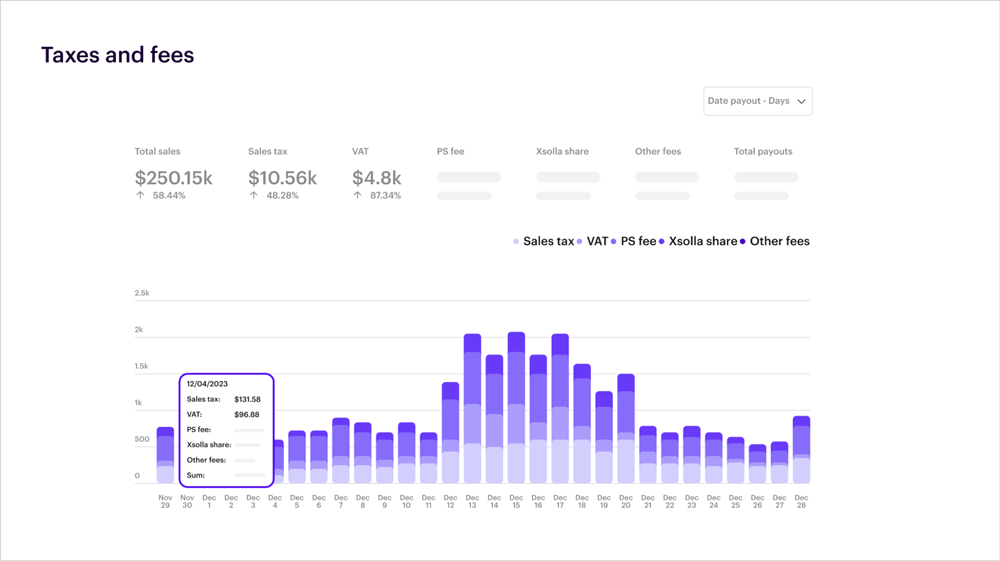

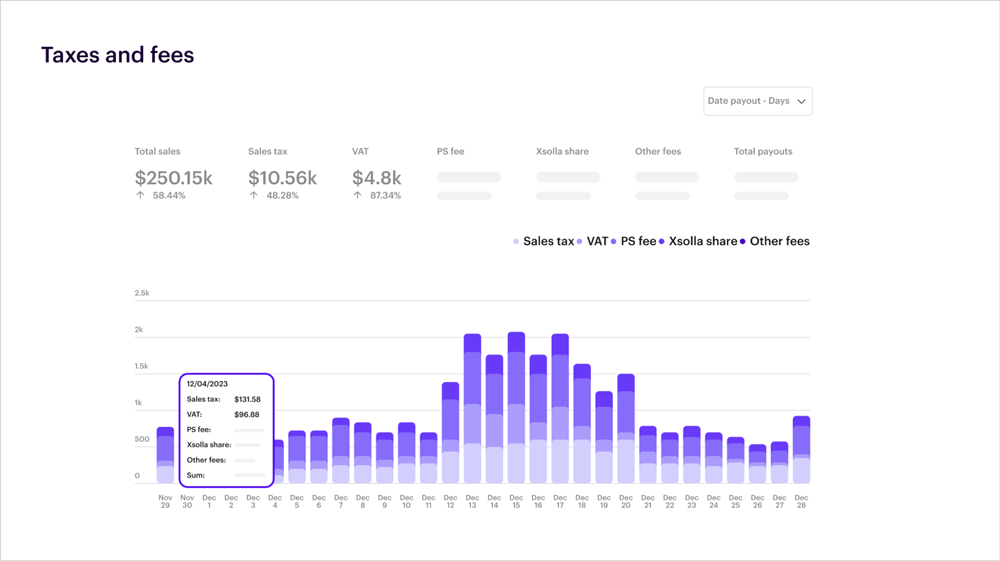

Publisher Account charts illustrate trends, statistics and breakdown on taxes and fees

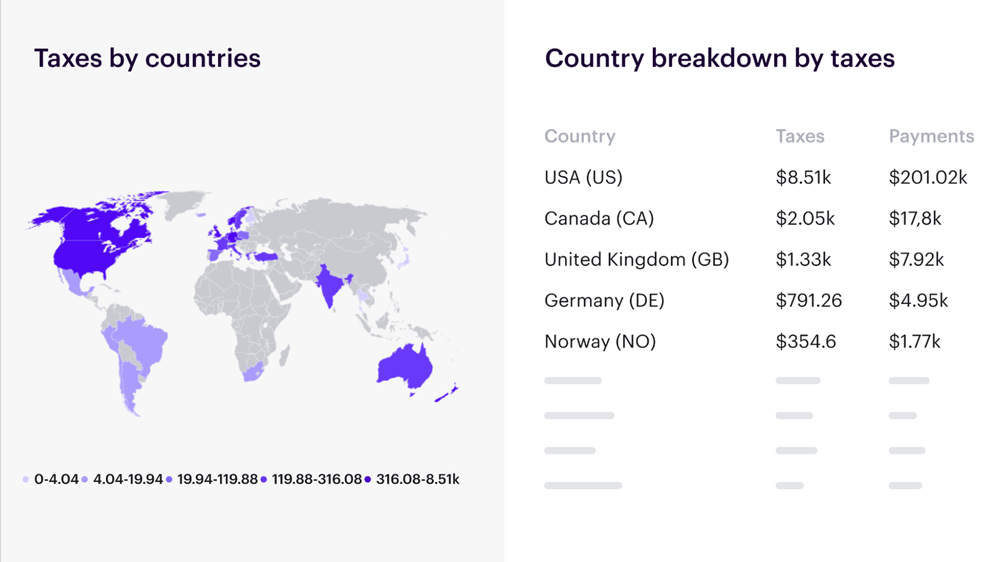

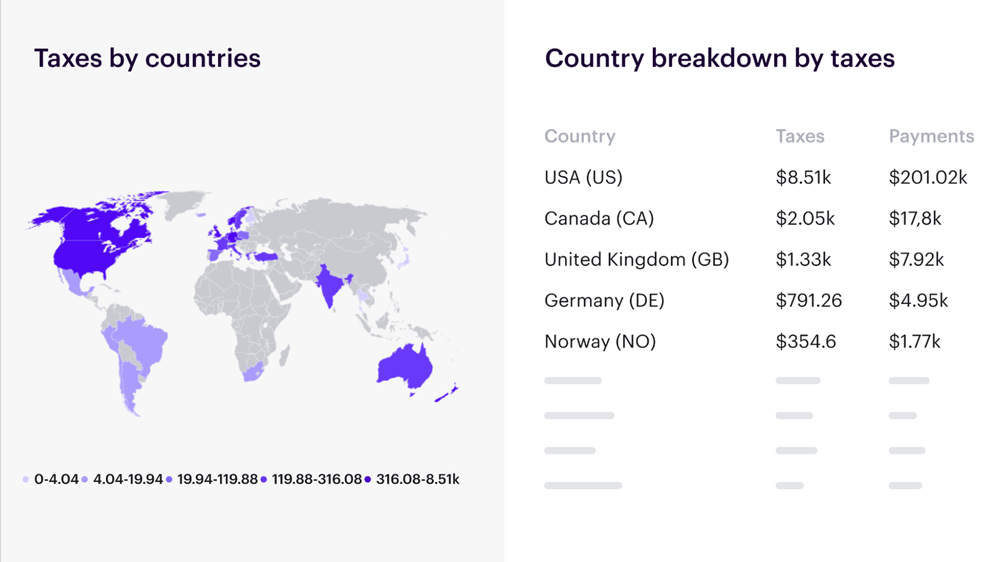

Publisher Account charts illustrate trends, statistics and breakdown on taxes and fees (by countries)

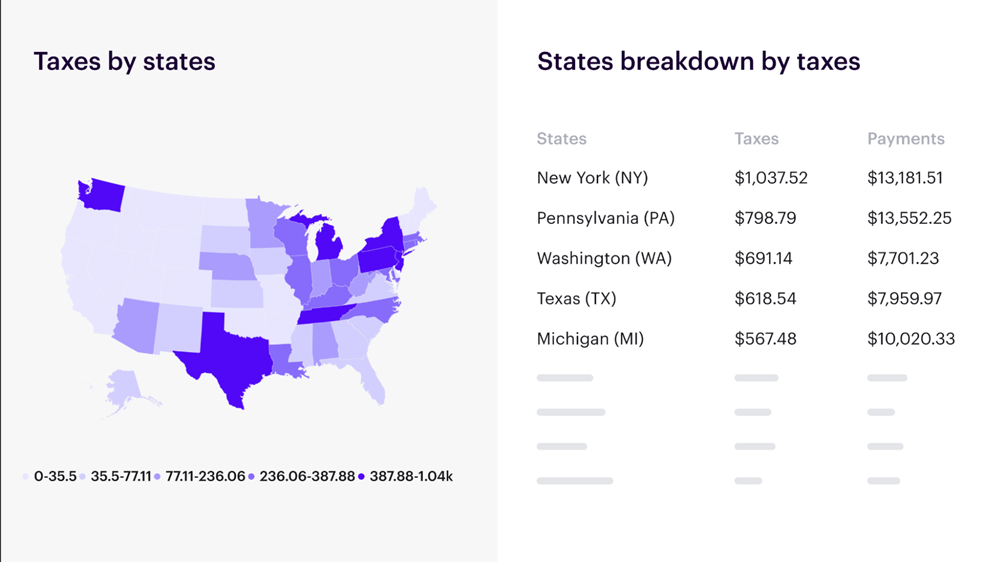

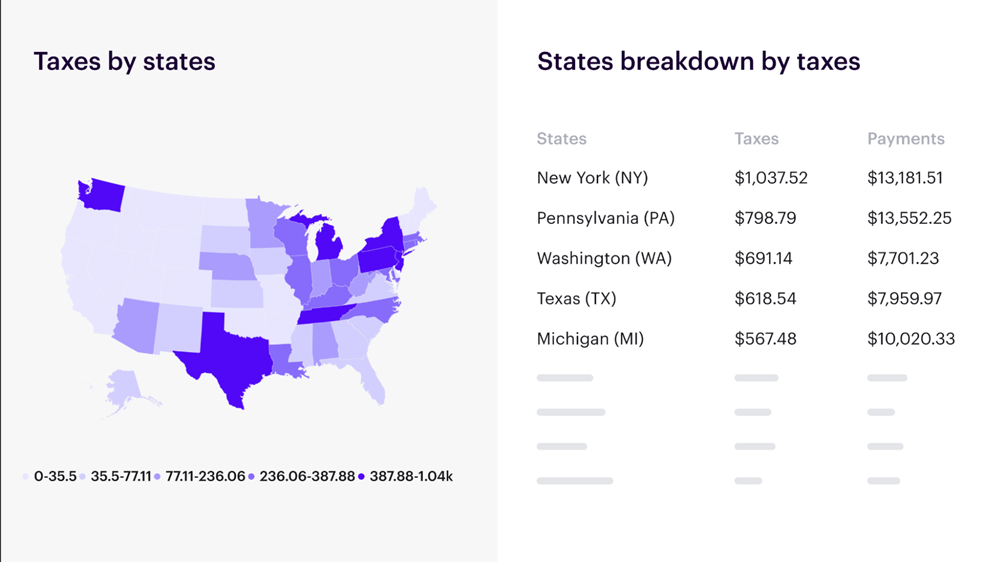

Publisher Account charts illustrate trends, statistics and breakdown on taxes and fees (by US states)

Merchant of record

In today's global economy, the sale of digital goods is a process that involves three separate entities - merchants, financial institutions, and payment processors. Merchants sell their digital goods, while financial institutions like banks act as secure vaults, holding funds and approving transactions. Payment processors become the trusted messengers, safely carrying payment information between merchants and customers. MoRs do more than just handle the technical stuff of online payments. They also handle tricky tasks like collecting and reporting taxes, sending money internationally, and ensuring everything follows the rules. That is where MoRs go above and beyond what regular payment processors can do. As an MoR, Xsolla covers the following areas for your company to save your business time and money and protect you from potential financial pitfalls:- Up-to-date information. Xsolla monitors tax law changes worldwide to ensure they comply in every region.

- Automatic tax calculations. Based on each buyer's location, Xsolla automatically figures out the right amount of tax to collect for each transaction.

- Filing and payments. Xsolla files tax returns, pays taxes in every country where you have a sale, and handles any necessary tax audits.

- Clear reporting. You'll get comprehensive reports from Xsolla showing your global sales performance and how much tax has been collected.

- Expert support. A team of international tax and compliance experts at Xsolla and top-tier tax consultants worldwide ensures everything runs smoothly.

The tax compliance process

Purchase determination The first step in the tax compliance process is determining where a purchase originated from and collecting the correct amount of tax from the user. Using a series of custom-developed algorithms to pinpoint a user's location, Xsolla automatically calculates, collects, and displays taxes to the user during checkout.

Example of Player’s Checkout Interface with transaction details

After the payment is complete, the user receives a purchase confirmation with all the transaction details, including the applied indirect tax rate and amount.

Example of Purchase Confirmation

In some countries, local laws might require issuing special tax invoices in a specific format or using specific equipment or software to issue the invoices. Xsolla handles that by creating and delivering these special invoices directly to the user, ensuring compliance even with the most complex regulations. Reporting and payment Reporting and paying taxes is the second step in the tax compliance process, and it can be the most complicated for a business to manage locally and globally. Regions and countries have different rules, regulations, and requirements for when and how to file and pay taxes. For example, the countries in which your customers are located may require you to file taxes for different periods (monthly, bimonthly, quarterly, or yearly), to use specific software for tax returns, to assign a local filing agent, to pay taxes through a local bank account, and so on. Xsolla handles all these details on your behalf as your MoR. Based on each region, Xsolla collects all the information on each purchase made and files the appropriate tax returns. Xsolla also constantly monitors changes in global tax regulations to ensure full compliance across multiple regions. Tax aggregation, filing returns, and paying taxes are handled by our tax experts, leaving you free to focus on other aspects of your business.

The reporting process with Xsolla as your merchant of record

Empowering partners via Xsolla Publisher Account

Xsolla Publisher Account provides many valuable tools, including sales and tax dashboards and analytics. Designed to be transparent, Publisher Account is your go-to command center once you create your login. Navigate your global tax performance by viewing fully customizable, up-to-date dashboards. You'll receive detailed, personalized reports showing indirect tax collection in every country of sales and easily track daily changes and trends with our dedicated tax analytics sections. You'll always have a clear picture of what's happening without diving into the whole compliance routine. Below are some screenshots of the high-level reporting that comes standard for every account holder, with views for real-time analytics, detailed tax information, global sales performance, indirect tax collection by country, and more.

Xsolla Publisher Account general overview

Transaction registry and indirect taxes in Xsolla Publisher Account

Exploring taxes and fees in Xsolla Publisher Account

Publisher Account charts illustrate trends, statistics and breakdown on taxes and fees

Publisher Account charts illustrate trends, statistics and breakdown on taxes and fees (by countries)

Publisher Account charts illustrate trends, statistics and breakdown on taxes and fees (by US states)

Staying compliant

Global tax compliance can be a complex and time-consuming burden for game developers. But with Xsolla as your merchant of record, you can focus on games, not taxes. Our team of experts handles everything from automatic tax calculations and filings to clear reporting and expert support, ensuring you stay compliant wherever you operate. Ready to simplify your global tax journey? Create a free Xsolla Publisher Account and get started today, or explore our next blog on why paying taxes matters and what troubles can happen when you aren't compliant.Featured articles

Contact us

Talk to an expert

Ready to maximize revenue opportunities? Reach out to our experts and learn how to start earning more and spending less.