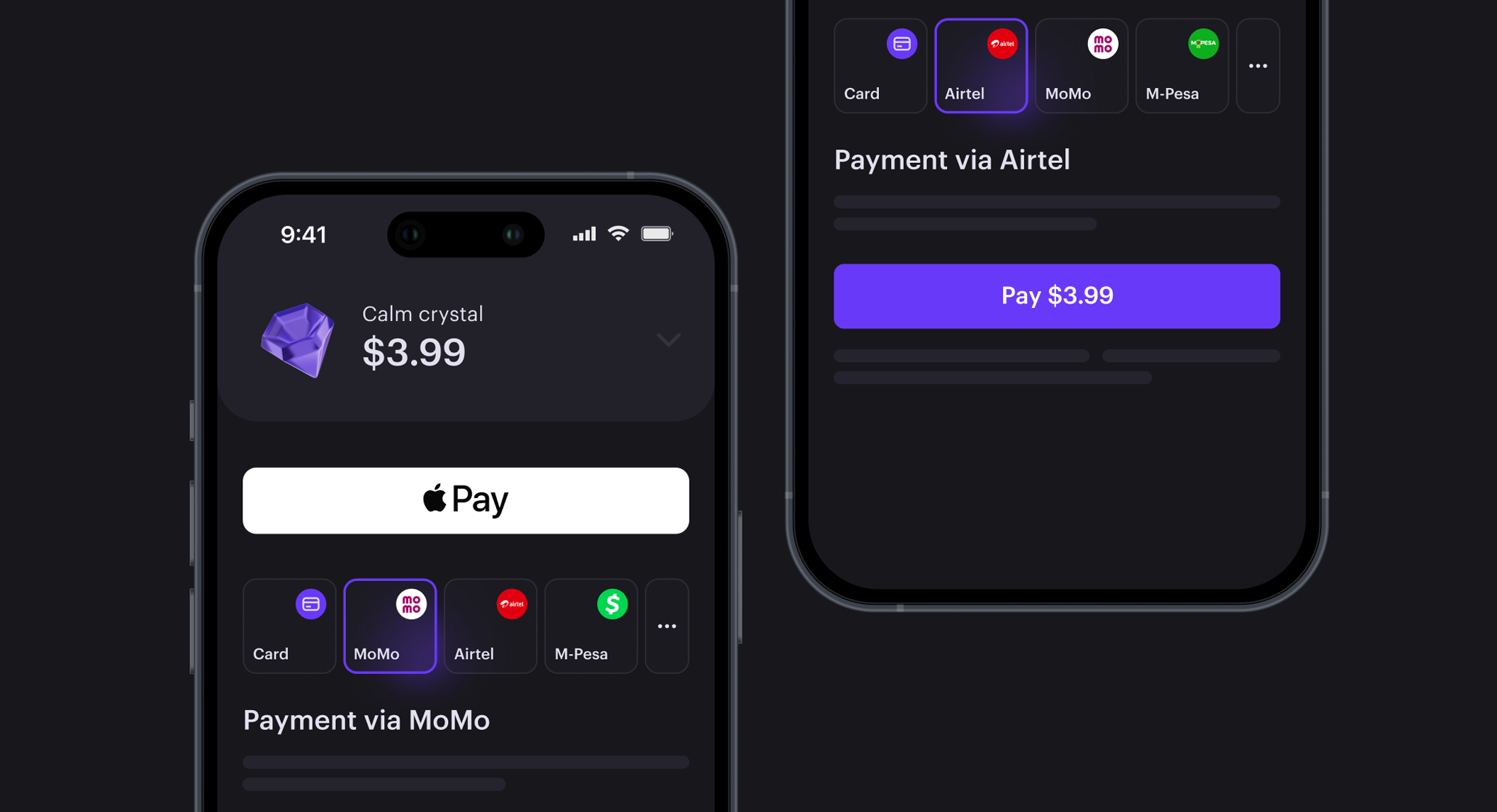

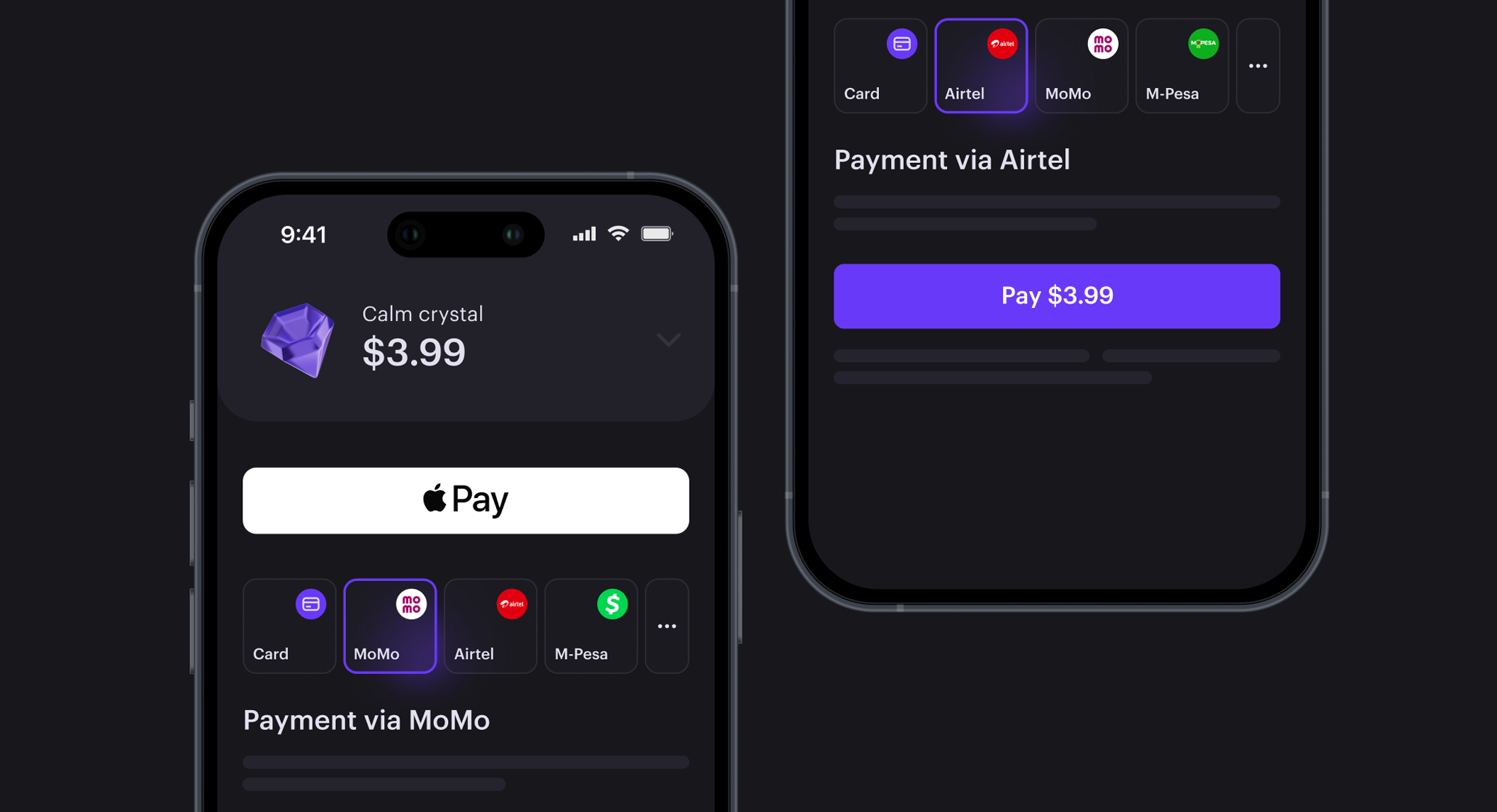

Alternative payment methods

Regional distribution

How digital payments can drive financial inclusion globally

March 19, 2025•6 min

The global financial landscape has transformed in recent years, with digital payment systems playing a crucial role in advancing financial inclusion. Traditionally, individuals and businesses, particularly in developing regions, have struggled with limited access to banking services. However, the rise of mobile money, digital wallets, and instant payment solutions has opened up new economic opportunities, reducing costs and promoting an inclusive financial ecosystem.

For game developers, embracing digital payment methods that drive financial inclusion is essential for expanding their player base and increasing conversions. By integrating local payment solutions, developers can ensure that gamers worldwide can seamlessly access and pay for their games, regardless of their banking status.

MTN MoMo and Airtel Money

MTN Mobile Money (MoMo) and Airtel Money are two other major digital payment platforms in Africa. MoMo processes over 900 million transactions per month and serves more than 50 million users across 16 countries. Meanwhile, Airtel is working to enhance digital and financial inclusion in 14 markets, expanding its 4G services to reach an anticipated 376 million unique users by 2027.

The adoption of these mobile money solutions has significantly reduced dependency on cash, facilitated access to essential financial services, and enabled secure digital transactions for millions across the continent.

Want to bring your game to the African market? Read our blog post to learn how Xsolla can help.

MTN MoMo and Airtel Money

MTN Mobile Money (MoMo) and Airtel Money are two other major digital payment platforms in Africa. MoMo processes over 900 million transactions per month and serves more than 50 million users across 16 countries. Meanwhile, Airtel is working to enhance digital and financial inclusion in 14 markets, expanding its 4G services to reach an anticipated 376 million unique users by 2027.

The adoption of these mobile money solutions has significantly reduced dependency on cash, facilitated access to essential financial services, and enabled secure digital transactions for millions across the continent.

Want to bring your game to the African market? Read our blog post to learn how Xsolla can help.

Aadhaar & UPI

India’s financial inclusion journey has been accelerated by Aadhaar, a unique digital ID system, and Unified Payments Interface (UPI). Aadhaar has registered over 1.38 billion people, streamlining identity verification for financial services.

UPI, developed by the National Payments Corporation of India (NPCI), is a real-time mobile payment system that increased transactions by 46% from 2023 to 2024.

Mobile Wallets

Brands such as PhonePe and Google Pay have further popularized mobile wallets in India, offering users a convenient method for digital payments, bill payments, and fund transfers—all without requiring a traditional bank account. These wallets play a crucial role in financial inclusion by catering to the needs of underserved communities, providing access to micro-loans and microinsurance, and enabling individuals to participate in the digital economy seamlessly.

Aadhaar & UPI

India’s financial inclusion journey has been accelerated by Aadhaar, a unique digital ID system, and Unified Payments Interface (UPI). Aadhaar has registered over 1.38 billion people, streamlining identity verification for financial services.

UPI, developed by the National Payments Corporation of India (NPCI), is a real-time mobile payment system that increased transactions by 46% from 2023 to 2024.

Mobile Wallets

Brands such as PhonePe and Google Pay have further popularized mobile wallets in India, offering users a convenient method for digital payments, bill payments, and fund transfers—all without requiring a traditional bank account. These wallets play a crucial role in financial inclusion by catering to the needs of underserved communities, providing access to micro-loans and microinsurance, and enabling individuals to participate in the digital economy seamlessly.

Digital payments driving financial inclusion

Since access to financial services is no longer limited to traditional banking institutions, digital payment systems have emerged as a powerful tool for bridging the financial gap, enabling millions—especially those in underserved and remote areas—to participate in the global economy. From mobile wallets to instant payment networks, these innovations provide secure, convenient, and affordable transaction methods that drive financial inclusion. Across different regions, localized digital payment solutions have transformed economies, empowering individuals and businesses alike. Let’s explore some of the most impactful digital payment systems that are making a difference worldwide.Africa

M-PESA M-PESA has revolutionized digital finance in Kenya and beyond. Originally launched in 2007 as a simple way to send and receive money via mobile phones, it has now grown into a comprehensive financial services platform. With a customer base of over 50 million users and more than $314 billion in transactions annually, M-PESA has expanded across Kenya, Tanzania, Mozambique, the Democratic Republic of Congo (DRC), Lesotho, Ghana, and Egypt. By offering mobile-based financial services, M-PESA has bridged the gap for millions of unbanked individuals, enabling them to participate in the digital economy. MTN MoMo and Airtel Money

MTN Mobile Money (MoMo) and Airtel Money are two other major digital payment platforms in Africa. MoMo processes over 900 million transactions per month and serves more than 50 million users across 16 countries. Meanwhile, Airtel is working to enhance digital and financial inclusion in 14 markets, expanding its 4G services to reach an anticipated 376 million unique users by 2027.

The adoption of these mobile money solutions has significantly reduced dependency on cash, facilitated access to essential financial services, and enabled secure digital transactions for millions across the continent.

Want to bring your game to the African market? Read our blog post to learn how Xsolla can help.

MTN MoMo and Airtel Money

MTN Mobile Money (MoMo) and Airtel Money are two other major digital payment platforms in Africa. MoMo processes over 900 million transactions per month and serves more than 50 million users across 16 countries. Meanwhile, Airtel is working to enhance digital and financial inclusion in 14 markets, expanding its 4G services to reach an anticipated 376 million unique users by 2027.

The adoption of these mobile money solutions has significantly reduced dependency on cash, facilitated access to essential financial services, and enabled secure digital transactions for millions across the continent.

Want to bring your game to the African market? Read our blog post to learn how Xsolla can help.

Asia

Alipay and WeChat Pay In 2003, China had fewer than 3 million credit cards but a vast number of internet users. To bridge this gap, Alipay was launched as an escrow service for online transactions. Eventually, it evolved into a mobile wallet with over 900 million users in China and 1.3 billion globally. Similarly, WeChat Pay, integrated into the WeChat app, became widely popular by facilitating peer-to-peer transactions and in-store payments. Today, it serves around 1.1 billion users worldwide, creating an expansive ecosystem that drives financial inclusion by integrating various services, including small business transactions. Aadhaar & UPI

India’s financial inclusion journey has been accelerated by Aadhaar, a unique digital ID system, and Unified Payments Interface (UPI). Aadhaar has registered over 1.38 billion people, streamlining identity verification for financial services.

UPI, developed by the National Payments Corporation of India (NPCI), is a real-time mobile payment system that increased transactions by 46% from 2023 to 2024.

Mobile Wallets

Brands such as PhonePe and Google Pay have further popularized mobile wallets in India, offering users a convenient method for digital payments, bill payments, and fund transfers—all without requiring a traditional bank account. These wallets play a crucial role in financial inclusion by catering to the needs of underserved communities, providing access to micro-loans and microinsurance, and enabling individuals to participate in the digital economy seamlessly.

Aadhaar & UPI

India’s financial inclusion journey has been accelerated by Aadhaar, a unique digital ID system, and Unified Payments Interface (UPI). Aadhaar has registered over 1.38 billion people, streamlining identity verification for financial services.

UPI, developed by the National Payments Corporation of India (NPCI), is a real-time mobile payment system that increased transactions by 46% from 2023 to 2024.

Mobile Wallets

Brands such as PhonePe and Google Pay have further popularized mobile wallets in India, offering users a convenient method for digital payments, bill payments, and fund transfers—all without requiring a traditional bank account. These wallets play a crucial role in financial inclusion by catering to the needs of underserved communities, providing access to micro-loans and microinsurance, and enabling individuals to participate in the digital economy seamlessly.

Latin America

Brazil Brazil’s financial ecosystem changed dramatically with the introduction of Pix, a fast payment system launched by the country’s central bank in November 2020. Pix enables real-time transfers using mobile numbers or QR codes and is now used by nearly 80% of Brazilian adults. With Pix surpassing credit and debit card transactions, it has significantly reduced costs and increased financial access, allowing millions of previously unbanked individuals to make digital transactions easily.

Why digital payment inclusion matters for the gaming industry

Enabling diverse digital payment methods is more than just an added convenience for the gaming industry — it’s a strategic necessity for long-term growth and global reach. As digital economies evolve and more players gain access to online services through alternative payment methods, developers who prioritize inclusive and localized payment solutions will be better positioned to engage new audiences and increase conversions.

- Market expansion. Digital payments allow developers to reach a broader audience, including players without traditional bank accounts. By supporting local payment solutions, developers ensure that more players can make purchases, expanding their revenue potential.

- Access to global markets. Integrating region-specific payment methods helps developers reach international gamers without friction. Whether through MoMo in Africa, UPI in India, or Pix in Brazil, localized payment options create a seamless purchasing experience.

- Enhanced user experience. A smooth and hassle-free payment process encourages users to complete transactions. Offering trusted payment methods increases player confidence and retention, driving higher conversion rates.

- Promoting financial inclusion. By supporting digital wallets and mobile money, game developers contribute to global financial inclusion, empowering underserved communities to access and enjoy digital content.

- Regulatory compliance. Many regions impose financial regulations that require businesses to support inclusive payment methods. Adopting compliant payment solutions ensures that developers meet legal requirements while expanding their business.

How Xsolla supports digital payments and financial inclusion

At Xsolla, we recognize that financial accessibility is key to unlocking new markets and maximizing player engagement. That’s why we continuously track global payment trends to ensure that Xsolla Pay Station is equipped with secure, diverse, and cutting-edge payment solutions tailored to regional needs. From M-PESA and Pix to Mobile Money and instant payments, we enable game developers to seamlessly integrate localized payment methods, making their games more accessible to players who may not have access to traditional banking. By partnering with Xsolla, game developers can effortlessly integrate localized payment solutions, allowing them to connect with millions of gamers worldwide, regardless of their banking access. By integrating accessible and localized digital payment methods, you can remove barriers to entry, improve player conversion rates, and create a seamless purchase experience for users worldwide. Schedule a meeting with our payments experts to ensure your game is accessible to players everywhere.Featured articles

Contact us

Talk to an expert

Ready to maximize revenue opportunities? Reach out to our experts and learn how to start earning more and spending less.