Revenue

Marketing

Gaming and direct carrier billing: Telco's big win

April 23, 2025•7 min

The 2020 pandemic accelerated the shift to remote interactions, placing new demands on telecommunications systems. Providers adapted quickly, supporting businesses and keeping people connected through significant disruption. At the same time, the video game industry experienced significant growth, cementing its role as a major force in global entertainment. This rise has attracted attention beyond the games sector, with entertainment, tech, and telecom companies making strategic moves into gaming as they recognize its long-term value and broad engagement potential.

As players worldwide climb the growing mountain of services, content, and apps spawned by the microtransaction trend, they also lean heavily toward mobile gaming —and their need for accessible, frictionless payment methods accelerates.

As players worldwide climb the growing mountain of services, content, and apps spawned by the microtransaction trend, they also lean heavily toward mobile gaming —and their need for accessible, frictionless payment methods accelerates.

The Asia-Pacific region is the global leader in DCB, just ahead of Europe. The reason is largely because DCB is more widely accepted in countries like Japan and South Korea, where it serves as a trusted alternative to credit cards. In other parts of the region, such as India, DCB is vital simply because many people don’t have access to traditional banking.

In 2019, Japan led the direct carrier billing (DCB) market in the Asia-Pacific region with a 36.1% share and is projected to maintain its lead with 35.0% by 2027. In Europe, Germany held the top spot with a 21.9% share in 2019 and is expected to grow slightly to 23.0% by 2027. Backing this up, Statista predicts that mobile gaming revenue in Asia-Pacific will hit $100 billion by 2023.

By 2027, DCB will be used by nearly 1.8 billion people - the majority of them will be gamers. The Middle East and North Africa will lead in user count, growing from 742 million to 803 million users during that time. For telcos and content companies, this is a clear sign: these regions offer massive potential for growth, and DCB is a key part of tapping into it.

The Asia-Pacific region is the global leader in DCB, just ahead of Europe. The reason is largely because DCB is more widely accepted in countries like Japan and South Korea, where it serves as a trusted alternative to credit cards. In other parts of the region, such as India, DCB is vital simply because many people don’t have access to traditional banking.

In 2019, Japan led the direct carrier billing (DCB) market in the Asia-Pacific region with a 36.1% share and is projected to maintain its lead with 35.0% by 2027. In Europe, Germany held the top spot with a 21.9% share in 2019 and is expected to grow slightly to 23.0% by 2027. Backing this up, Statista predicts that mobile gaming revenue in Asia-Pacific will hit $100 billion by 2023.

By 2027, DCB will be used by nearly 1.8 billion people - the majority of them will be gamers. The Middle East and North Africa will lead in user count, growing from 742 million to 803 million users during that time. For telcos and content companies, this is a clear sign: these regions offer massive potential for growth, and DCB is a key part of tapping into it.

DCB isn’t just a backup payment method—it’s a growth lever in markets where credit cards are not the norm. Game publishers targeting regions like India, Africa, or Latin America should consider DCB integration to expand reach and drive conversions.

DCB isn’t just a backup payment method—it’s a growth lever in markets where credit cards are not the norm. Game publishers targeting regions like India, Africa, or Latin America should consider DCB integration to expand reach and drive conversions.

Global developers like Zynga, Garena, and Tencent have capitalized on platforms like Google Play and the App Store to reach SEA users quickly. Freemium business models and broad distribution channels offer a significant edge but still rely on third-party payment systems to monetize. This is where local telecom companies have an opening.

SEA telcos control the billing infrastructure. With Direct Carrier Billing (DCB) and mobile wallets already integrated into their systems, telcos can provide seamless payment options, especially in markets with low credit card use. This is crucial for reaching younger and underbanked consumers—2 major segments of the gaming population.

Telcos like dtac in Thailand and Singtel in Singapore have gone a step further by launching their own gaming platforms and bundles (e.g., dtac Gaming Nation, RiotGO by Singtel). These services let telcos capture more of the value chain—offering game credits and exclusive content directly, without needing third-party platforms.

To sum up the opportunity: SEA telcos can turn their billing systems into strategic assets, using them to carve out a larger share of the fast-growing mobile gaming economy.

Global developers like Zynga, Garena, and Tencent have capitalized on platforms like Google Play and the App Store to reach SEA users quickly. Freemium business models and broad distribution channels offer a significant edge but still rely on third-party payment systems to monetize. This is where local telecom companies have an opening.

SEA telcos control the billing infrastructure. With Direct Carrier Billing (DCB) and mobile wallets already integrated into their systems, telcos can provide seamless payment options, especially in markets with low credit card use. This is crucial for reaching younger and underbanked consumers—2 major segments of the gaming population.

Telcos like dtac in Thailand and Singtel in Singapore have gone a step further by launching their own gaming platforms and bundles (e.g., dtac Gaming Nation, RiotGO by Singtel). These services let telcos capture more of the value chain—offering game credits and exclusive content directly, without needing third-party platforms.

To sum up the opportunity: SEA telcos can turn their billing systems into strategic assets, using them to carve out a larger share of the fast-growing mobile gaming economy.

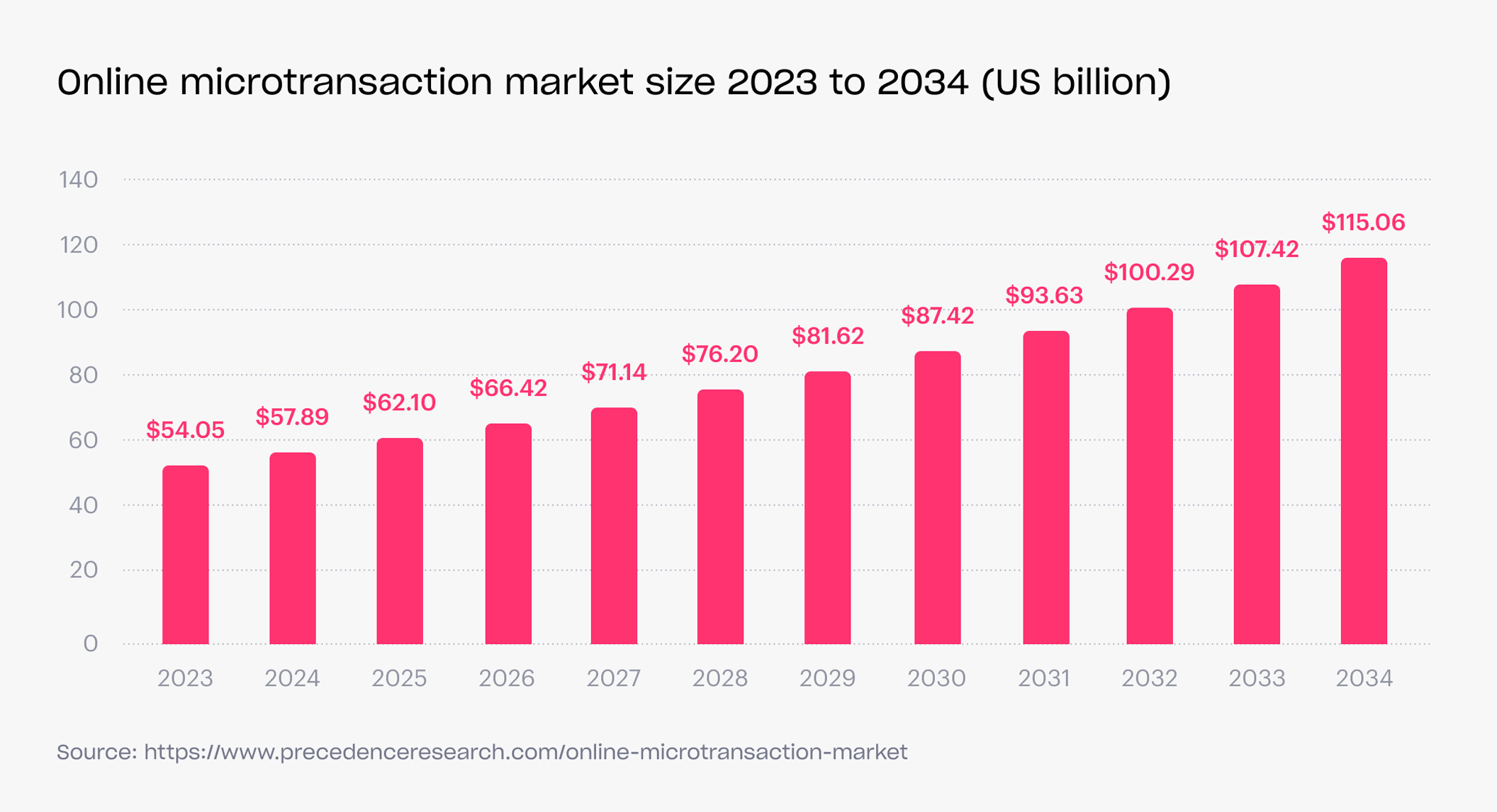

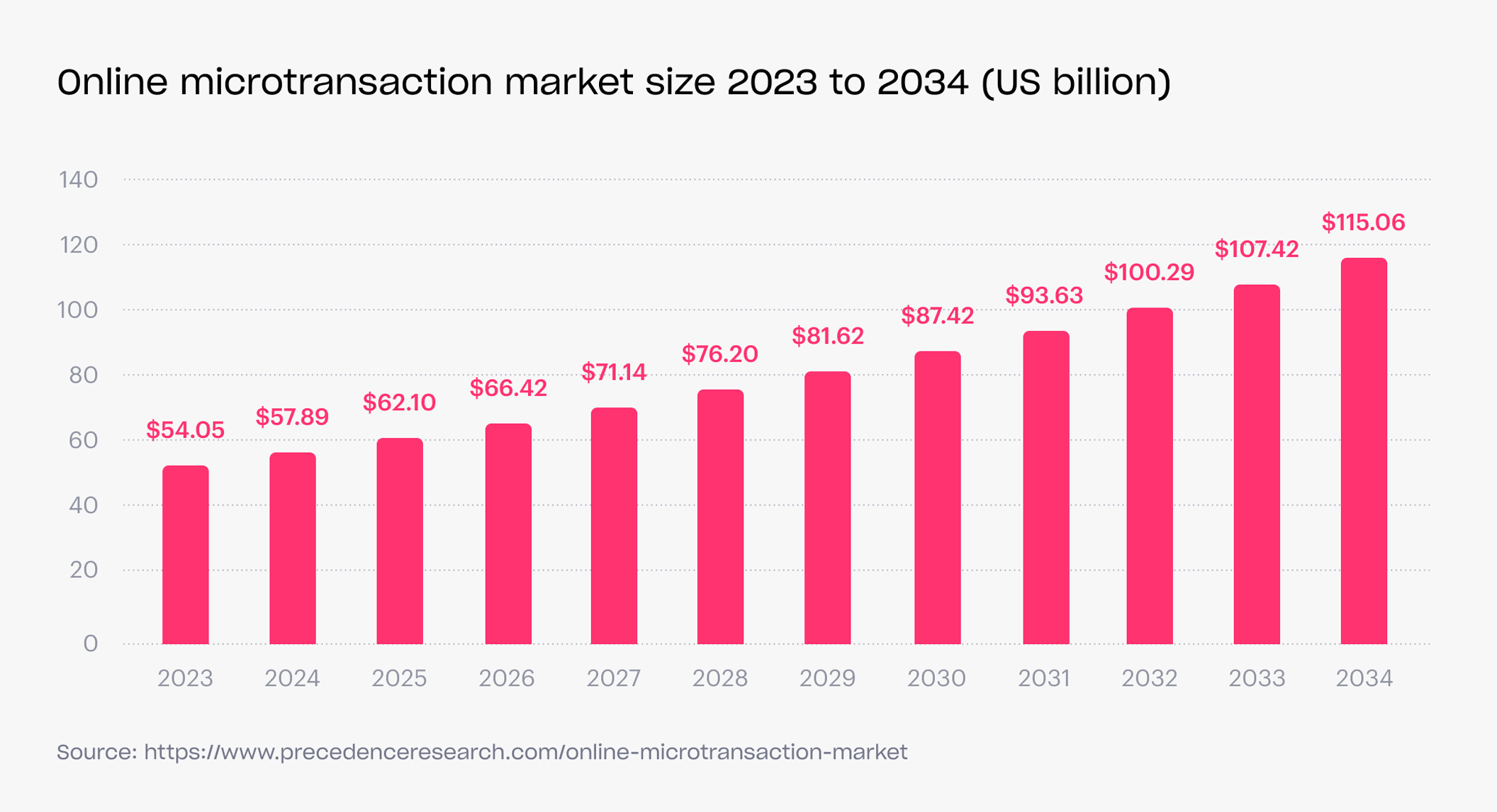

The rise of microtransactions

When The Elder Scrolls introduced them in 2006, microtransactions — then, small, low-priced pieces of in-game content— were embraced as an easy revenue generator for developers and publishers. But, cosmetics and clothing were just the beginning. What players viewed as a lark, game-industry CEOs adopted as powerful monetization tools. By 2023, microtransaction revenue peaked at almost $4.3 billion for Electronic Arts. Today, commerce experts project the global online microtransaction market will grow to about USD 115.06 billion by 2034, with a CAGR of 7.11%, primarily driven by young gamers and the esports culture. As players worldwide climb the growing mountain of services, content, and apps spawned by the microtransaction trend, they also lean heavily toward mobile gaming —and their need for accessible, frictionless payment methods accelerates.

As players worldwide climb the growing mountain of services, content, and apps spawned by the microtransaction trend, they also lean heavily toward mobile gaming —and their need for accessible, frictionless payment methods accelerates.

DCB: A fast-growing driver of mobile games

Direct Carrier Billing (DCB) is becoming a key payment method for the growing audience of global, mobile gamers—especially in areas with limited access to credit cards or traditional banking. It’s simple, fast, and doesn’t require users to enter sensitive financial information. That makes it particularly effective in the mobile-first digital economy. Global DCB spending is projected to grow from $78.5 billion in 2024 to $122 billion by 2027, a 55% increase and a compound annual growth rate (CAGR) of 15.7%. This growth is being driven by mobile-first regions where traditional financial tools lag. The Asia-Pacific region is the global leader in DCB, just ahead of Europe. The reason is largely because DCB is more widely accepted in countries like Japan and South Korea, where it serves as a trusted alternative to credit cards. In other parts of the region, such as India, DCB is vital simply because many people don’t have access to traditional banking.

In 2019, Japan led the direct carrier billing (DCB) market in the Asia-Pacific region with a 36.1% share and is projected to maintain its lead with 35.0% by 2027. In Europe, Germany held the top spot with a 21.9% share in 2019 and is expected to grow slightly to 23.0% by 2027. Backing this up, Statista predicts that mobile gaming revenue in Asia-Pacific will hit $100 billion by 2023.

By 2027, DCB will be used by nearly 1.8 billion people - the majority of them will be gamers. The Middle East and North Africa will lead in user count, growing from 742 million to 803 million users during that time. For telcos and content companies, this is a clear sign: these regions offer massive potential for growth, and DCB is a key part of tapping into it.

The Asia-Pacific region is the global leader in DCB, just ahead of Europe. The reason is largely because DCB is more widely accepted in countries like Japan and South Korea, where it serves as a trusted alternative to credit cards. In other parts of the region, such as India, DCB is vital simply because many people don’t have access to traditional banking.

In 2019, Japan led the direct carrier billing (DCB) market in the Asia-Pacific region with a 36.1% share and is projected to maintain its lead with 35.0% by 2027. In Europe, Germany held the top spot with a 21.9% share in 2019 and is expected to grow slightly to 23.0% by 2027. Backing this up, Statista predicts that mobile gaming revenue in Asia-Pacific will hit $100 billion by 2023.

By 2027, DCB will be used by nearly 1.8 billion people - the majority of them will be gamers. The Middle East and North Africa will lead in user count, growing from 742 million to 803 million users during that time. For telcos and content companies, this is a clear sign: these regions offer massive potential for growth, and DCB is a key part of tapping into it.

Mobile gaming meets DCB

Digital games are the top-performing DCB segment, expected to take 34% of the active market ($40.8 billion in global spend) by 2027. Mobile gaming’s explosive growth, combined with DCB’s ease of use, makes it an ideal match—especially in emerging markets where other payment options are limited. Other segments on the rise:- Digital Video (25%)

- Physical Goods (21%)

- Ticketing (7%)

- Digital Music (6%)

- Other (7%)

DCB isn’t just a backup payment method—it’s a growth lever in markets where credit cards are not the norm. Game publishers targeting regions like India, Africa, or Latin America should consider DCB integration to expand reach and drive conversions.

DCB isn’t just a backup payment method—it’s a growth lever in markets where credit cards are not the norm. Game publishers targeting regions like India, Africa, or Latin America should consider DCB integration to expand reach and drive conversions.

A lucrative opportunity for telcos

With 5G expanding fast, telecom companies are in a strong position to tap into the ever-expanding video game boom. By 2027, global mobile data use is projected to hit 288 exabytes per month, four times higher than today. 5G will handle 62% of all smartphone traffic and connect 4.4 billion users. It will also support over half of all mobile IoT (internet of things) connections, unlocking new services and business models. One high-value area is digital payments, especially carrier billing, which lets users charge in-game purchases directly to their phone bill. By 2026, games will make up over half of all digital goods bought this way. This makes microtransactions—like game skins, tools, and virtual currency—a clear entry point for telcos. The data backs it up: in 2020, gamers spent $54 billion on in-game content, making up 74% of total gaming revenue. By 2025, this is expected to grow to $74.4 billion. Telcos can also boost value by partnering with developers to offer exclusive content, cloud gaming access, and in-game rewards. These perks encourage more gameplay, which drives up data usage and opens the door to bundled offers and upgrades. In short: Telecom companies that support gaming not only keep their subscribers engaged—they unlock serious growth.Telcos in Southeast Asia - one to watch

Southeast Asia (SEA) is one of the world’s fastest-growing mobile gaming markets. In this region, as many as 90% of internet users access digital services primarily through mobile devices. Gaming is a major part of that activity, with mobile game spending in SEA far outpacing other emerging markets. Here’s a quick look at annual per capita spending on mobile games:- Thailand: $21

- Philippines: $14

- Bangladesh: $6

- India: $2

Global developers like Zynga, Garena, and Tencent have capitalized on platforms like Google Play and the App Store to reach SEA users quickly. Freemium business models and broad distribution channels offer a significant edge but still rely on third-party payment systems to monetize. This is where local telecom companies have an opening.

SEA telcos control the billing infrastructure. With Direct Carrier Billing (DCB) and mobile wallets already integrated into their systems, telcos can provide seamless payment options, especially in markets with low credit card use. This is crucial for reaching younger and underbanked consumers—2 major segments of the gaming population.

Telcos like dtac in Thailand and Singtel in Singapore have gone a step further by launching their own gaming platforms and bundles (e.g., dtac Gaming Nation, RiotGO by Singtel). These services let telcos capture more of the value chain—offering game credits and exclusive content directly, without needing third-party platforms.

To sum up the opportunity: SEA telcos can turn their billing systems into strategic assets, using them to carve out a larger share of the fast-growing mobile gaming economy.

Global developers like Zynga, Garena, and Tencent have capitalized on platforms like Google Play and the App Store to reach SEA users quickly. Freemium business models and broad distribution channels offer a significant edge but still rely on third-party payment systems to monetize. This is where local telecom companies have an opening.

SEA telcos control the billing infrastructure. With Direct Carrier Billing (DCB) and mobile wallets already integrated into their systems, telcos can provide seamless payment options, especially in markets with low credit card use. This is crucial for reaching younger and underbanked consumers—2 major segments of the gaming population.

Telcos like dtac in Thailand and Singtel in Singapore have gone a step further by launching their own gaming platforms and bundles (e.g., dtac Gaming Nation, RiotGO by Singtel). These services let telcos capture more of the value chain—offering game credits and exclusive content directly, without needing third-party platforms.

To sum up the opportunity: SEA telcos can turn their billing systems into strategic assets, using them to carve out a larger share of the fast-growing mobile gaming economy.

Introducing Xsolla Play Deck

Xsolla Play Deck is a global gaming marketplace that enables telcos and superapps to sell gaming content through white-labeled storefronts, driving engagement and new revenue. Xsolla Play Deck empowers telcos worldwide to connect their apps into publishers’ games and game shops; ultimately offering their subscribers the world's leading entertainment content.

Final thoughts

Telecommunication companies have an effective new way to grow by tapping into the $100+ billion mobile gaming market. Xsolla helps them do this by making it easy to offer popular games directly through their own apps or marketplaces. With tools like Xsolla Play Deck, telcos and superapps can quickly launch full gaming services. This includes working directly with top game developers, setting up their own storefronts, and offering bundled game packages and loyalty programs. Customers can pay using methods they already trust—like direct carrier billing (DCB)—and gain access to exclusive content, all without leaving the telco’s branded environment. These features and benefits not only drive user engagement but also open up new revenue streams in a market that continues to grow year over year. The big question for telcos is no longer whether to get into gaming—it’s how fast they can scale up. The backend systems and partnerships already exist, thanks to Xsolla. What's next? Fast execution to meet consumer demand and secure a long-term place in the very lucrative gaming ecosystem. Talk with our experts to see how Xsolla can help elevate your telco business. Not an Xsolla partner yet? Register with Xsolla Publisher Account.Featured articles

Contact us

Talk to an expert

Ready to maximize revenue opportunities? Reach out to our experts and learn how to start earning more and spending less.