Development

Regional distribution

Revenue

Unlocking MENA’s gaming potential: A deep dive into monetization trends

March 21, 2025•3 min

The Middle East and North Africa (MENA) region has rapidly become one of the most exciting gaming markets in the world. With a growing player base, increasing revenue potential, and evolving monetization strategies, game developers and publishers have a uniquely timed opportunity to expand their reach.

How can you effectively navigate this diverse market’s unique challenges and opportunities? To answer this question, Niko Partners and Xsolla have teamed up to co-publish an in-depth white paper titled, What does the monetization landscape look like for video games in MENA? Scroll to read some quick highlights, or click here to download the complete white paper today.

With a tech-savvy youth population, increasing disposable income, and strong government support for gaming and esports, MENA presents unique prospects for developers looking to expand into new markets. However, the games industry must tailor their monetization strategies to the region’s unique economic and cultural landscape.

With a tech-savvy youth population, increasing disposable income, and strong government support for gaming and esports, MENA presents unique prospects for developers looking to expand into new markets. However, the games industry must tailor their monetization strategies to the region’s unique economic and cultural landscape.

Here’s how the region is embracing alternative payment methods:

Here’s how the region is embracing alternative payment methods:

What’s inside this white paper?

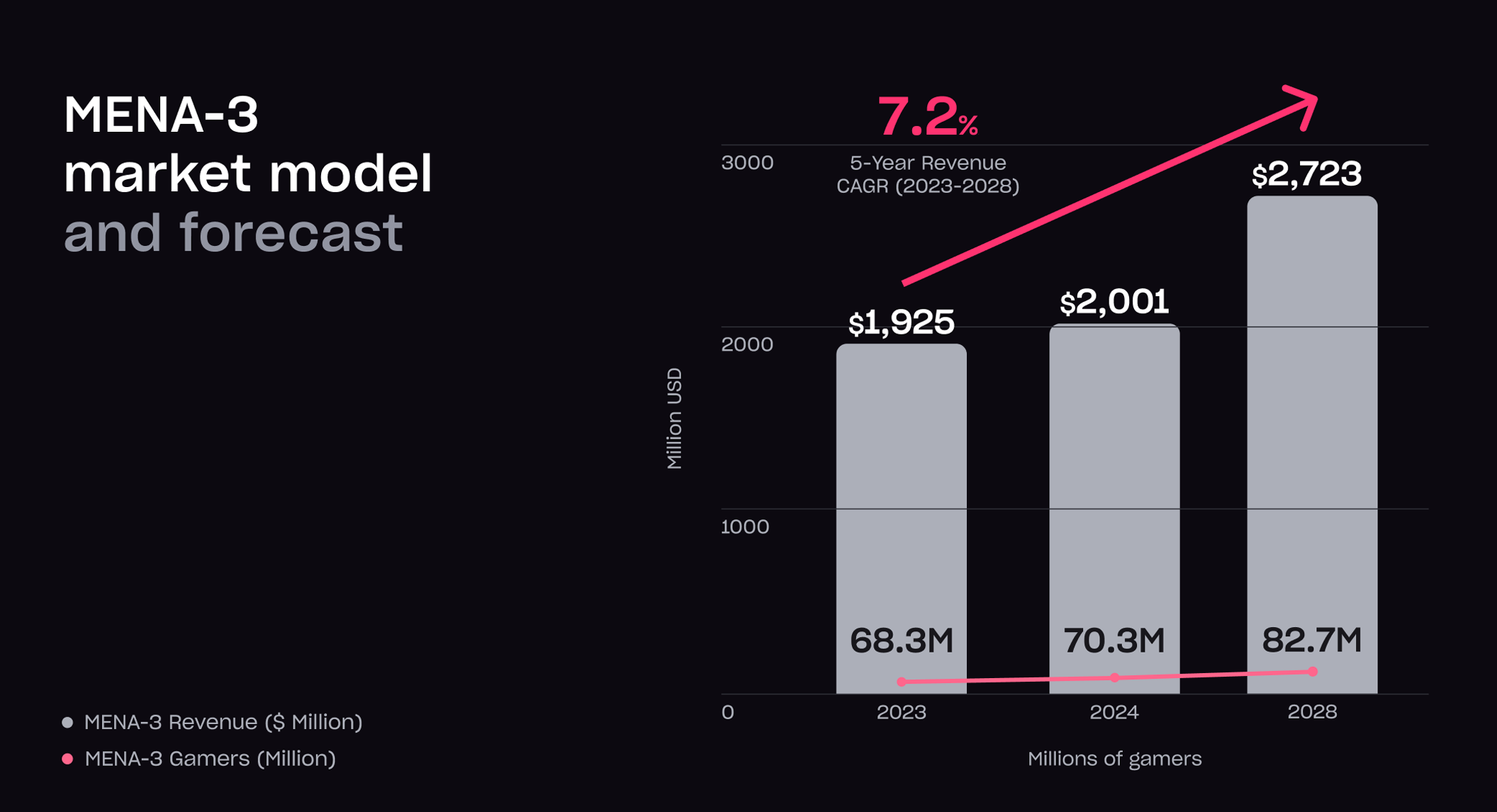

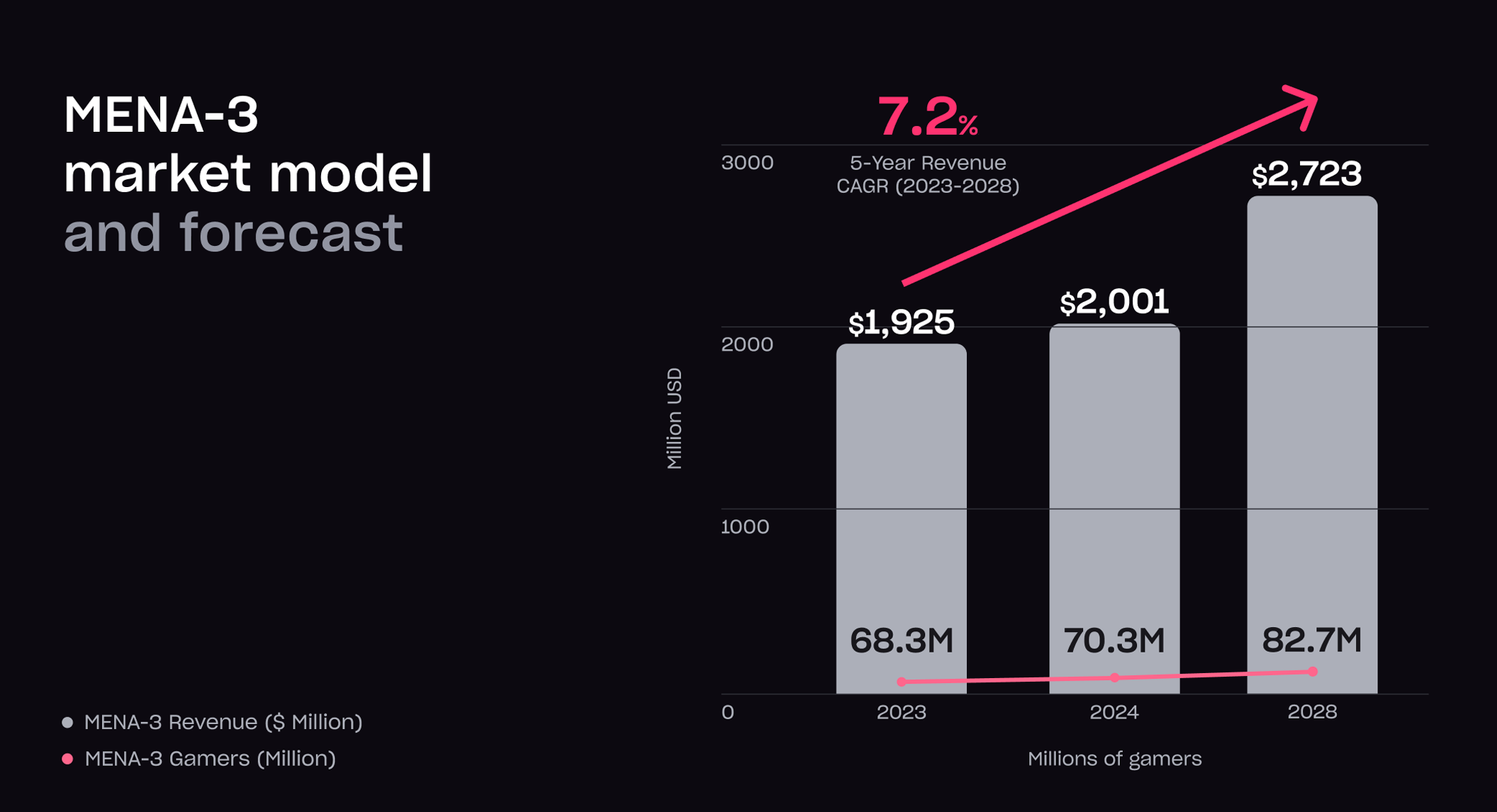

This comprehensive report provides data-driven insights, expert analysis, and practical strategies to help game companies succeed in MENA, with a focus on Saudi Arabia, the United Arab Emirates, and Egypt— collectively, the MENA-3 region.The MENA-3 gaming boom

This area is on a steep growth trajectory, with projected player spending expected to increase to $2.7 billion in 2028, representing a 5-year compound annual growth rate (CAGR) of 7.2%. The number of gamers is also projected to rise to 82.7 million in 2028, making up 51% of the population across the three countries. With a tech-savvy youth population, increasing disposable income, and strong government support for gaming and esports, MENA presents unique prospects for developers looking to expand into new markets. However, the games industry must tailor their monetization strategies to the region’s unique economic and cultural landscape.

With a tech-savvy youth population, increasing disposable income, and strong government support for gaming and esports, MENA presents unique prospects for developers looking to expand into new markets. However, the games industry must tailor their monetization strategies to the region’s unique economic and cultural landscape.

Navigating monetization in MENA

One of the biggest challenges in MENA is payment accessibility. With 67% of the population unbanked or underbanked, traditional payment methods are not always viable. Instead, mobile wallets and direct-to-consumer (D2C) monetization solutions have emerged as the most effective strategies for reaching and engaging players. Here’s how the region is embracing alternative payment methods:

Here’s how the region is embracing alternative payment methods:

- Egypt: Vodafone Cash is the preferred payment method for 74% of gamers.

- Saudi Arabia: While credit card usage is higher, 49% of players use STC Pay to purchase video game content.

- UAE: With the highest annual ARPU at $84.60, there are opportunities to enhance spending through D2C strategies.

Direct-to-consumer: A winning strategy in MENA

The shift toward D2C monetization is reshaping how developers distribute games in MENA. By leveraging Xsolla’s trusted payment solutions, game companies can:- Reduce platform fees associated with traditional app stores

- Offer region-specific pricing to maximize accessibility

- Support a wide range of local payment options, including mobile wallets and carrier billing

- Increase player engagement through exclusive rewards and promotions

Get your free copy of the white paper

Download the complete Niko Partners x Xsolla white paper and get the full insights on MENA’s gaming economy, including detailed consumer insights, revenue projections, and complete monetization strategies.Featured articles

Contact us

Talk to an expert

Ready to maximize revenue opportunities? Reach out to our experts and learn how to start earning more and spending less.