Smart strategies for choosing the best partner for your card payments

April 17, 2024•7 min

There is an ongoing debate on the importance of credit cards versus alternative payment methods in the payments world. Certain providers say that accepting credit cards and PayPal helps businesses capture the majority of global gamers. Other companies argue that credit cards aren’t popular in many countries. Such statements often reflect the provider's emphasis on one aspect over the other, while both credit cards and alternative payment methods are equally important in the global payments landscape. For instance, companies focused on local alternative payments in Asia completely lack focus on their card solutions and can hardly sustain its integrity and growth in developed markets.

Indeed, there are countries where card payments hold a lower market share compared to local alternative payment methods. This can be attributed to the dominance of major fintech brands in the country, such as Alipay in China, Naver Pay and Toss in South Korea, QRIS in Indonesia, and Blik in Poland, which have a majority of gamers as their active day-to-day users. Some emerging markets still have a large share of the unbanked population, further reducing reliance on traditional card payments.

Still, in the context of a global distribution strategy, if you were limited to just one payment method for your checkout, bank cards would undoubtedly be your preferred choice, and here is why:

While game monetization encompasses various revenue streams, the ultimate goal is a successful payment. Three major factors contributing to an increased number of successful card payments are a conversion-optimized checkout interface, higher acceptance rates, and service stability. Providers, in turn, are implementing a wide range of features to support seamless payment flows.

While game monetization encompasses various revenue streams, the ultimate goal is a successful payment. Three major factors contributing to an increased number of successful card payments are a conversion-optimized checkout interface, higher acceptance rates, and service stability. Providers, in turn, are implementing a wide range of features to support seamless payment flows.

- The volume distribution between card and non-card payments we observe from our data is evenly split, accounting for 50% of the transactions. Selecting a trustworthy provider for your card payments will secure 50% of your game’s revenue while you work on your local payment strategies.

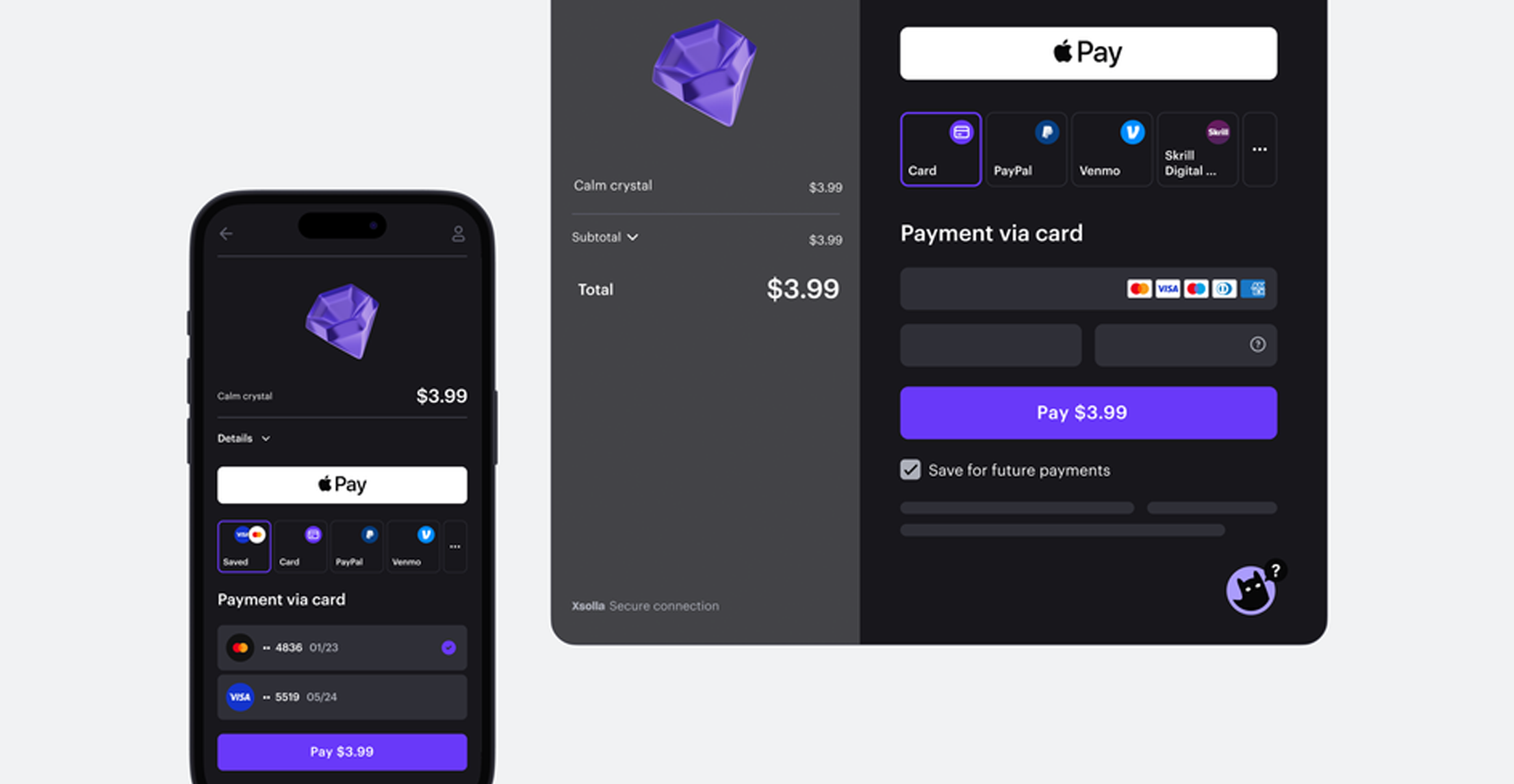

- Unlike most alternative payment methods, card payments support white-label integration with no redirect to third-party payment pages. This gives businesses and their selected providers greater control over the user journey and more opportunities to optimize conversion to a successful payment. Such user flow is preferred and commonly used by consumers across online games and Ecommerce in general specifically for card payments, not alternative payments.

- Card payments are constantly evolving. A lack of focus on maintaining and developing a card payments solution can lead to compliance and regulatory challenges and make this solution irrelevant for local markets due to the absence of region-specific features.

- On average, card payment fees closely align with the pricing of digital wallets and are much lower compared to other alternative payment methods, including cash or mobile payments.

Think Globally, Act Locally

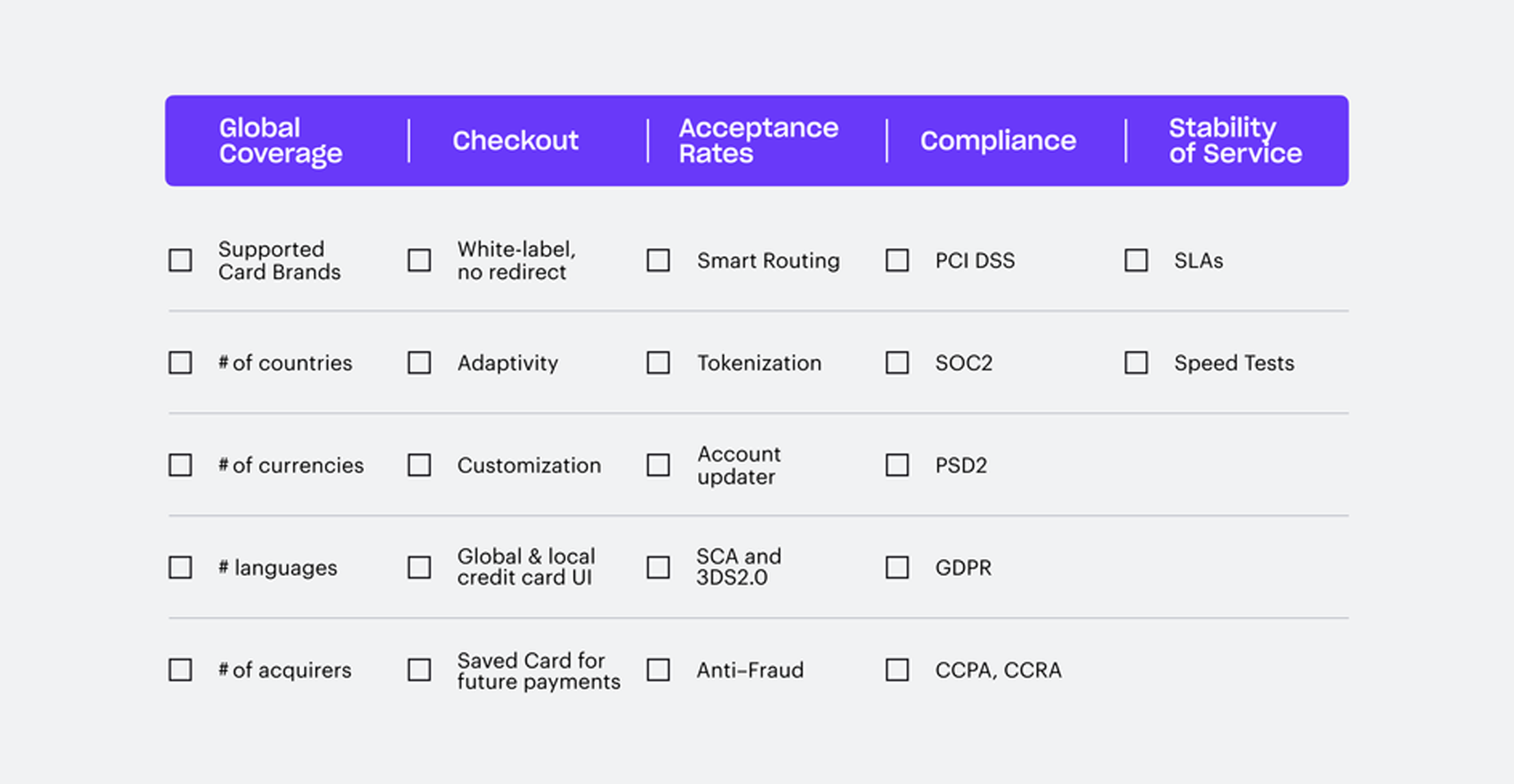

Card payments are at the intersection of global and local commerce. Gamers pay with cards in more than 200 countries and territories worldwide, driving businesses to adopt a global card payment strategy. To ensure solution scalability, we recommend specifically checking if the provider only accepts international card payments with Visa and Mastercard, possesses a stronger local presence in one region, or is equally strong in several regions. These are the factors you can consider:- Local Card Brands: Certain countries have their own local card networks, functioning similarly to Visa and Mastercard but specific to that country. Some, like UnionPay (originating from China) or JCB (originating from Japan), are recognized internationally and accepted globally. Others, such as RuPay in India, Elo and Hipercard in Brazil, or Shinhan Card, BC Card, Samsung Card and other local card brands in South Korea, are limited to particular territories. To reach more gamers in more places and ensure more successful payments, look for a provider that supports most card brands.

- Local Currency: Businesses should ensure their card payment solution supports transactions in the local currency of their region. Some providers focusing only on international transactions might offer USD processing currency for local card brands. In other words, gamers from Japan who own JCB cards might end up paying in USD rather than JPY, resulting in currency conversion costs and customer dissatisfaction.

- Local Card Acquiring: Providers aiming to improve their performance on the regional level regularly should be connected with major local acquirers to optimize transaction processing, improve acceptance rates, and reduce costs associated with cross-border transactions.

- Region-Specific Features: Different regions may have unique regulatory requirements or consumer preferences that impact card payments. Brazil is one of the markets that exemplifies this statement. From a regulatory perspective, the card payment interface differs from the rest of the world, with more obligatory fields for the user to fill in during the payment process. Thus, providers might have to redesign their solution interfaces to comply when selling in Brazil. From a consumer perspective, businesses should check if their provider supports installments for card payments, which is a general practice for most online and offline businesses in the country.

Your Ultimate Goal is More Successful Payments

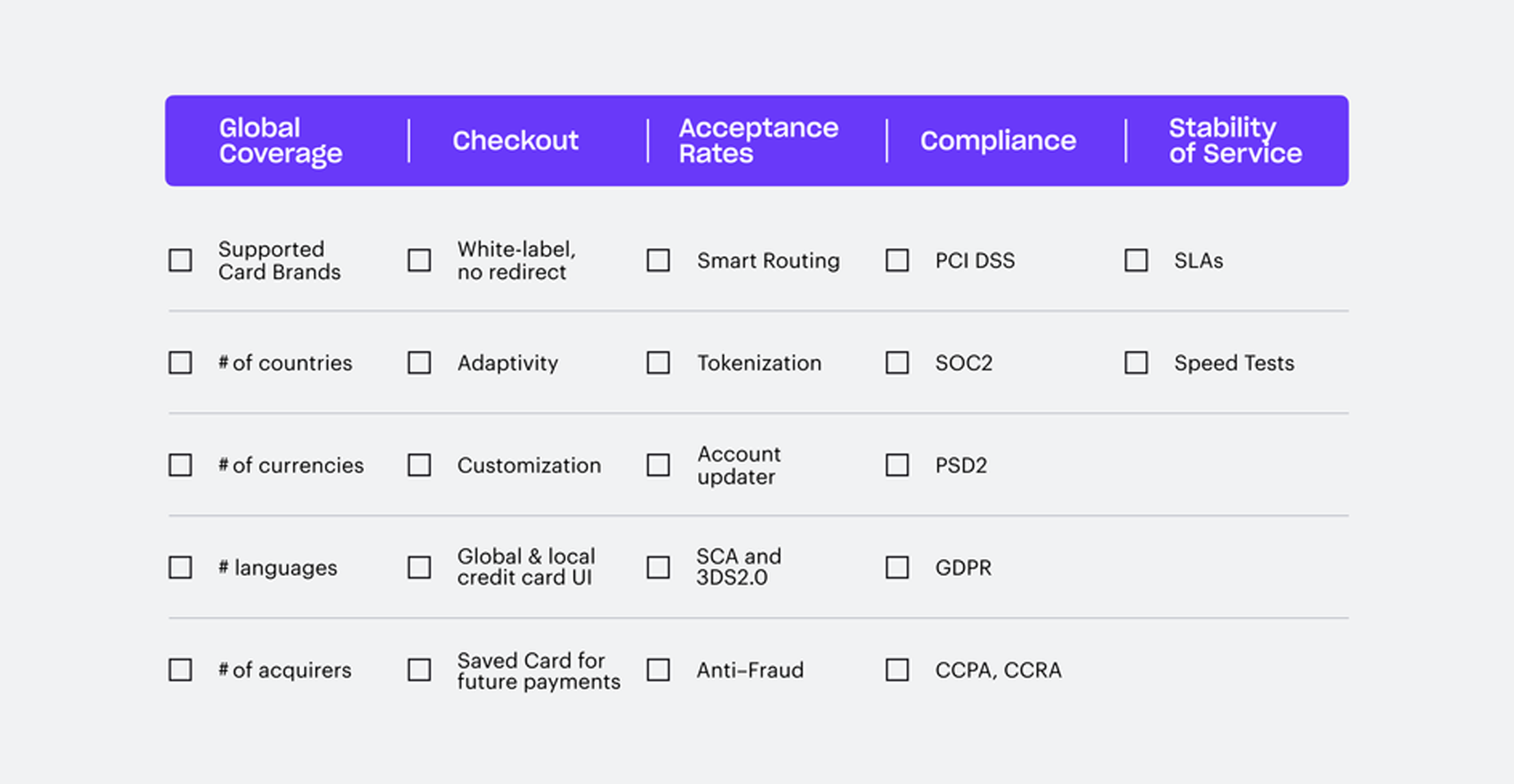

While game monetization encompasses various revenue streams, the ultimate goal is a successful payment. Three major factors contributing to an increased number of successful card payments are a conversion-optimized checkout interface, higher acceptance rates, and service stability. Providers, in turn, are implementing a wide range of features to support seamless payment flows.

While game monetization encompasses various revenue streams, the ultimate goal is a successful payment. Three major factors contributing to an increased number of successful card payments are a conversion-optimized checkout interface, higher acceptance rates, and service stability. Providers, in turn, are implementing a wide range of features to support seamless payment flows.

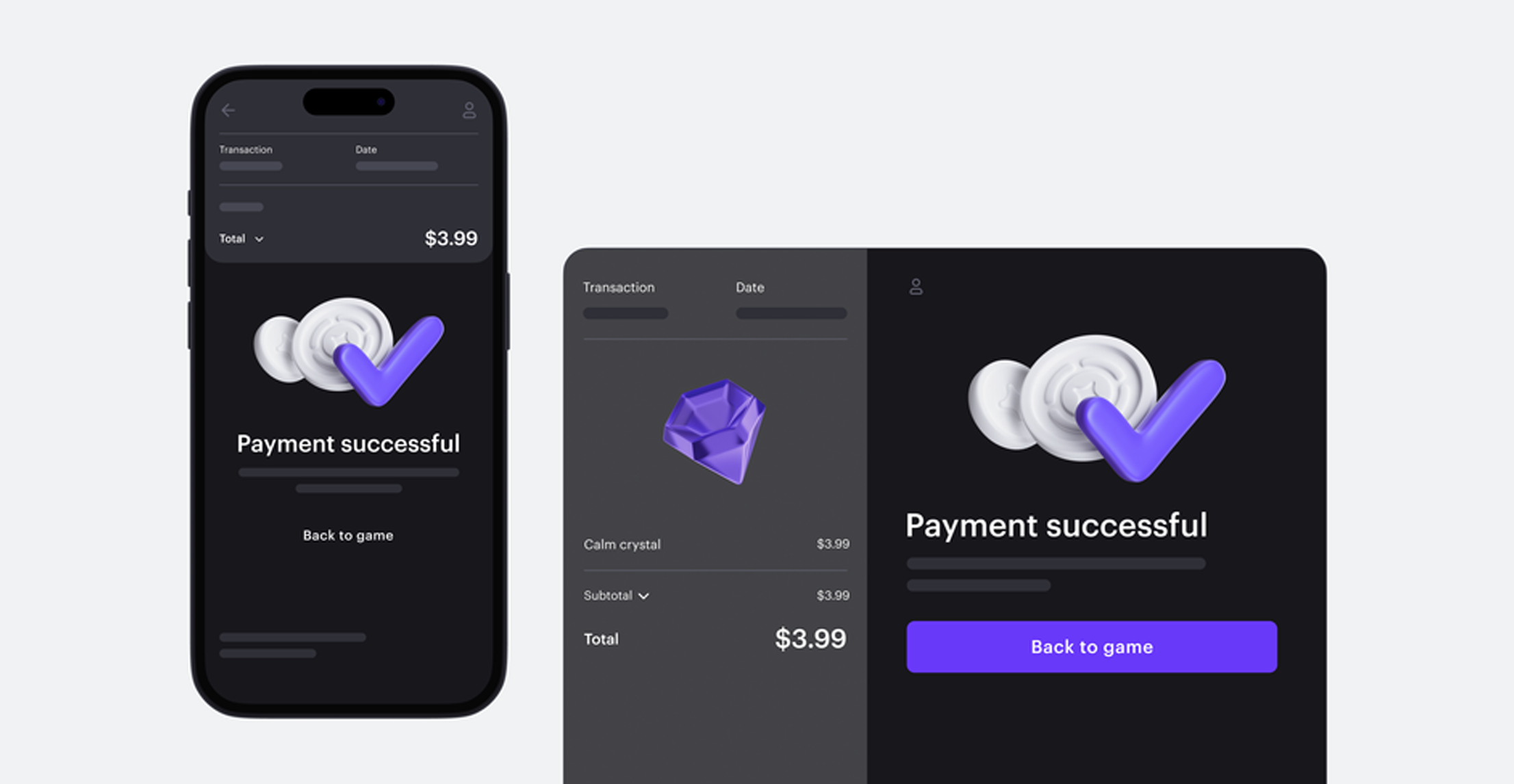

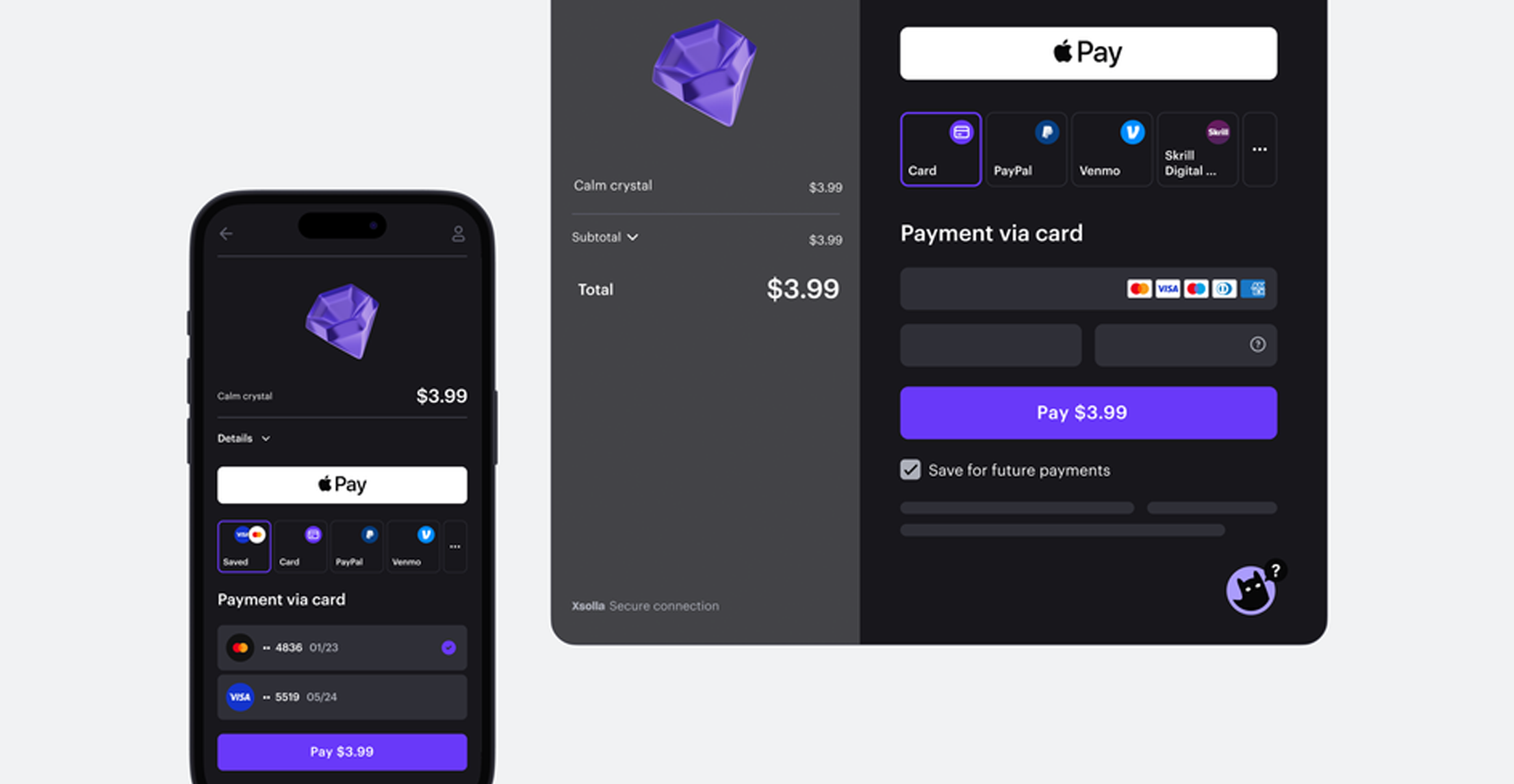

- The first step is to ensure that the provider offers a conversion-optimized checkout. The main objective of this first step is to guide the gamer through the process to confirm their intent to make a payment.Typically, this entails an adaptive UI accessible across multiple devices, customized to match the game’s brand look and feel, and localized based on the gamer’s location and language preferences. It should feature a simple credit card form with visual tooltips for consumers to enter their card data. It also allows saving a card for future purchases with no additional redirect to third-party providers.

- The second step is ensuring that the card acquirer successfully processes the payment, increasing acceptance rates. Providers achieve this by offering domestic acquiring through major local processors, implementing smart routing functionality to pick up a wide range of payment data points to find the best path for a single transaction, and incorporating seamless verification procedures with Strong Customer Authentication (SCA) and 3D Secure 2.0 protocols.

- Finally, ensuring service stability and an average time for processing a transaction is essential. Providers should publicly share their Service Level Agreements (SLAs) so that businesses can track the performance of their card payment provider. Additionally, They should share the data regarding speed tests to stay competitive in the market.

Your Solution Should be Globally Compliant

International and governmental regulatory institutions and card networks should accredit card payment solution providers.- Adherence to the Payment Card Industry Data Security Standard (PCI DSS) allows merchants to handle and store consumer card data securely as they follow regulations and security standards: network security, data encryption, vulnerability management, monitoring, and more.

- System and Organization Controls Type 2, a cybersecurity compliance framework by the AICPA, aims to verify the secure storage and processing of client data by third-party service providers. Avoiding data breaches prevents financial and reputation damage that comes with them.

- The revised Payment Services Directive (PSD2) is an EU law governing providers of payment services that regulates third-party access to payment data, promoting innovation and competition in the European payments market. Compliance with PSD2 is essential to enable SCA and 3DS 2.0 for transaction verification.

- Compliance with GDPR, CCPA, CPRA, and other regulations showcases a business's dedication to data privacy and establishes customer trust and loyalty.

Checklist for Selecting a Credit Card Solution Provider

Unlock Card Payments with Xsolla

At Xsolla, we are dedicated to ensuring the best solutions for your credit card payments:- We accept payments from all major global and local card brands in over 200 countries and territories worldwide, supporting transactions in more than 130 currencies.

- Our white-label integration with acquirers eliminates redirection to third-party pages, reducing friction during the checkout process.

- Card payments are seamlessly integrated into Xsolla Pay Station, a multi-platform customizable checkout in over 20 languages.

- Through partnerships with leading acquiring banks, we ensure efficient routing of card transactions.

- Our comprehensive feature set is designed to maximize conversions and optimize the payment experience for both game developers and customers.

- Our solutions are globally compliant and accredited by card networks, ensuring the highest security and reliability standards.

Written & Published By

Natalia Sobakina, Global Director of Product Marketing at XsollaFeatured articles

Contact us

Talk to an expert

Ready to maximize revenue opportunities? Reach out to our experts and learn how to start earning more and spending less.