Alternative payment methods

Pricing

Revenue

POPs or MoRs: Making the right choice

September 3, 2024•4 min

The rise of POPs, or payment orchestration platforms, is a growing trend in the world of payment processing. Haven't heard about it yet? Well, we've got you covered. In our current series, where we dive into what's new with payments, we previously broke down the difference between PSPs, payment service providers, and MoRs, merchants of record. In short, PSPs primarily handle payment transactions but often require additional services, like fraud protection or tax remittance, for a complete solution. This can increase costs and complexity for game developers. On the other hand, MoRs offer a more comprehensive solution that handles the legal, financial, and technical aspects of game commerce. You can find more in-depth details and a guide helping you choose between the two here. As we continue this series, we'll cover the ins and outs of POPs and how they stack up with PSPs and MoRs.

POPs offer a hybrid approach, combining the advantages of payment gateways and MoR models. Unlike a payment gateway, a POP handles multiple payment methods, allowing businesses to cater to a larger user base while gaining more functionality. This added layer includes smart routing, fraud prevention, analytics, and more control over payment processes. However, partnering with a POP still requires significant investment in legal, customer support, and other operational areas, primarily because merchants must opt-in to direct agreements with payment methods, which involves passing KYC processes, legal paperwork, settlements, and accounting.

POPs offer a hybrid approach, combining the advantages of payment gateways and MoR models. Unlike a payment gateway, a POP handles multiple payment methods, allowing businesses to cater to a larger user base while gaining more functionality. This added layer includes smart routing, fraud prevention, analytics, and more control over payment processes. However, partnering with a POP still requires significant investment in legal, customer support, and other operational areas, primarily because merchants must opt-in to direct agreements with payment methods, which involves passing KYC processes, legal paperwork, settlements, and accounting.

It's important to note that some POPs do have a hybrid model, which includes features of both payment gateways and MoR models. While this can provide businesses with more payment options, transparent fees, and greater control over their payment processes, it still requires significant investment in legal, customer support, and other operational areas. The bottom line is that while some POPs offer more, they may also cost your business more for each additional add-on.

It's important to note that some POPs do have a hybrid model, which includes features of both payment gateways and MoR models. While this can provide businesses with more payment options, transparent fees, and greater control over their payment processes, it still requires significant investment in legal, customer support, and other operational areas. The bottom line is that while some POPs offer more, they may also cost your business more for each additional add-on.

What is a POP?

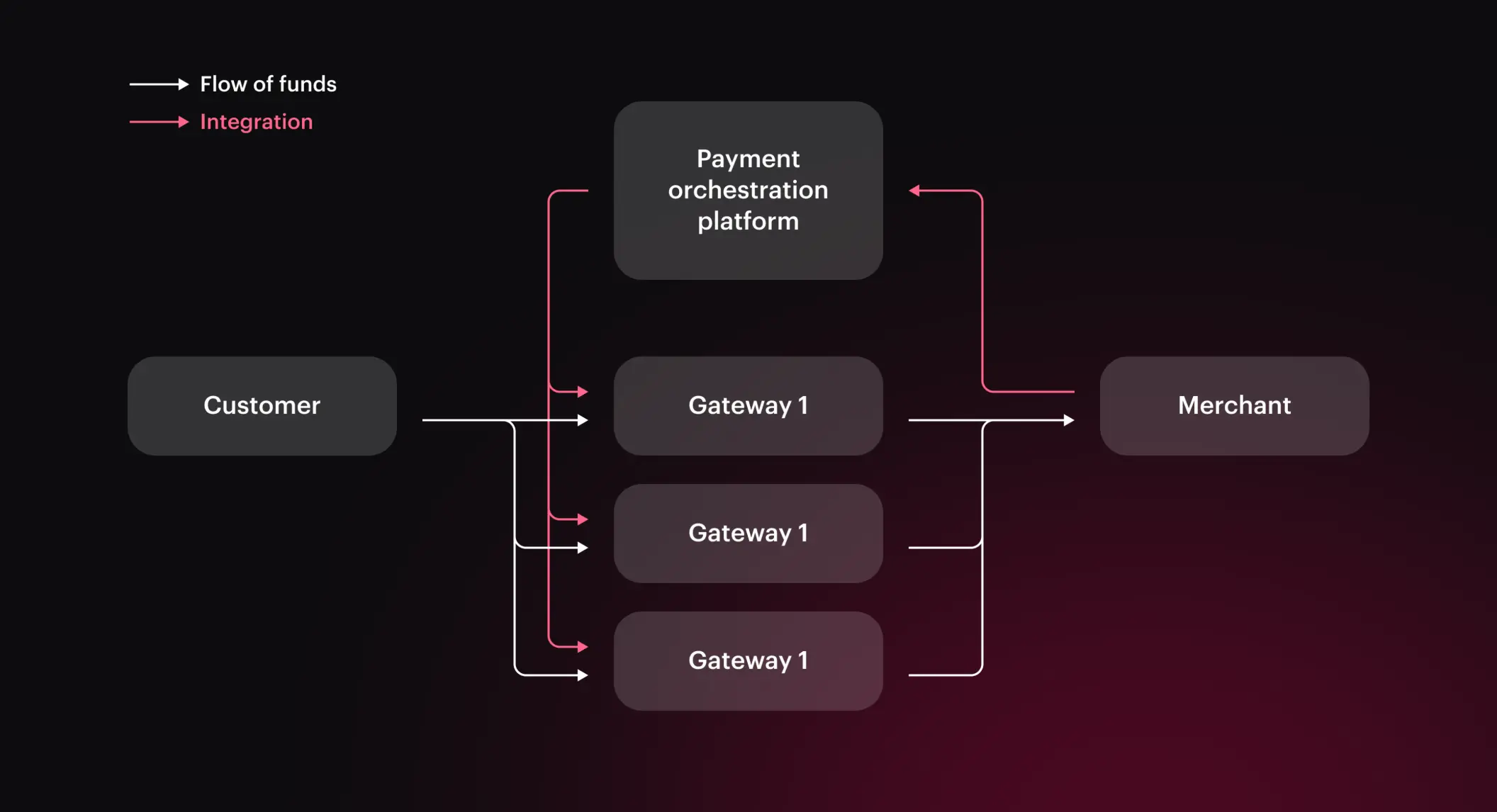

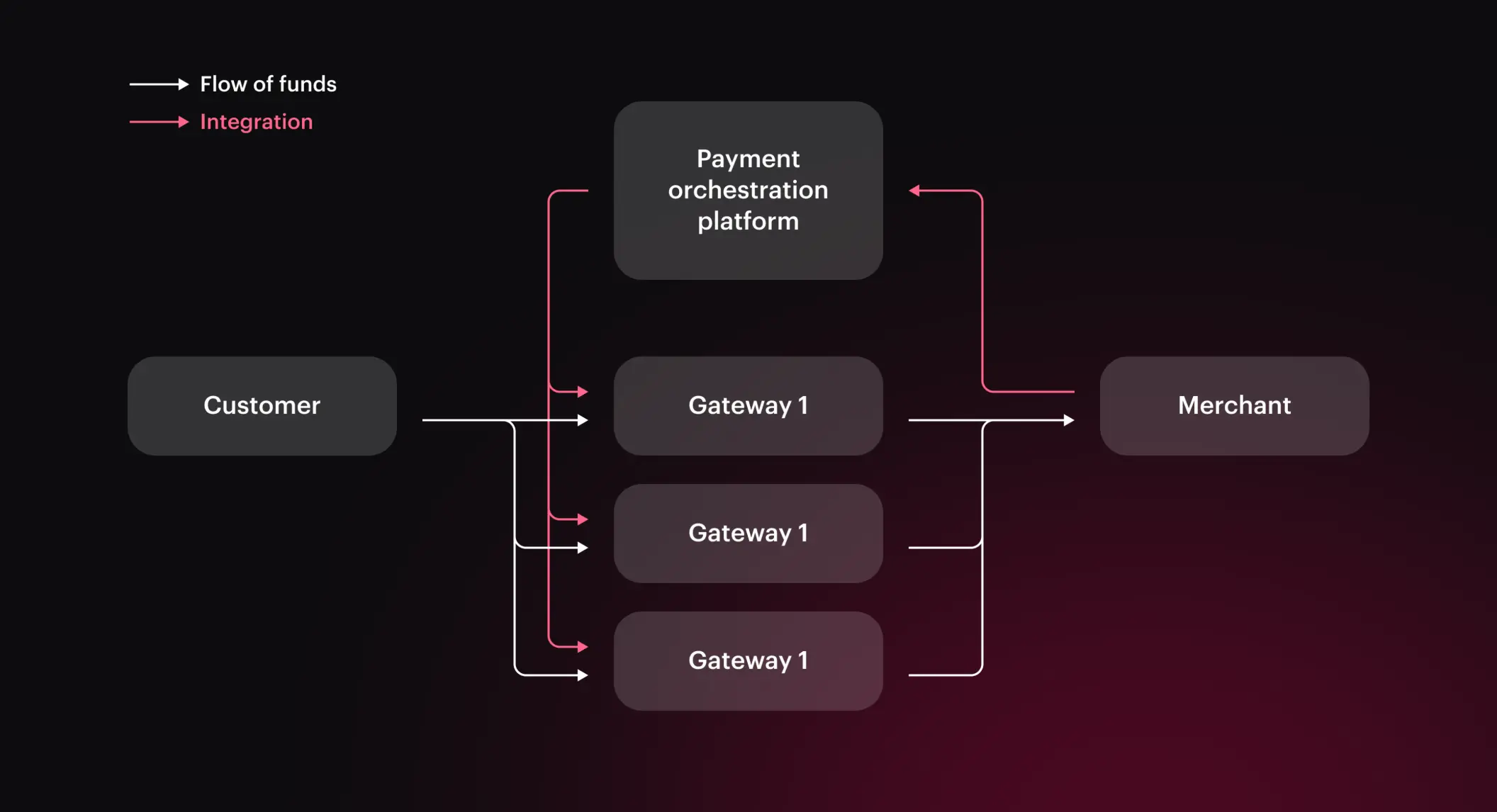

Payment orchestration platforms, or POPs, are centralized platforms that manage payment methods, providers, and channels for a merchant. By managing payments, businesses that use POPs can efficiently process payments and reduce costs. POPs are attractive because of their wide range of supported payment options and ability to connect to multiple payment service providers. To understand how payment orchestration platforms work in practice, let's examine the steps involved from a merchant's perspective.- Step 1: The merchant connects their business to a payment orchestration platform, which has connections to various payment methods. This is a technical connection, where the merchant integrates the POPs API within its technical framework.

- Step 2: The merchant signs contracts with each payment provider, receives funds directly from them, and pays a processing fee.

- Step 3: The payment orchestration platform manages and automates the payment process for the merchant.

POPs offer a hybrid approach, combining the advantages of payment gateways and MoR models. Unlike a payment gateway, a POP handles multiple payment methods, allowing businesses to cater to a larger user base while gaining more functionality. This added layer includes smart routing, fraud prevention, analytics, and more control over payment processes. However, partnering with a POP still requires significant investment in legal, customer support, and other operational areas, primarily because merchants must opt-in to direct agreements with payment methods, which involves passing KYC processes, legal paperwork, settlements, and accounting.

POPs offer a hybrid approach, combining the advantages of payment gateways and MoR models. Unlike a payment gateway, a POP handles multiple payment methods, allowing businesses to cater to a larger user base while gaining more functionality. This added layer includes smart routing, fraud prevention, analytics, and more control over payment processes. However, partnering with a POP still requires significant investment in legal, customer support, and other operational areas, primarily because merchants must opt-in to direct agreements with payment methods, which involves passing KYC processes, legal paperwork, settlements, and accounting.

POPs vs MoRs

To make the best decision for your business, it's important to understand the functional differences between a POP and an MoR. While both offer benefits, they address different needs and priorities. POPs offer businesses greater control over their payment processes, allowing them to customize workflows and routing strategies. MoRs provide this same level of control but go a step further, offering a more streamlined approach for business, taking on operational tasks. While POPs focus primarily on the technical aspects of payment processing, MoRs handle legal, financial, and compliance matters. MoRs also offer a wider range of services like fraud prevention, tax management, and customer support, which may require additional providers for POPs to incorporate. It's important to note that some POPs do have a hybrid model, which includes features of both payment gateways and MoR models. While this can provide businesses with more payment options, transparent fees, and greater control over their payment processes, it still requires significant investment in legal, customer support, and other operational areas. The bottom line is that while some POPs offer more, they may also cost your business more for each additional add-on.

It's important to note that some POPs do have a hybrid model, which includes features of both payment gateways and MoR models. While this can provide businesses with more payment options, transparent fees, and greater control over their payment processes, it still requires significant investment in legal, customer support, and other operational areas. The bottom line is that while some POPs offer more, they may also cost your business more for each additional add-on.

Xsolla as your Merchant of Record

As a game-tailored MoR, Xsolla offers a comprehensive solution that handles all aspects of game commerce. By choosing Xsolla, game developers can streamline their operations, expand their reach, and focus on creating exceptional gaming experiences. Benefit from key aspects of our solution, like,- Reduced complexity: our one-stop shop for payment services

- Improved fraud protection: Lower your chargeback rates and reduce fraudulent transactions

- Simplified tax management: Our experts can handle all tax laws and regulations, staying up-to-date

- Comprehensive customer support: Our team is available 24/7 to help you out

Explore our

latest articles

Contact us

Talk to an expert

Ready to maximize revenue opportunities? Reach out to our experts and learn how to start earning more and spending less.