Alternative payment methods

Pricing

Regional distribution

Monetize Indonesia’s growing gamer base with localized payment options

October 24, 2024•6 min

Southeast Asia’s (SEA) gaming market is thriving, with revenue reaching $5.1 billion in 2023 – an 8.8% increase from the previous year.

That boom is also reflected in the growing number of gamers across the region, with 277.2 million players in 2023, and a forecast to reach 285.9 million players by 2024. And Indonesia, with its vast population of 275 million and growing mobile gaming culture, is a major contributor to this growth.

As a leader in video game payments, Xsolla has already expanded its reach across SEA by introducing local payment methods in key regions like Hong Kong and Singapore.

Now, our focus has shifted to two key markets: the emerging market of Indonesia, one of the largest Southeast Asian markets by player number, and Cambodia, a rising player in Southeast Asia’s gaming industry. In this article, we’ll explore the untapped opportunities for game developers in Indonesia. To learn more about the gaming landscape in Cambodia, read our other article.

In addition to these platforms, Pay Station also supports bank transfers from leading financial institutions like BTN, BNI, CIMB, and Danamon, as well as digital banking and direct debit: Jenius, Allobank, and digital wallets/BNPL options: Ceria, Kredivo, and Indodana.

By offering a variety of local payment methods, developers can cater to the diverse preferences of gamers in Indonesia, driving higher conversion rates and unlocking new revenue streams.

Discover untapped markets with Xsolla

With our payments solution, you can offer a wide range of localized payment options for players in Indonesia, provide seamless purchasing experiences, leverage the full potential of the country’s video game market, and

In addition to these platforms, Pay Station also supports bank transfers from leading financial institutions like BTN, BNI, CIMB, and Danamon, as well as digital banking and direct debit: Jenius, Allobank, and digital wallets/BNPL options: Ceria, Kredivo, and Indodana.

By offering a variety of local payment methods, developers can cater to the diverse preferences of gamers in Indonesia, driving higher conversion rates and unlocking new revenue streams.

Discover untapped markets with Xsolla

With our payments solution, you can offer a wide range of localized payment options for players in Indonesia, provide seamless purchasing experiences, leverage the full potential of the country’s video game market, and

The digitization of Indonesia’s market

Indonesia is a lucrative video game market, boasting the largest gamer base in Southeast Asia. Among the top six gaming markets in the region, Indonesia stands out as one of the largest by revenue and is the fastest-growing market, with over 9% growth from 2022 to 2023. Not only is its video game industry is projected to generate over $1.2 billion in revenue by the end of 2024, the widespread adoption of smartphones and a thriving digital infrastructure have accelerated this growth, with more than 185 million active gamers across the country. The market is also expected to continue growing to $1.5 billion by 2027, with mobile devices contributing over 94% of the country’s online gaming activity. The rapid digital transformation of Indonesia is why game developers can find promising opportunities in the region. With a young, tech-savvy population and rising internet penetration, the demand for mobile games and digital entertainment has been skyrocketing. Monetizing this market requires adapting to local gamers’ payment preferences, and Xsolla has created a solution to help you capitalize on these trends. The rise of alternative payments in Indonesia One of the key factors enabling access to Indonesia’s growing gaming market is the rise of alternative payment methods. Bank transfers dominate the digital payment landscape, accounting for 44% of all transactions. Digital wallets are also seeing explosive growth, making up 34% of transactions in 2023 — a significant rise fueled by the pandemic and Indonesia’s shift toward digital services. While credit and debit card penetration is relatively low — only accounting for around 10% of transactions — digital banking is on the rise. Initiatives like Jenius from BTPN Bank are transforming the financial sector by offering full banking services via mobile phones. As a result, digital banking adoption surged to 57% between 2017 and 2021, providing more people in Indonesia with access to digital payments. THE GROWTH OF MOBILE WALLETS & BUY NOW, PAY LATER (BNPL) Mobile wallets have been the fastest-growing digital payment method in Indonesia, with their share of gross transaction value (GTV) rising from 23% in 2019 to 28% in 2022. Platforms such as GoPay, OVO, and Dana are leading this transformation, enabling millions in Indonesia — especially the underbanked — to participate in the digital economy. Additionally, Buy Now, Pay Later (BNPL) services have gained traction, particularly among younger audiences. BNPL accounted for 11% of all digital payments on e-commerce platforms in 2021, and this trend is expected to continue as more people in Indonesia embrace the convenience of deferred payments.Now available on Xsolla Pay Station: Payments in Indonesia

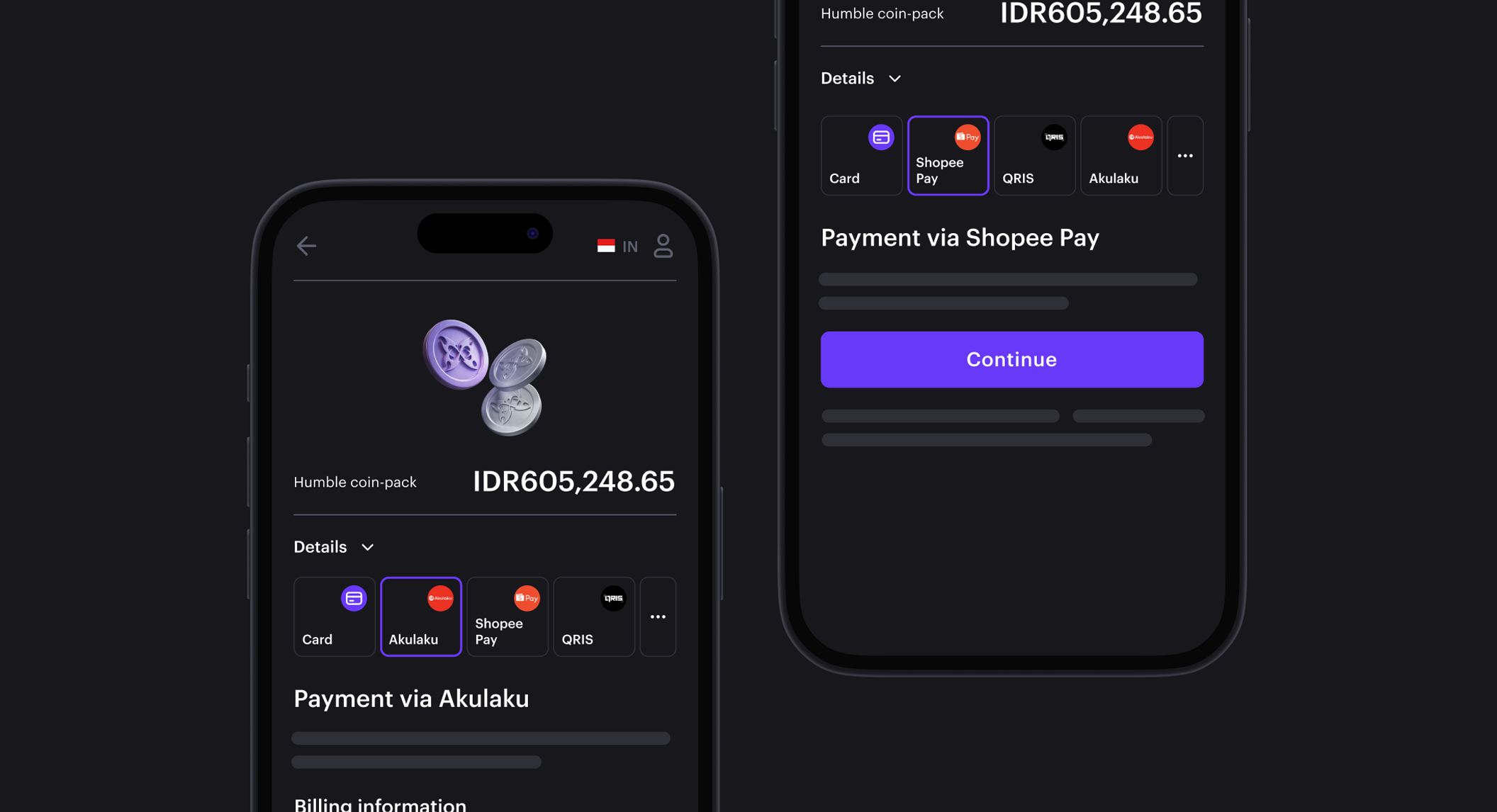

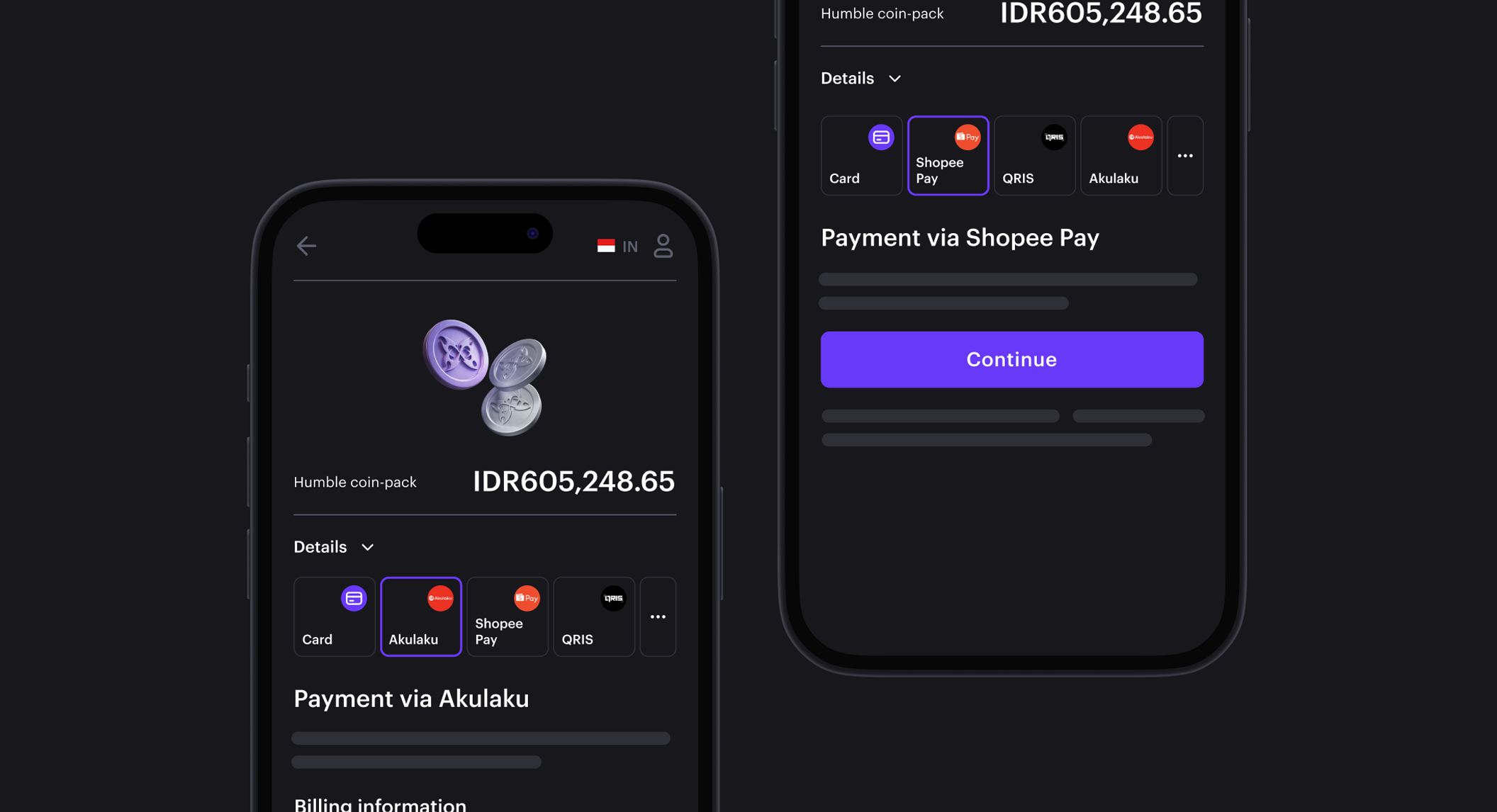

To help game developers tap into this fast-growing market, Xsolla has expanded its payment portfolio to include a wide range of localized payment methods tailored to Indonesia’s financial landscape. Xsolla Pay Station now supports 14 new popular payment options that dominate Indonesia’s wallet and payment market. These are in addition to the digital wallets we already support, including QRIS, GoPay, DANA, OVO, and LinkAja!. These new options offer seamless and secure payment experiences, making it easier for gamers to make in-app purchases and developers to monetize their games. Among the most popular payment methods are Akulaku and ShopeePay, combining to encompass over 130 million active users in Indonesia:- Akulaku (Ewallet; Buy Now, Pay Later). Akulaku serves over 32 million users across Indonesia and has become a leading e-wallet and BNPL platform. It allows gamers to make purchases with flexible payment options, catering to the increasing demand for installment-based transactions.

- ShopeePay (Ewallet). With over 103 million active users in Indonesia, ShopeePay is one of the most widely used mobile wallets in the country. Integrated with the popular Shopee e-commerce platform, it enables smooth, secure payments, making it ideal for in-game purchases and digital goods.

In addition to these platforms, Pay Station also supports bank transfers from leading financial institutions like BTN, BNI, CIMB, and Danamon, as well as digital banking and direct debit: Jenius, Allobank, and digital wallets/BNPL options: Ceria, Kredivo, and Indodana.

By offering a variety of local payment methods, developers can cater to the diverse preferences of gamers in Indonesia, driving higher conversion rates and unlocking new revenue streams.

Discover untapped markets with Xsolla

With our payments solution, you can offer a wide range of localized payment options for players in Indonesia, provide seamless purchasing experiences, leverage the full potential of the country’s video game market, and

In addition to these platforms, Pay Station also supports bank transfers from leading financial institutions like BTN, BNI, CIMB, and Danamon, as well as digital banking and direct debit: Jenius, Allobank, and digital wallets/BNPL options: Ceria, Kredivo, and Indodana.

By offering a variety of local payment methods, developers can cater to the diverse preferences of gamers in Indonesia, driving higher conversion rates and unlocking new revenue streams.

Discover untapped markets with Xsolla

With our payments solution, you can offer a wide range of localized payment options for players in Indonesia, provide seamless purchasing experiences, leverage the full potential of the country’s video game market, and

- Expand market reach. With over 185 million active gamers, Indonesia represents a massive opportunity for developers to grow their market share by offering flexible and trusted payment methods.

- Unlock new revenue streams. By catering to local payment preferences, developers can tap into Indonesia’s fast-growing gaming market and open up new revenue opportunities.

- Simplify compliance and fraud management. One of the biggest challenges in entering new markets is dealing with local regulations, taxes, and fraud management. Serving as the Merchant of Record, Xsolla can handle all the backend logistics, ensuring that transactions are secure and compliant with local regulations, so developers can focus on building and promoting their games.

Featured articles

Contact us

Talk to an expert

Ready to maximize revenue opportunities? Reach out to our experts and learn how to start earning more and spending less.